Region:Asia

Author(s):Dev

Product Code:KRAB0343

Pages:85

Published On:August 2025

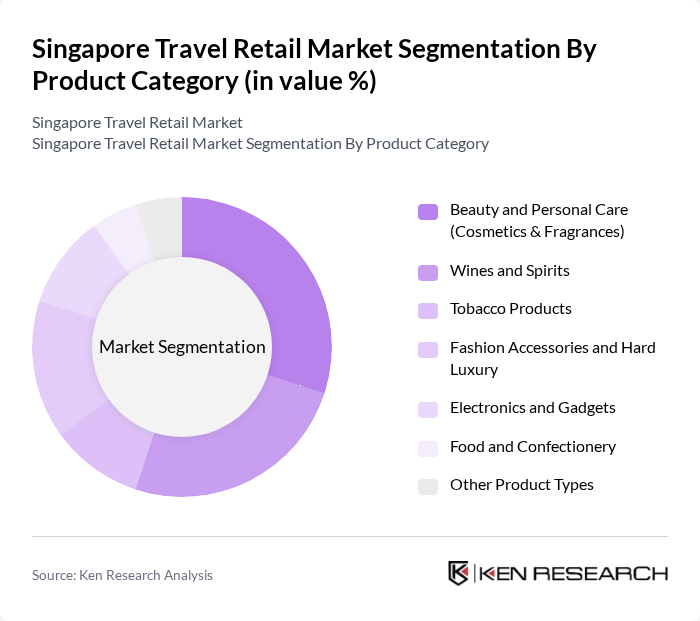

By Product Category:The product category segmentation includes various subsegments such as Beauty and Personal Care (Cosmetics & Fragrances), Wines and Spirits, Tobacco Products, Fashion Accessories and Hard Luxury, Electronics and Gadgets, Food and Confectionery, and Other Product Types. Among these, Beauty and Personal Care products have shown significant growth due to increasing consumer awareness and demand for premium cosmetics and fragrances. The trend towards self-care, personal grooming, and experiential retail has further propelled this segment, making it a dominant force in the market.

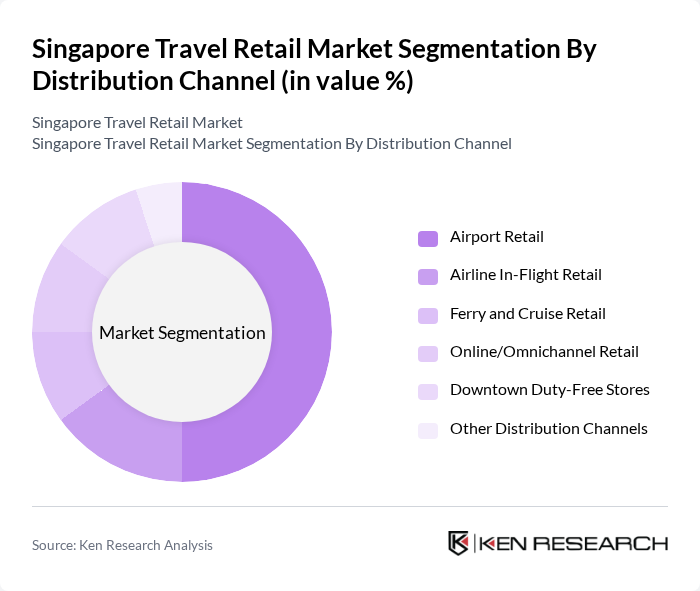

By Distribution Channel:The distribution channel segmentation encompasses Airport Retail, Airline In-Flight Retail, Ferry and Cruise Retail, Online/Omnichannel Retail, Downtown Duty-Free Stores, and Other Distribution Channels. Airport Retail is the leading channel, driven by the high volume of international travelers passing through Singapore's Changi Airport. The convenience, variety, and integration of digital platforms in airport retail outlets cater to the preferences of travelers, making it a preferred shopping destination.

The Singapore Travel Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as DFS Venture Singapore (DFS Group Limited), Lotte Duty Free Singapore, Changi Airport Group (Singapore) Pte Ltd, Heinemann Asia Pacific (Heinemann Duty Free), Dufry Singapore Pte Ltd (Dufry AG), Lagardère Travel Retail Singapore, King Power Group (Hong Kong) Co., Ltd., The Shilla Duty Free Singapore, Duty Free Americas Singapore, Aer Rianta International (ARI Singapore), The Nuance Group (Singapore) Pte Ltd, Gebr. Heinemann SE & Co. KG, Motta Internacional S.A., Travel Retail Norway AS, Qatar Duty Free contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore travel retail market is poised for significant transformation in the coming years, driven by evolving consumer preferences and technological advancements. The integration of digital solutions, such as augmented reality and personalized shopping experiences, is expected to enhance customer engagement. Additionally, the focus on sustainability will likely shape product offerings, with retailers increasingly prioritizing eco-friendly options. As the market adapts to these trends, it is anticipated that overall sales will experience a robust upward trajectory, reflecting the dynamic nature of consumer behavior in travel retail.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Beauty and Personal Care (Cosmetics & Fragrances) Wines and Spirits Tobacco Products Fashion Accessories and Hard Luxury Electronics and Gadgets Food and Confectionery Other Product Types |

| By Distribution Channel | Airport Retail Airline In-Flight Retail Ferry and Cruise Retail Online/Omnichannel Retail Downtown Duty-Free Stores Other Distribution Channels |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Nationality |

| By Product Origin | Domestic Brands International Brands |

| By Packaging Type | Eco-Friendly Packaging Luxury Packaging Standard Packaging |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Occasional Shoppers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Duty-Free Shoppers | 120 | Frequent Travelers, Business Class Passengers |

| Luxury Goods Purchasers | 60 | High Net-Worth Individuals, Tourists from Emerging Markets |

| Alcohol and Tobacco Buyers | 50 | International Travelers, Tour Groups |

| Cosmetics and Fragrance Consumers | 40 | Female Travelers, Beauty Enthusiasts |

| Travel Retail Experience Feedback | 70 | General Travelers, First-Time Airport Visitors |

The Singapore Travel Retail Market is valued at approximately USD 52.8 billion, driven by a growing number of international travelers and increased consumer spending on luxury goods, cosmetics, and electronics.