Region:Africa

Author(s):Shubham

Product Code:KRAB1104

Pages:84

Published On:October 2025

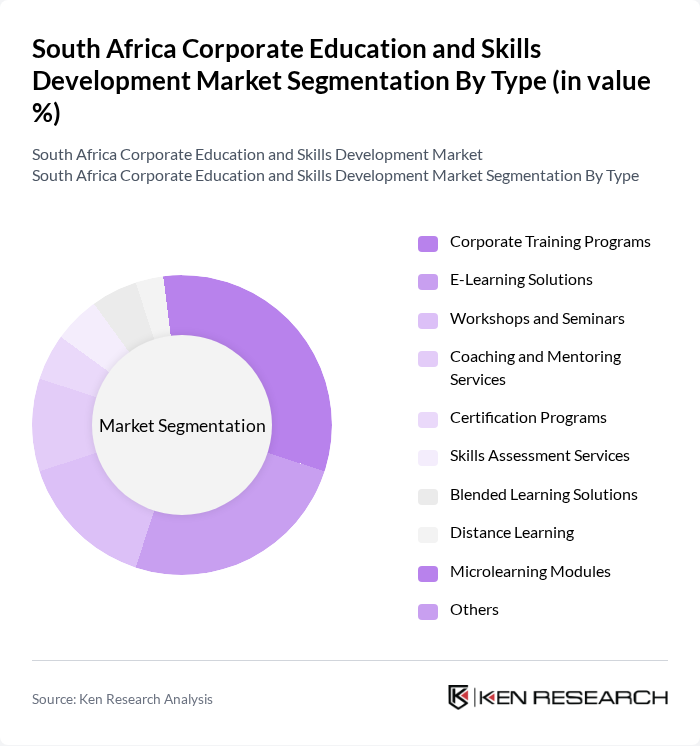

By Type:The market is segmented into various types of educational and training services, including Corporate Training Programs, E-Learning Solutions, Workshops and Seminars, Coaching and Mentoring Services, Certification Programs, Skills Assessment Services, Blended Learning Solutions, Distance Learning, Microlearning Modules, and Others. Among these, Corporate Training Programs and E-Learning Solutions are particularly prominent due to the increasing preference for flexible, scalable, and technology-enabled learning options. Organizations are prioritizing tailored training solutions that address specific business needs, while blended and microlearning formats are gaining traction for their adaptability and learner engagement .

By End-User:The end-user segmentation includes Large Corporations, Small and Medium Enterprises (SMEs), Government Agencies, Non-Profit Organizations, Educational Institutions, Industry Associations, and Others. Large Corporations and SMEs are the primary consumers of corporate education services, driven by their need to upskill employees, comply with regulatory requirements, and enhance productivity in a competitive market. Government agencies and educational institutions are increasingly leveraging digital platforms for workforce development and professional training .

The South Africa Corporate Education and Skills Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as GetSmarter (a 2U, Inc. brand), The Training Room Online (TTRO), DVT, Learnfast, Mindset Learn, iLearn, Optimi Workplace, MasterStart, The Skills Development Corporation (SDC), Inscape Education Group, Varsity College (part of The Independent Institute of Education), Milpark Education, University of Cape Town - Graduate School of Business, University of the Witwatersrand - Wits Business School, and South African Institute of Chartered Accountants (SAICA) contribute to innovation, geographic expansion, and service delivery in this space.

The South African corporate education market is poised for transformation, driven by technological advancements and evolving workforce needs. As companies increasingly recognize the importance of continuous learning, the integration of AI and personalized learning experiences will become more prevalent. Furthermore, the emphasis on soft skills training will grow, addressing the gap between technical skills and interpersonal abilities. This shift will create a more adaptable workforce, better equipped to meet the challenges of a dynamic job market.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Training Programs E-Learning Solutions Workshops and Seminars Coaching and Mentoring Services Certification Programs Skills Assessment Services Blended Learning Solutions Distance Learning Microlearning Modules Others |

| By End-User | Large Corporations Small and Medium Enterprises (SMEs) Government Agencies Non-Profit Organizations Educational Institutions Industry Associations Others |

| By Sector | Information Technology & Services Finance and Banking Manufacturing & Engineering Healthcare & Life Sciences Retail & Consumer Goods Telecommunications & Media Mining & Resources Public Sector Others |

| By Delivery Mode | Online Learning In-Person Training Hybrid/Blended Learning Mobile Learning Virtual Instructor-Led Training (VILT) Others |

| By Duration | Short-Term Courses (Up to 3 months) Medium-Term Programs (3-12 months) Long-Term Programs (Over 12 months) Ongoing/Continuous Training Others |

| By Certification Type | Professional Certifications Academic Degrees Industry-Specific Certifications Digital Badges & Micro-Credentials Others |

| By Investment Source | Private Sector Funding Government Grants International Aid & Development Funding Corporate Sponsorships Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 60 | CEOs, Training Managers |

| Human Resource Departments | 80 | HR Directors, Learning and Development Specialists |

| Employees in Corporate Training Programs | 70 | Participants, Team Leaders |

| Government Education Officials | 40 | Policy Makers, Program Coordinators |

| Industry Associations | 40 | Executive Directors, Research Analysts |

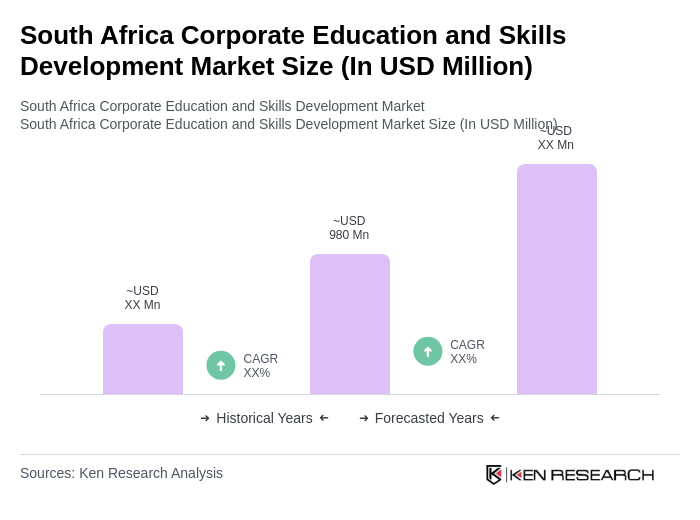

The South Africa Corporate Education and Skills Development Market is valued at approximately USD 980 million, reflecting significant growth driven by the demand for skilled labor and the adoption of digital learning platforms.