Region:Africa

Author(s):Dev

Product Code:KRAD0384

Pages:96

Published On:August 2025

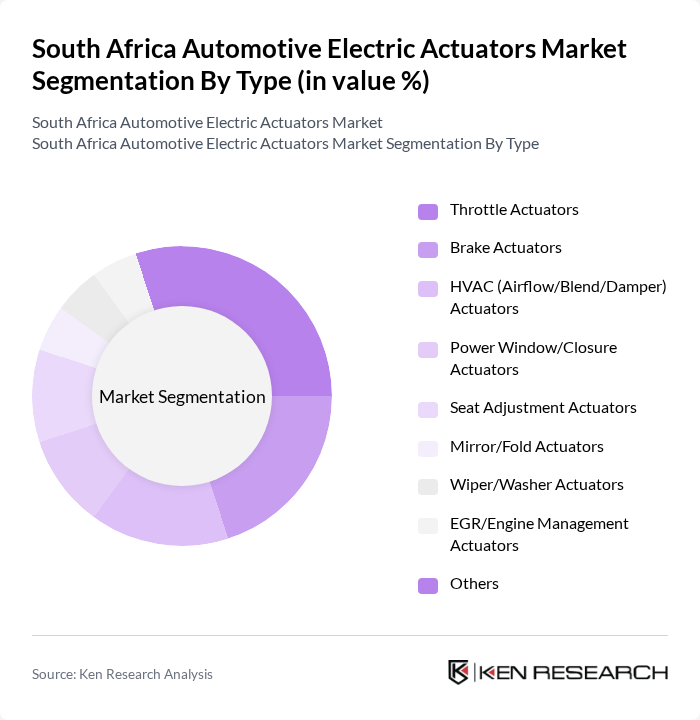

By Type:The market is segmented into various types of electric actuators, including Throttle Actuators, Brake Actuators, HVAC (Airflow/Blend/Damper) Actuators, Power Window/Closure Actuators, Seat Adjustment Actuators, Mirror/Fold Actuators, Wiper/Washer Actuators, EGR/Engine Management Actuators, and Others. Among these, Throttle Actuators and Brake Actuators are particularly significant due to their critical roles in vehicle performance and safety.

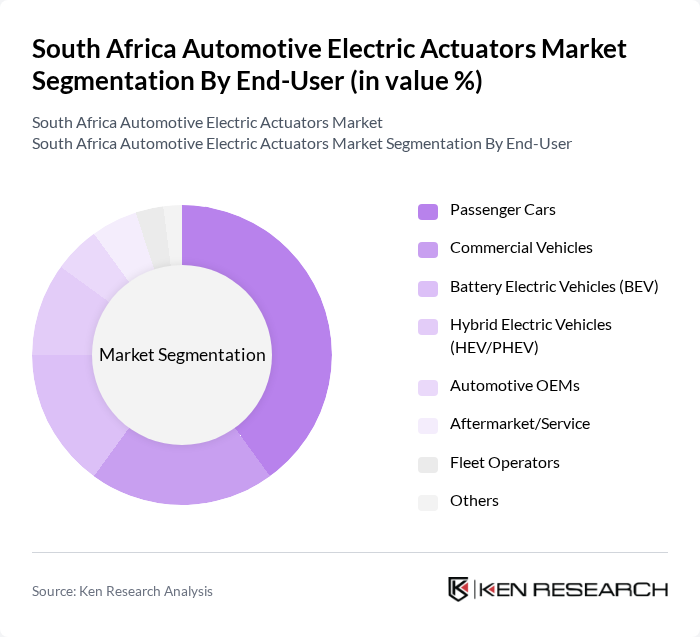

By End-User:The end-user segmentation includes Passenger Cars, Commercial Vehicles, Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV/PHEV), Automotive OEMs, Aftermarket/Service, Fleet Operators, and Others. The Passenger Cars segment is the largest due to the high demand for personal vehicles and the increasing trend towards electric mobility.

The South Africa Automotive Electric Actuators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH / Bosch South Africa (Pty) Ltd, Continental AG / Continental Automotive South Africa (Pty) Ltd, Denso Corporation, Mitsubishi Electric Corporation, Nidec Corporation, Hitachi, Ltd. (Hitachi Astemo), ZF Friedrichshafen AG, Valeo SA, Schaeffler Technologies AG & Co. KG, Johnson Electric Holdings Limited, Aptiv PLC, Infineon Technologies AG, HELLA GmbH & Co. KGaA (Forvia Hella), NGK SPARK PLUG Co., Ltd. (Niterra Co., Ltd.), Actom Electrical Products (South Africa) contribute to innovation, geographic expansion, and service delivery in this space.

The South African automotive electric actuators market is poised for significant transformation as technological advancements and government initiatives converge. With a projected increase in electric vehicle adoption and a focus on sustainability, the demand for electric actuators is expected to rise. Additionally, the integration of smart technologies and IoT in vehicles will create new opportunities for innovation. As consumer awareness grows, the market is likely to expand, driven by a collective push towards more efficient and automated automotive solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Throttle Actuators Brake Actuators HVAC (Airflow/Blend/Damper) Actuators Power Window/Closure Actuators Seat Adjustment Actuators Mirror/Fold Actuators Wiper/Washer Actuators EGR/Engine Management Actuators Others |

| By End-User | Passenger Cars Commercial Vehicles Battery Electric Vehicles (BEV) Hybrid Electric Vehicles (HEV/PHEV) Automotive OEMs Aftermarket/Service Fleet Operators Others |

| By Application | Engine Management Systems Powertrain Systems Chassis and Safety Systems (ABS/ESC) Body and Interior Systems HVAC and Thermal Management ADAS/Autonomy Subsystems Others |

| By Distribution Channel | Direct Sales to OEMs Tier-1/Tier-2 Distributors Independent Aftermarket (IAM) Online Retail/Marketplaces Authorized Automotive Parts Stores OEM Service Networks Others |

| By Component | DC/BLDC Actuator Motors Sensors & Position Feedback Controllers/ECUs Geartrain/Lead Screw Power Electronics/Drivers Housings/Connectors Others |

| By Price Range | Economy Mid Premium Performance/High-Spec Others |

| By Technology | Electric Actuation Smart/Integrated Actuators (with ECU/Sensors) ADAS/Autonomy-Ready Actuators Others |

| By Region (South Africa) | Gauteng Eastern Cape KwaZulu-Natal Western Cape Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 120 | Product Development Engineers, R&D Managers |

| Commercial Vehicle Manufacturers | 90 | Procurement Managers, Operations Directors |

| Electric Actuator Suppliers | 70 | Sales Managers, Technical Support Engineers |

| Automotive Component Distributors | 60 | Supply Chain Managers, Inventory Analysts |

| Industry Analysts and Consultants | 50 | Market Research Analysts, Automotive Consultants |

The South Africa Automotive Electric Actuators Market is valued at approximately USD 190 million, reflecting a significant growth trend driven by the adoption of electrified powertrains and advanced safety features in vehicles.