Region:Middle East

Author(s):Shubham

Product Code:KRAD0648

Pages:89

Published On:August 2025

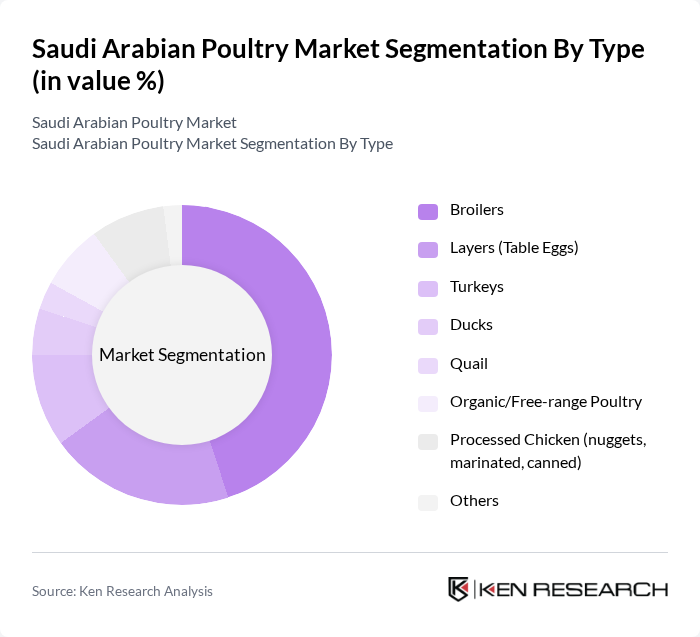

By Type:The poultry market can be segmented into various types, including Broilers, Layers (Table Eggs), Turkeys, Ducks, Quail, Organic/Free-range Poultry, Processed Chicken (nuggets, marinated, canned), and Others. Among these, Broilers are the most dominant segment due to their high demand in both retail and foodservice sectors. The increasing preference for chicken as a primary protein source, coupled with the convenience of processed chicken products, drives this segment's growth.

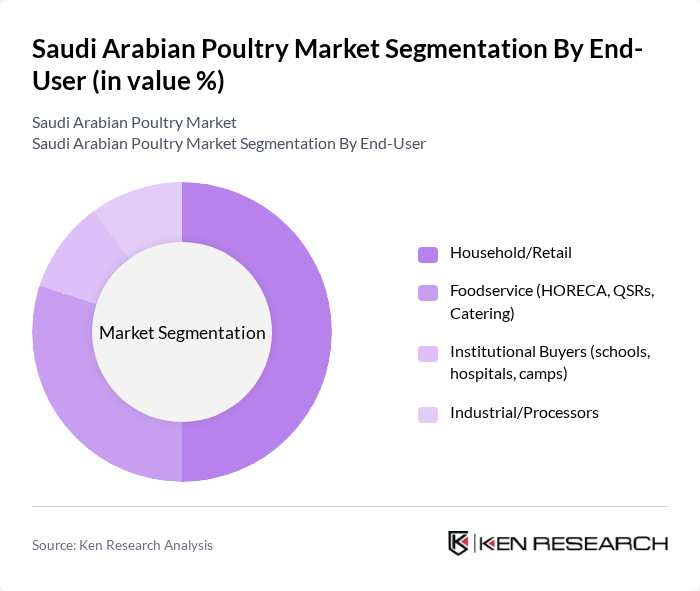

By End-User:The end-user segmentation includes Household/Retail, Foodservice (HORECA, QSRs, Catering), Institutional Buyers (schools, hospitals, camps), and Industrial/Processors. The Household/Retail segment is the largest due to the increasing consumption of poultry products in homes. The trend towards convenience foods and ready-to-cook options has further bolstered this segment's growth, as families seek quick meal solutions.

The Saudi Arabian Poultry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Watania Poultry (Al-Watania Poultry Co.), Almarai Company (Poultry & EVYD/Al-Youm brand), Fakieh Poultry Farms Co., Tanmiah Food Company, Al Ajlan Poultry (Ajlan & Bros Holding – agriculture), Al Dabbagh Group – Supreme Foods Processing Co., Al Kabeer Group ME, Radwa Food Production Co. (Radwa Poultry), Al-Jazira Poultry Farm, Al-Safa Poultry Co., Arabian Farms (Arabian Farms Development Co.), Al Youm Poultry (Brand of Almarai), Almunajem Foods, BRF Sadia (BRF Türkiye/BRF GCC – KSA operations), Al Salam Poultry Co. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian poultry market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As consumer preferences evolve, the demand for organic and locally sourced poultry products is expected to rise, aligning with global health trends. Additionally, the government's ongoing investments in poultry infrastructure will likely enhance production efficiency and food security, positioning the market for robust growth in the coming years. The integration of e-commerce platforms will further facilitate access to poultry products, catering to the tech-savvy consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Broilers Layers (Table Eggs) Turkeys Ducks Quail Organic/Free-range Poultry Processed Chicken (nuggets, marinated, canned) Others |

| By End-User | Household/Retail Foodservice (HORECA, QSRs, Catering) Institutional Buyers (schools, hospitals, camps) Industrial/Processors |

| By Sales Channel | Supermarkets and Hypermarkets Convenience and Specialty Stores Online Retail and Quick Commerce Traditional/Local Markets Wholesale Distributors |

| By Distribution Mode | Direct (integrators to retail/HORECA) Indirect (via distributors) Import/Export Trade |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Bulk/HoReCa Packs Retail Packs (tray, vacuum, MAP) Canned/Shelf-stable Eco-Friendly/Sustainable |

| By Product Form | Fresh/Chilled Frozen Processed/Value-added Marinated/Ready-to-cook Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Farm Operations | 100 | Poultry Farm Owners, Farm Managers |

| Poultry Distribution Channels | 80 | Distributors, Supply Chain Managers |

| Retail Market Insights | 70 | Retail Managers, Category Buyers |

| Consumer Preferences | 120 | Household Consumers, Health-Conscious Shoppers |

| Regulatory Compliance | 60 | Compliance Officers, Regulatory Affairs Managers |

The Saudi Arabian poultry market is valued at approximately USD 19 billion, reflecting significant growth driven by increasing consumer demand for protein-rich diets and a growing population, alongside urbanization trends.