Region:Middle East

Author(s):Dev

Product Code:KRAD0413

Pages:93

Published On:August 2025

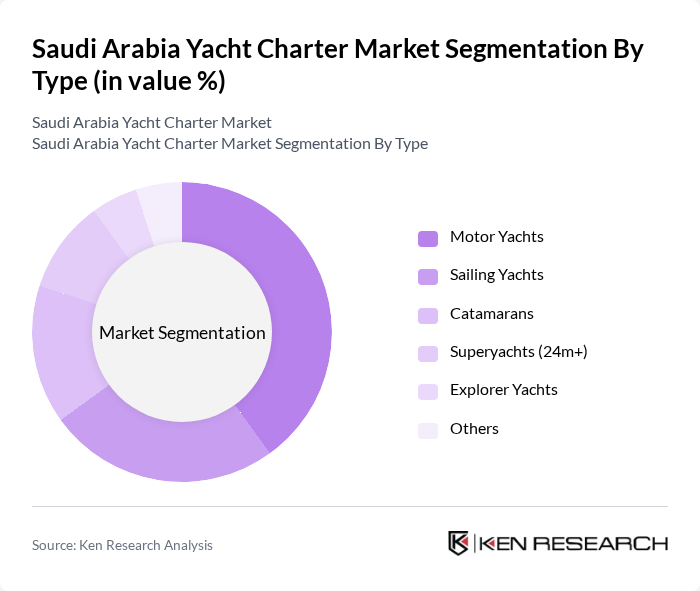

By Type:The yacht charter market can be segmented into various types, including motor yachts, sailing yachts, catamarans, superyachts (24m+), explorer yachts, and others. Among these, motor yachts are particularly popular due to their speed and luxury features, appealing to a wide range of consumers; sailing yachts attract those looking for a traditional experience; superyachts cater to the ultra-wealthy seeking exclusive services and amenities. Growth in crewed luxury segments aligns with high-end resort and marina developments on the Red Sea corridor.

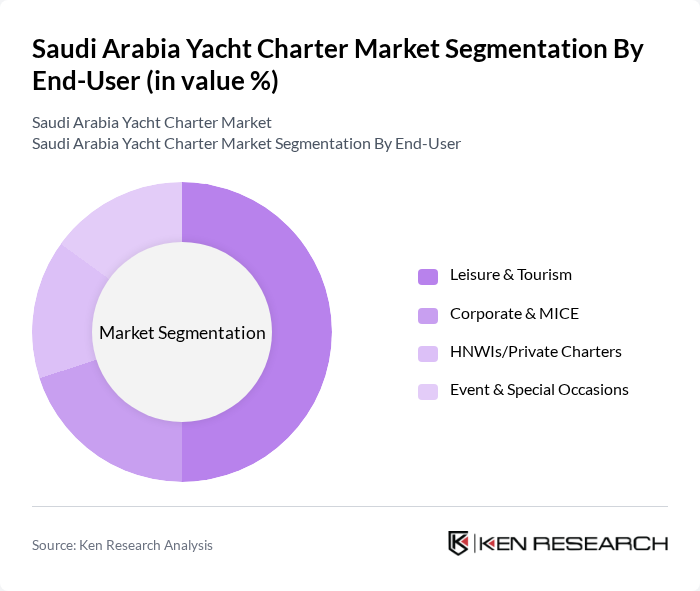

By End-User:The end-user segmentation includes leisure & tourism, corporate & MICE, high-net-worth individuals (HNWIs)/private charters, and event & special occasions. The leisure & tourism segment dominates the market, supported by expanding inbound tourism and luxury resort openings on the Red Sea. Corporate charters are gaining traction as businesses seek exclusive venues for meetings and incentives, while HNWIs continue to invest in private charters, with crewed charters preferred for premium service levels.

The Saudi Arabia Yacht Charter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sindalah (NEOM) Yacht Club & Marina, The Yacht Club at Jeddah Yacht Club & Marina, Red Sea Global (The Red Sea, Amaala) Marine Adventures, P&O Marinas Saudi (Dubai Ports World – KSA operations), Al Mouj-like Marina Operations Saudi JV (prospective operators), OceanX Charter Saudi, PR Marine Saudi, Royal Yachts KSA, Xclusive Yachts Saudi, Eden Yachting KSA, Navis Yacht Charter Middle East, Burgess Yachts (Saudi-serving), Northrop & Johnson (Saudi-serving), Camper & Nicholsons (Saudi-serving), Fraser Yachts (Saudi-serving) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia yacht charter market is expected to experience significant growth driven by increasing tourism, government support, and rising disposable incomes. As the country enhances its marine infrastructure and promotes luxury tourism, the market will likely attract both local and international clients. Additionally, the shift towards eco-friendly practices and technological advancements in yacht design will further shape the industry landscape, creating a more sustainable and appealing offering for consumers seeking unique leisure experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Yachts Sailing Yachts Catamarans Superyachts (24m+) Explorer Yachts Others |

| By End-User | Leisure & Tourism Corporate & MICE HNWIs/Private Charters Event & Special Occasions |

| By Duration of Charter | Half-Day/Daily Charters Weekly Charters Multi-week/Seasonal Charters |

| By Service Type | Bareboat Charters Crewed Charters Cabin Charters |

| By Booking Channel | Online Platforms/Brokers Travel Agencies & DMCs Direct/Marina Bookings |

| By Region | Red Sea Coast (Jeddah, NEOM/Sindalah, Al Wajh) Arabian Gulf Coast (Al Khobar, Dammam) Inland Waterways (Limited/Private Lakes) |

| By Price Range | Budget Charters Mid-Range Charters Luxury/Ultra-Luxury Charters |

| By Yacht Length | Up to 20 ft –50 ft Above 50 ft |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Yacht Charter Customers | 90 | Affluent Tourists, Business Executives |

| Local Residents Interested in Charters | 80 | Young Professionals, Families |

| Marina Operators | 50 | Marina Managers, Operations Directors |

| Tourism Board Officials | 40 | Policy Makers, Tourism Development Managers |

| Yacht Charter Operators | 60 | Business Owners, Fleet Managers |

The Saudi Arabia yacht charter market is valued at approximately USD 90 million, driven by increasing tourism, leisure activities, and significant investments in marine infrastructure as part of the Vision 2030 initiative.