Region:Asia

Author(s):Geetanshi

Product Code:KRAA4539

Pages:91

Published On:September 2025

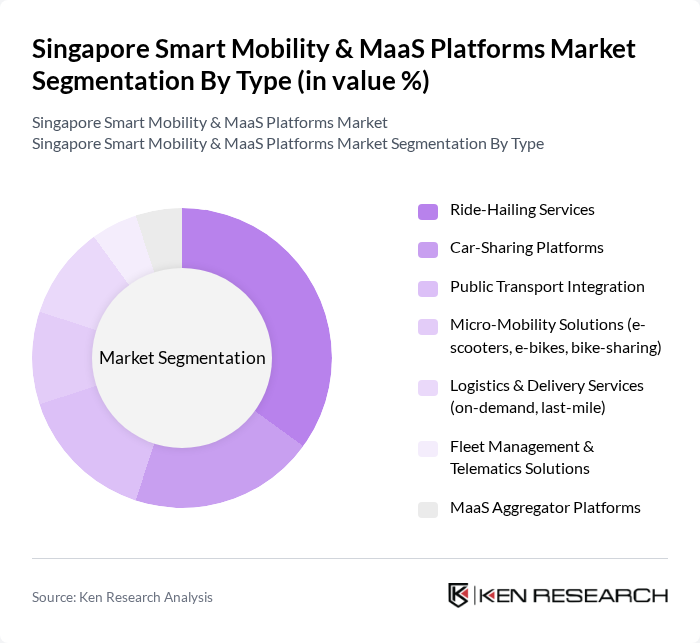

By Type:The market can be segmented into various types, includingRide-Hailing Services,Car-Sharing Platforms,Public Transport Integration,Micro-Mobility Solutions(e-scooters, e-bikes, bike-sharing),Logistics & Delivery Services(on-demand, last-mile),Fleet Management & Telematics Solutions, andMaaS Aggregator Platforms. Each segment plays a pivotal role in enhancing urban mobility and providing efficient, technology-driven transport solutions. Ride-hailing and micro-mobility are experiencing rapid adoption due to consumer demand for convenience and sustainability, while public transport integration and MaaS aggregators are central to Singapore's smart city strategy.

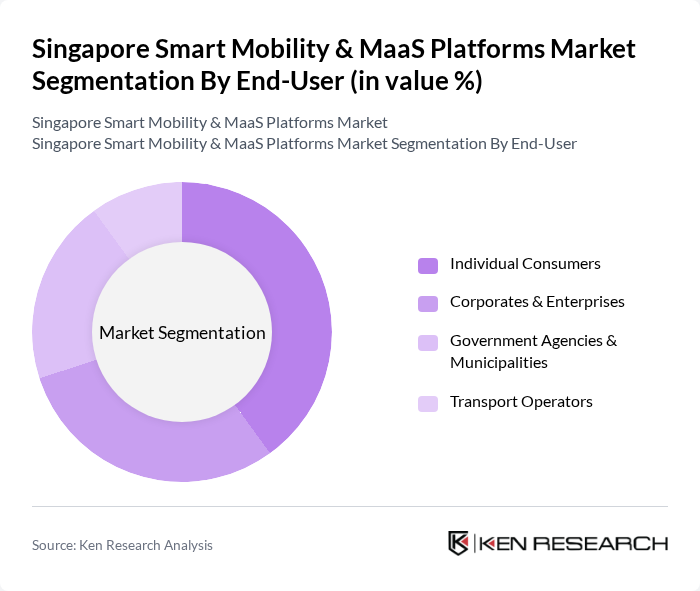

By End-User:The end-user segmentation includesIndividual Consumers,Corporates & Enterprises,Government Agencies & Municipalities, andTransport Operators. Each segment has unique needs and preferences, influencing the demand for various mobility solutions. Individual consumers drive demand for app-based and micro-mobility services, while corporates and government agencies focus on integrated transport management and sustainability.

The Singapore Smart Mobility & MaaS Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grab Holdings Inc., Gojek, ComfortDelGro Corporation Limited, Land Transport Authority (LTA), Moovaz, Tada Mobility, Anywheel, Beam Mobility Holdings Pte Ltd, SG Bike, Razer Mobility, TransitLink Pte Ltd, Uber Technologies Inc., Dott, Mobike, Whizz Mobility contribute to innovation, geographic expansion, and service delivery in this space.

The future of Singapore's smart mobility and MaaS platforms is poised for transformative growth, driven by technological advancements and increasing urbanization. As the government continues to invest in smart city initiatives, the integration of AI and big data analytics will enhance user experiences and operational efficiencies. Furthermore, the rise of electric vehicles and autonomous transport solutions will reshape the mobility landscape, fostering a more sustainable and interconnected urban environment that meets the evolving needs of residents and visitors alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride-Hailing Services Car-Sharing Platforms Public Transport Integration Micro-Mobility Solutions (e-scooters, e-bikes, bike-sharing) Logistics & Delivery Services (on-demand, last-mile) Fleet Management & Telematics Solutions MaaS Aggregator Platforms |

| By End-User | Individual Consumers Corporates & Enterprises Government Agencies & Municipalities Transport Operators |

| By Application | Urban Mobility Last-Mile Connectivity Logistics and Delivery Emergency & Healthcare Transport |

| By Distribution Mode | Online Platforms Mobile Applications Physical Kiosks & Terminals |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium & Bundled Models |

| By Customer Segment | Students Professionals Tourists |

| By Policy Support | Government Subsidies Tax Incentives Grants for Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transport Integration | 100 | Transport Planners, Public Policy Analysts |

| Ride-Sharing Services | 70 | Operations Managers, Marketing Directors |

| Micro-Mobility Solutions | 60 | Product Managers, Urban Mobility Experts |

| Smart Parking Solutions | 50 | Technology Developers, City Planners |

| Data Analytics in Mobility | 80 | Data Scientists, Business Analysts |

The Singapore Smart Mobility & MaaS Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by digital technology adoption, urbanization, and government initiatives aimed at enhancing public transport efficiency and sustainability.