South Africa Digital Lending and Fintech Platforms Market Overview

- The South Africa Digital Lending and Fintech Platforms Market is valued at USD 980 million, based on a five-year historical analysis. This growth is primarily driven by the rapid adoption of mobile technology, expanding smartphone penetration, and the increasing demand for fast, convenient, and accessible credit solutions among both consumers and SMEs. The rise of alternative lending solutions, such as buy now, pay later (BNPL) and automated loan origination platforms, further accelerates market expansion, as does the growing focus on financial inclusion initiatives and digital transformation across banks and fintechs .

- Key cities such as Johannesburg, Cape Town, and Durban dominate the market due to their robust financial ecosystems, high internet penetration rates, and a concentration of fintech startups. These urban centers serve as hubs for innovation, attracting investment and talent, which further fuels the growth of digital lending platforms .

- In 2023, the South African government implemented the National Credit Amendment Act, 2019 (Act No. 7 of 2019), issued by the Department of Trade, Industry and Competition. This regulation mandates stricter credit assessments, enhanced transparency in lending practices, and introduces debt intervention measures for over-indebted consumers. The Act requires lenders to provide clear disclosure of loan terms and obligations, and sets compliance requirements for credit providers, thereby promoting responsible lending and consumer protection .

South Africa Digital Lending and Fintech Platforms Market Segmentation

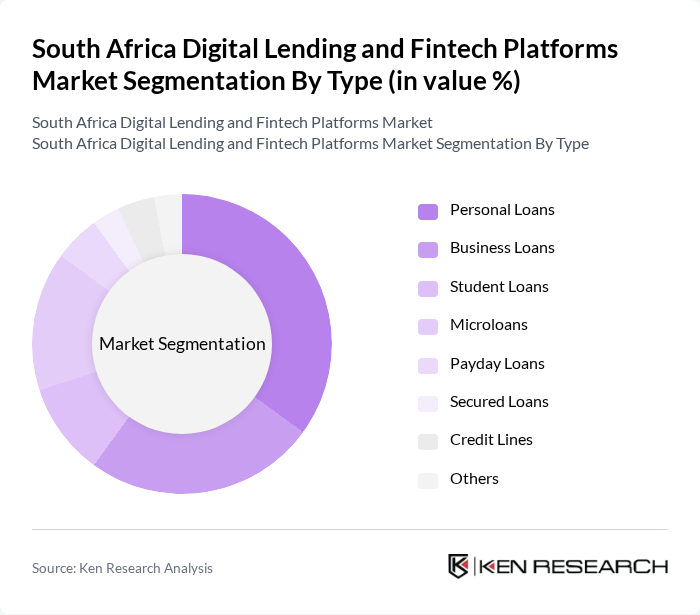

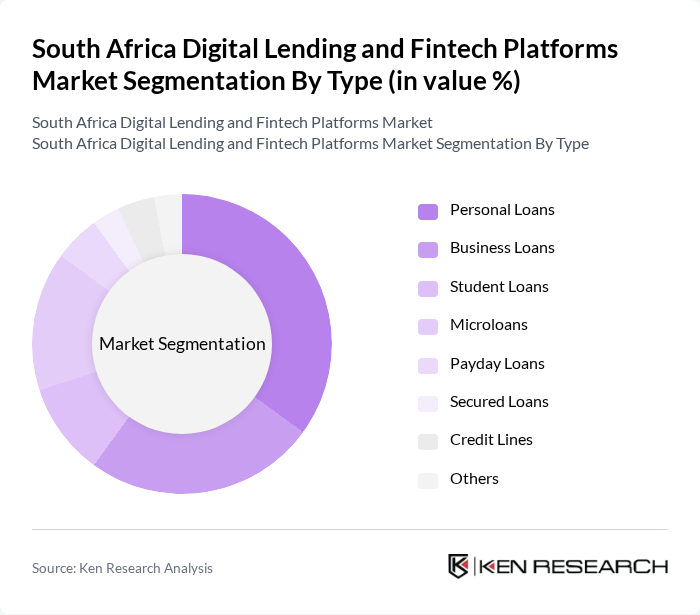

By Type:The market is segmented into various types of lending products, including personal loans, business loans, student loans, microloans, payday loans, secured loans, credit lines, and others. Personal loans remain the most popular segment, driven by strong consumer demand for quick and flexible access to funds for personal expenses. Business loans are also gaining traction, as SMEs increasingly seek digital financing options to support growth, working capital, and operational needs. The market is further characterized by the rise of microloans and payday loans, which cater to underserved and unbanked populations seeking short-term credit solutions .

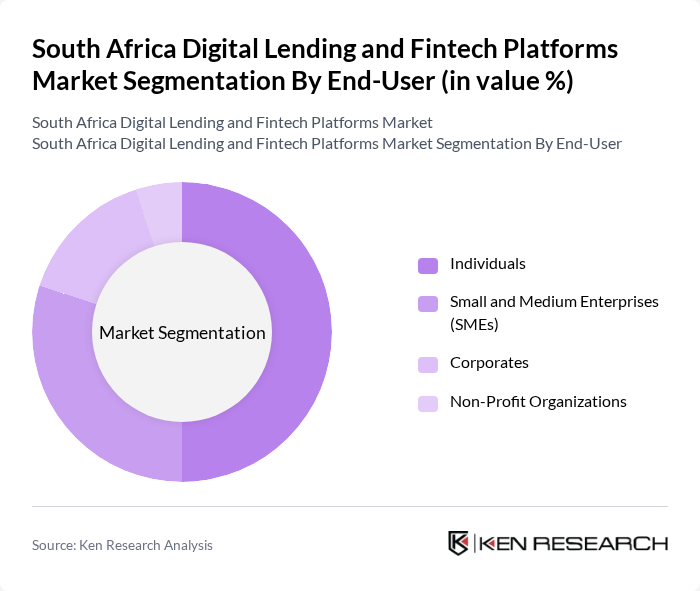

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individuals represent the largest segment, as personal loans and consumer credit products are widely sought for emergencies, purchases, and lifestyle needs. SMEs are also significant users of digital lending platforms, leveraging automated and flexible financing solutions to support business expansion, working capital, and operational resilience. Corporates and non-profit organizations utilize digital lending for specialized financing needs, though their market share remains comparatively lower .

South Africa Digital Lending and Fintech Platforms Market Competitive Landscape

The South Africa Digital Lending and Fintech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capitec Bank, African Bank, Finbond Group, Wonga South Africa, Lulalend, GetBucks South Africa, Finchoice (Weaver Fintech), RainFin, PayJustNow (Weaver Fintech), Capfin, Sanlam, Ubank, Fundi, Kiva, TymeBank contribute to innovation, geographic expansion, and service delivery in this space.

South Africa Digital Lending and Fintech Platforms Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, South Africa's smartphone penetration is projected to reach 60%, with approximately 40 million users. This surge facilitates access to digital lending platforms, enabling consumers to apply for loans conveniently. The World Bank reports that mobile internet usage has increased by 30% in the last two years, driving demand for mobile financial services. This trend is crucial for fintech growth, as it allows lenders to reach a broader audience and streamline the loan application process.

- Rise of Alternative Credit Scoring Models:In future, it is estimated that 40% of South African consumers will lack traditional credit histories, creating a significant opportunity for alternative credit scoring models. These models utilize data from social media, utility payments, and mobile usage to assess creditworthiness. According to the South African Reserve Bank, this innovation can potentially increase access to credit for millions of unbanked individuals, thereby expanding the customer base for digital lenders and enhancing financial inclusion.

- Demand for Quick and Accessible Loans:The demand for quick loans in South Africa is expected to grow, with the micro-lending sector projected to issue millions of loans in future. This demand is driven by consumers seeking immediate financial relief, particularly in urban areas where living costs are rising. The National Credit Regulator indicates that the average loan amount has increased to R5,000, reflecting a shift towards smaller, more accessible loans that cater to urgent financial needs, thus benefiting digital lending platforms.

Market Challenges

- Regulatory Compliance Complexities:The South African digital lending landscape faces significant regulatory hurdles, with over 50 regulations impacting fintech operations. Compliance with the National Credit Act and data protection laws requires substantial investment in legal and operational frameworks. The Financial Sector Conduct Authority reported that non-compliance can lead to penalties exceeding R1 million, posing a financial risk for startups and established lenders alike, which may hinder market growth and innovation.

- High Levels of Consumer Debt:As of future, South Africa's household debt-to-income ratio stands at approximately 62%, indicating a concerning level of consumer indebtedness. This high ratio limits the ability of consumers to take on additional loans, creating a challenging environment for digital lenders. The South African Reserve Bank warns that rising debt levels could lead to increased defaults, impacting the profitability of lending platforms and necessitating more stringent credit assessments to mitigate risks.

South Africa Digital Lending and Fintech Platforms Market Future Outlook

The South African digital lending market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in lending processes is expected to enhance risk assessment and streamline operations. Additionally, the shift towards peer-to-peer lending models is gaining traction, offering consumers more flexible financing options. As fintech companies continue to innovate, the focus on financial literacy will empower consumers, fostering a more informed borrowing environment and potentially reducing default rates in the future.

Market Opportunities

- Growth in E-commerce:The e-commerce sector in South Africa is projected to reach R55 billion by future, creating a substantial opportunity for digital lenders to offer tailored financing solutions. As online shopping becomes more prevalent, integrating lending options at checkout can enhance customer experience and drive sales, positioning fintech platforms as essential partners for e-commerce businesses.

- Partnerships with Fintech Startups:Collaborations between established lenders and fintech startups are expected to flourish, with over 30 partnerships anticipated in future. These alliances can leverage innovative technologies and customer insights, enabling traditional banks to enhance their digital offerings. By combining resources, both parties can expand their market reach and improve service delivery, ultimately benefiting consumers seeking diverse lending options.