Region:Africa

Author(s):Geetanshi

Product Code:KRAB4585

Pages:82

Published On:October 2025

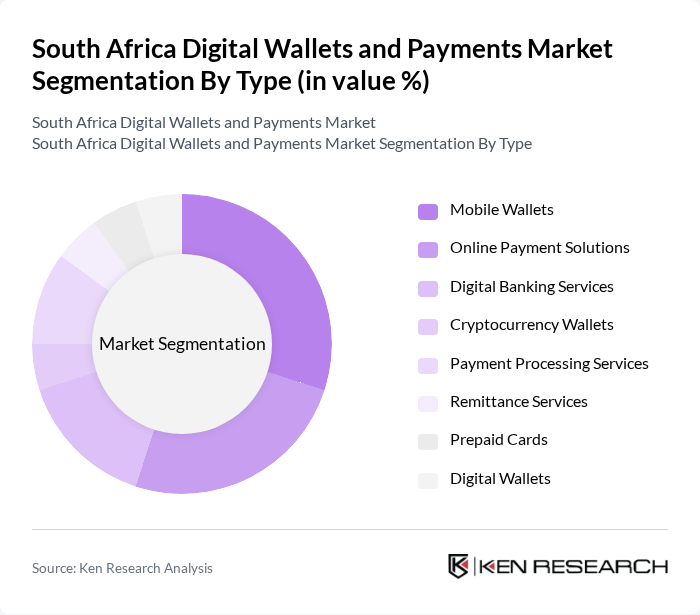

By Type:The market is segmented into mobile wallets, online payment solutions, digital banking services, cryptocurrency wallets, payment processing services, remittance services, prepaid cards, and digital wallets. These segments collectively shape the market, with mobile wallets and online payment solutions leading due to their ease of use, security features, and integration with e-commerce platforms. Payment processing services and digital banking are also gaining traction among businesses and consumers for their reliability and efficiency .

The mobile wallets segment dominates the market, driven by the widespread adoption of smartphones and the convenience they offer for everyday transactions. Consumers increasingly use mobile wallets for shopping, bill payments, and money transfers. Enhanced security features such as biometrics, tokenization, and device authentication, along with integration of loyalty programs and promotional offers, have made mobile wallets the preferred choice for users .

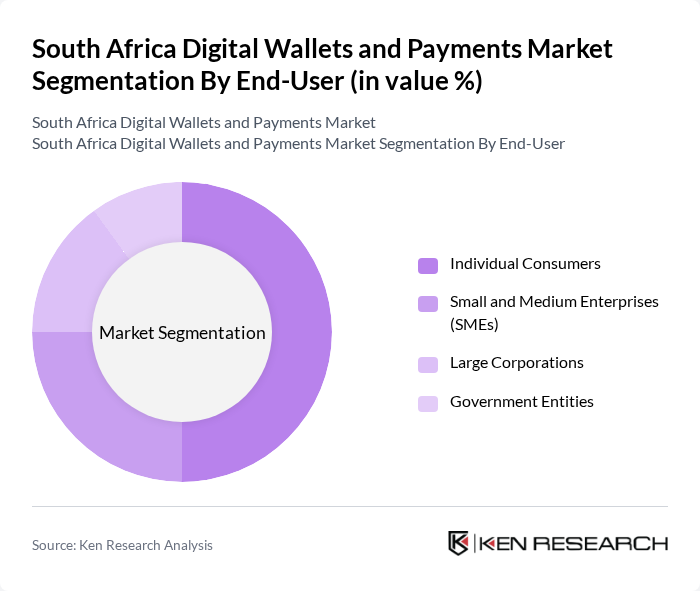

By End-User:The market is also segmented by end-users: individual consumers, small and medium enterprises (SMEs), large corporations, and government entities. Each group has distinct requirements, with individual consumers driving the largest share due to the convenience and accessibility of digital payment solutions. SMEs and large corporations leverage digital payments to streamline operations, improve customer experience, and enhance financial management .

Individual consumers represent the largest segment, supported by growing smartphone penetration and user-friendly digital wallet applications. The trend toward cashless transactions and the integration of digital payments into daily life have accelerated adoption. SMEs are increasingly utilizing digital payment solutions to optimize business processes and enhance customer engagement, further contributing to market growth .

The South Africa Digital Wallets and Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayFast, SnapScan, Zapper, Yoco, Standard Bank, Absa, FNB, Nedbank, Mastercard, Visa, PayPal, Apple Pay, Google Pay, Samsung Pay, Ukheshe Technologies, and Telkom contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital wallets and payments market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning will enhance transaction security and user experience. Additionally, the rise of peer-to-peer payment systems is expected to reshape the competitive landscape, offering consumers more choices. As digital wallets become increasingly mainstream, their role in facilitating financial inclusion and supporting local businesses will be paramount in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Payment Solutions Digital Banking Services Cryptocurrency Wallets Payment Processing Services Remittance Services Prepaid Cards Digital Wallets |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | E-commerce Transactions In-store Payments Bill Payments Fund Transfers Expense Management |

| By Distribution Channel | Direct Sales Online Platforms Retail Partnerships Mobile Apps |

| By User Demographics | Age Groups Income Levels Urban vs Rural |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Prepaid Cards |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 120 | Regular Users, Occasional Users |

| Merchant Adoption of Digital Payments | 80 | Small Business Owners, Retail Managers |

| Fintech Industry Insights | 60 | Fintech Executives, Product Managers |

| Regulatory Impact Assessment | 45 | Policy Makers, Compliance Officers |

| Consumer Attitudes Towards Security in Digital Payments | 75 | General Consumers, Tech-Savvy Users |

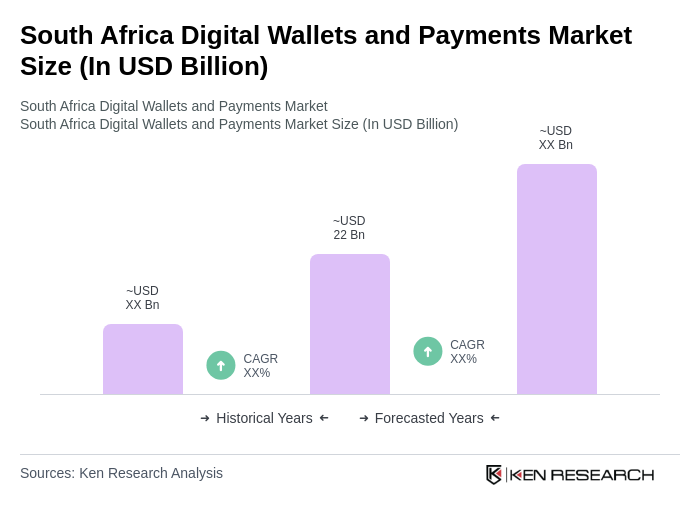

The South Africa Digital Wallets and Payments Market is valued at approximately USD 22 billion, reflecting significant growth driven by smartphone adoption, e-commerce expansion, and a shift towards cashless transactions among consumers.