Region:Asia

Author(s):Shubham

Product Code:KRAB5665

Pages:90

Published On:October 2025

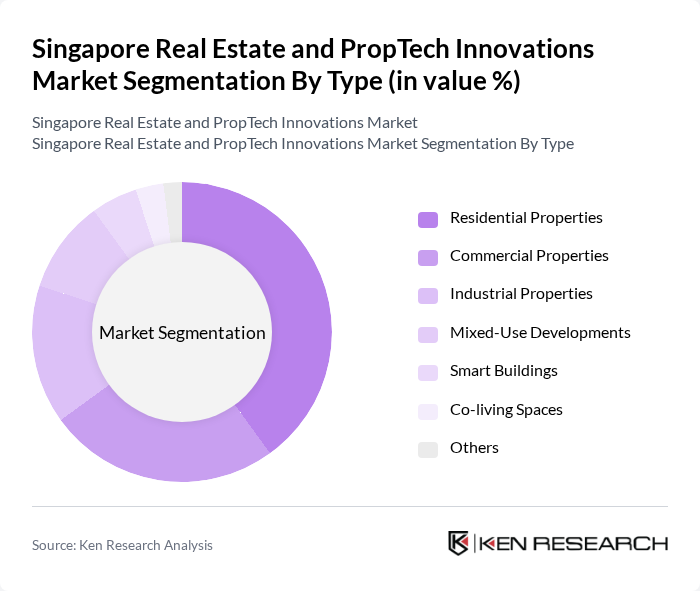

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Smart Buildings, Co-living Spaces, and Others. Among these, Residential Properties dominate the market due to the high demand for housing driven by population growth and urbanization. The trend towards smart living solutions is also gaining traction, with consumers increasingly seeking technologically integrated homes.

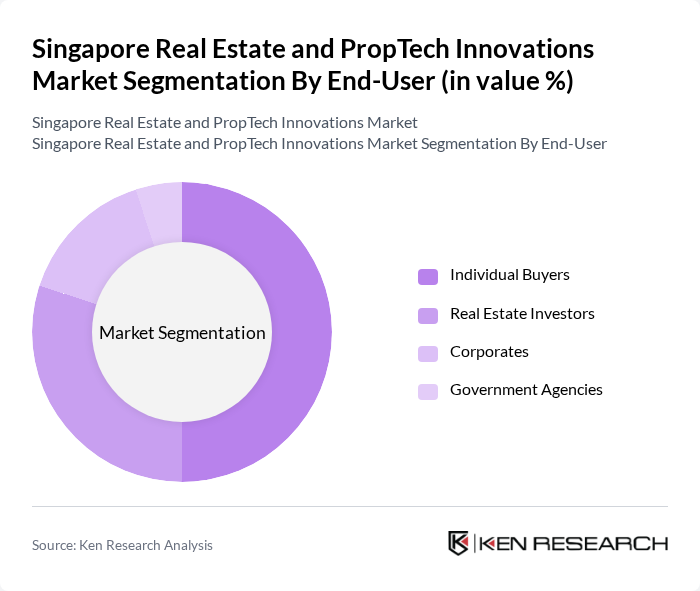

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporates, and Government Agencies. Individual Buyers represent the largest segment, driven by the growing population and the need for housing. Real Estate Investors are also significant, as they seek opportunities in both residential and commercial properties, capitalizing on the market's growth potential.

The Singapore Real Estate and PropTech Innovations Market is characterized by a dynamic mix of regional and international players. Leading participants such as CapitaLand Limited, City Developments Limited, Frasers Property Limited, Oxley Holdings Limited, UOL Group Limited, GuocoLand Limited, SingHaiyi Group Ltd, Hongkong Land Holdings Limited, Mapletree Investments Pte Ltd, Keppel Land Limited, Ascendas-Singbridge Group, Raffles Medical Group, PropTech Solutions Pte Ltd, PropertyGuru Group, 99.co contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore real estate and PropTech market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As remote work continues to influence housing demands, the market will likely see a rise in flexible living solutions. Additionally, the integration of smart technologies in property management will enhance operational efficiencies. With government support for sustainable practices, the sector is expected to embrace green innovations, positioning itself as a leader in environmentally responsible real estate development.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Smart Buildings Co-living Spaces Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Agencies |

| By Sales Channel | Direct Sales Online Platforms Real Estate Agents Auctions |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Application | Residential Use Commercial Use Industrial Use Mixed-Use Developments |

| By Policy Support | Tax Incentives Subsidies for Green Buildings Regulatory Support for PropTech Urban Redevelopment Authority Initiatives |

| By Market Maturity | Emerging Market Growth Market Mature Market Declining Market |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Agents | 100 | Real Estate Agents, Sales Managers |

| Commercial Property Developers | 80 | Development Managers, Project Directors |

| PropTech Startups | 60 | Founders, Product Managers |

| Real Estate Investors | 75 | Investment Analysts, Portfolio Managers |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

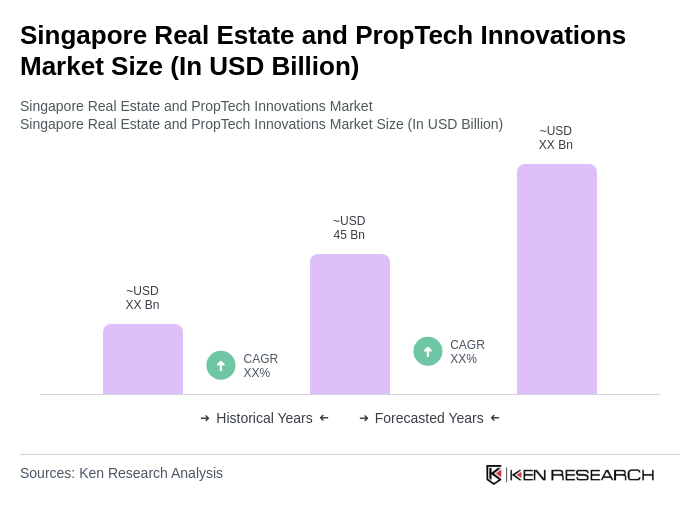

The Singapore Real Estate and PropTech Innovations Market is valued at approximately USD 45 billion, driven by urbanization, technological advancements, and a strong economy that fosters investment in real estate and innovative property technologies.