Region:Middle East

Author(s):Shubham

Product Code:KRAD0773

Pages:100

Published On:August 2025

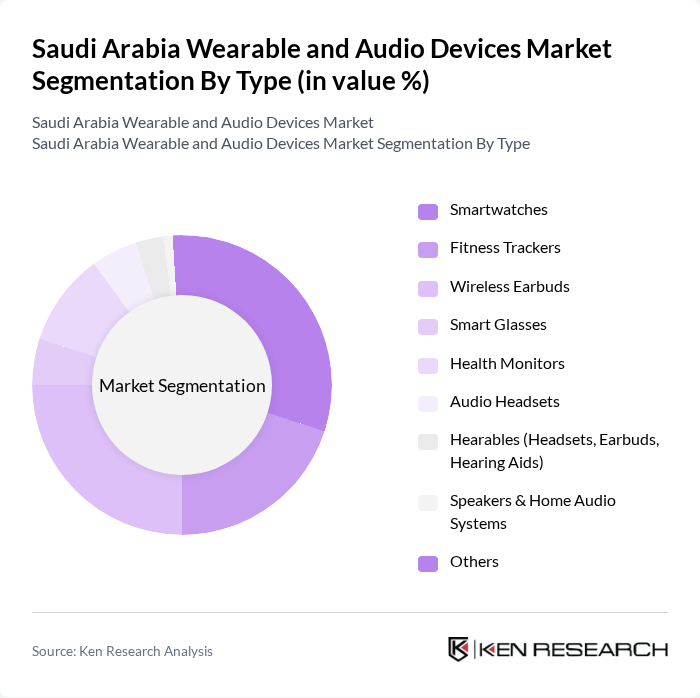

By Type:The market is segmented into various types of wearable and audio devices, including smartwatches, fitness trackers, wireless earbuds, smart glasses, health monitors, audio headsets, hearables, speakers, and other devices. Among these, smartwatches and wireless earbuds are particularly popular due to their multifunctionality and convenience. The increasing trend of health monitoring and fitness tracking has led to a surge in demand for fitness trackers and health monitors as well. Wireless audio solutions and hearables are also gaining traction, driven by advancements in connectivity and immersive audio experiences .

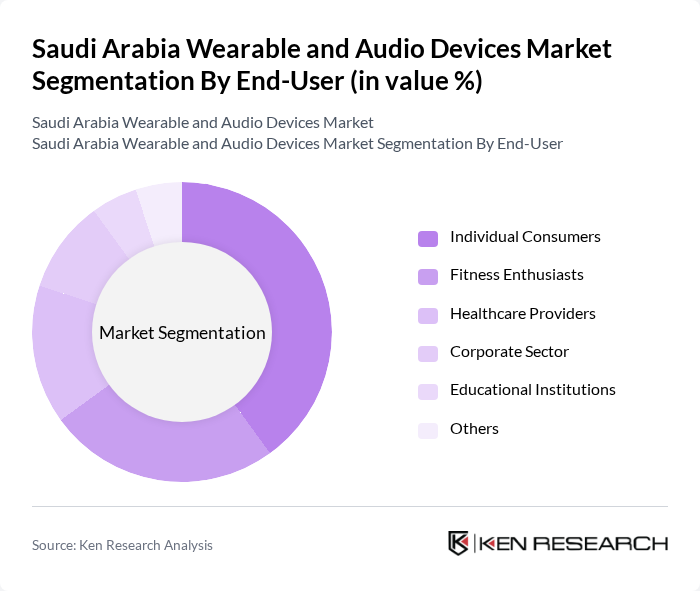

By End-User:The end-user segmentation includes individual consumers, fitness enthusiasts, healthcare providers, the corporate sector, educational institutions, and others. Individual consumers and fitness enthusiasts are the primary drivers of the market, as they seek devices that enhance their lifestyle and health. The corporate sector is also increasingly adopting wearable technology for employee wellness programs and productivity tracking. Healthcare providers are leveraging wearable health monitors for patient care and remote health management .

The Saudi Arabia Wearable and Audio Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Fitbit, Inc., Garmin Ltd., Huawei Technologies Co., Ltd., Sony Corporation, Xiaomi Corporation, Bose Corporation, Jabra (GN Audio A/S), LG Electronics Inc., Beats Electronics, LLC, Withings S.A., Amazfit (Zepp Health Corporation), Realme TechLife, Anker Innovations Limited, United Matbouli Group, Polar Electro Oy, Sennheiser electronic GmbH & Co. KG, Shure Incorporated, JBL (Harman International Industries, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia wearable and audio devices market appears promising, driven by technological advancements and increasing consumer engagement. As the government continues to invest in health initiatives and digital infrastructure, the integration of wearables with IoT devices is expected to enhance user experience. Additionally, the rise of personalized health solutions will likely attract a broader consumer base, fostering innovation and competition among manufacturers, ultimately benefiting the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartwatches Fitness Trackers Wireless Earbuds Smart Glasses Health Monitors Audio Headsets Hearables (Headsets, Earbuds, Hearing Aids) Speakers & Home Audio Systems Others |

| By End-User | Individual Consumers Fitness Enthusiasts Healthcare Providers Corporate Sector Educational Institutions Others |

| By Distribution Channel | E-Commerce Offline Retail Direct Sales Third-Party Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Application | Health Monitoring Fitness Tracking Entertainment Communication Gaming & AR/VR Others |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers |

| By Technology Integration | Standalone Devices Connected Devices Integrated Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Device Users | 120 | Fitness Enthusiasts, Tech Savvy Consumers |

| Audio Device Consumers | 100 | Music Lovers, Audiophiles |

| Retail Electronics Managers | 60 | Store Managers, Sales Executives |

| Health and Fitness Professionals | 50 | Personal Trainers, Health Coaches |

| Technology Adoption Researchers | 40 | Market Analysts, Academic Researchers |

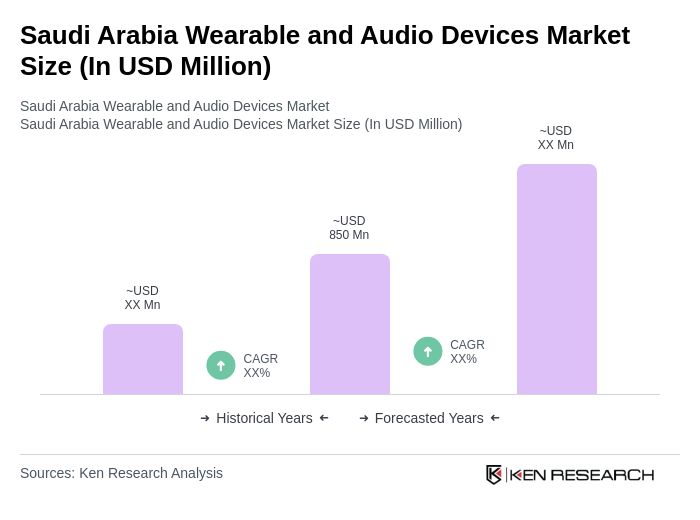

The Saudi Arabia Wearable and Audio Devices Market is valued at approximately USD 850 million, reflecting significant growth driven by the adoption of smart technology and increasing health consciousness among consumers.