Region:Africa

Author(s):Shubham

Product Code:KRAB5661

Pages:91

Published On:October 2025

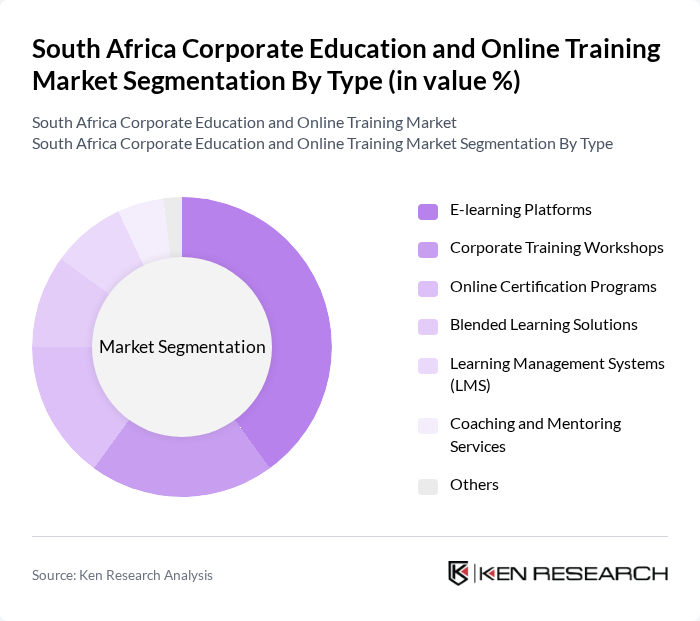

By Type:The market is segmented into various types of corporate education and online training solutions. The subsegments include E-learning Platforms, Corporate Training Workshops, Online Certification Programs, Blended Learning Solutions, Learning Management Systems (LMS), Coaching and Mentoring Services, and Others. Among these, E-learning Platforms have emerged as the dominant subsegment due to their flexibility, scalability, and ability to cater to diverse learning needs. The increasing adoption of mobile learning and the demand for personalized learning experiences have further propelled the growth of this segment.

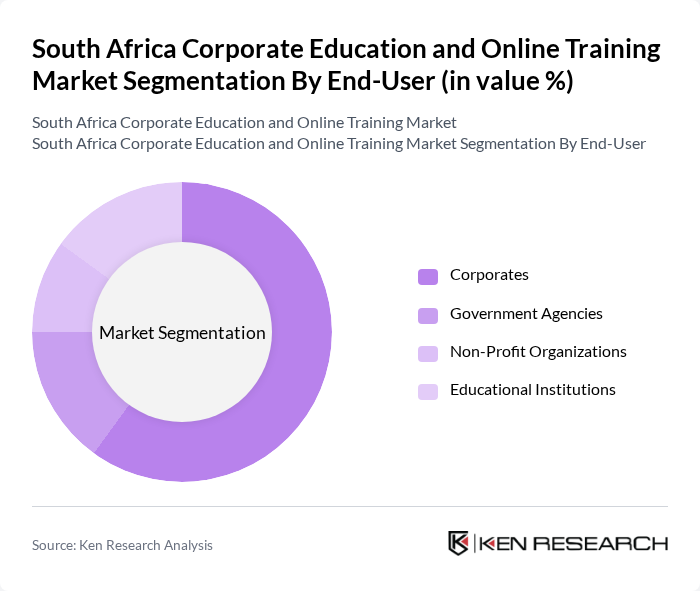

By End-User:The corporate education and online training market is segmented by end-users, which include Corporates, Government Agencies, Non-Profit Organizations, and Educational Institutions. Corporates are the leading end-user segment, driven by the need for continuous employee development and compliance with industry standards. The increasing focus on employee engagement and retention has led organizations to invest significantly in training programs, making this segment a key driver of market growth.

The South Africa Corporate Education and Online Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as DVT, GetSmarter, Udemy for Business, Skillshare, Coursera, LinkedIn Learning, The Knowledge Academy, Learnfast, Mindset Learn, Inscape Education Group, The Training Room Online, Academy of Digital Arts, Varsity College, Boston City Campus and Business College, CPUT Corporate Training contribute to innovation, geographic expansion, and service delivery in this space.

The South African corporate education and online training market is poised for significant transformation, driven by technological advancements and evolving workforce needs. As companies increasingly embrace blended learning approaches, the integration of data analytics will enhance training effectiveness. Furthermore, the growing emphasis on compliance training will necessitate innovative solutions to meet regulatory requirements. These trends indicate a shift towards more personalized and adaptive learning experiences, positioning the market for sustained growth and development in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | E-learning Platforms Corporate Training Workshops Online Certification Programs Blended Learning Solutions Learning Management Systems (LMS) Coaching and Mentoring Services Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions |

| By Industry Sector | Information Technology Finance and Banking Healthcare Manufacturing Retail Telecommunications Others |

| By Delivery Mode | Online Learning In-Person Training Hybrid Learning |

| By Duration | Short Courses (Less than 3 months) Medium Courses (3 to 6 months) Long Courses (More than 6 months) |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | Training Managers, Learning and Development Heads |

| Online Learning Platforms | 100 | Product Managers, Marketing Directors |

| Employee Skill Development | 80 | HR Managers, Talent Acquisition Specialists |

| Industry-Specific Training Needs | 70 | Operations Managers, Compliance Officers |

| Technology Adoption in Training | 90 | IT Managers, E-learning Coordinators |

The South Africa Corporate Education and Online Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for upskilling and reskilling in the workforce, as well as the rise of digital learning platforms.