Region:Africa

Author(s):Dev

Product Code:KRAB3130

Pages:87

Published On:October 2025

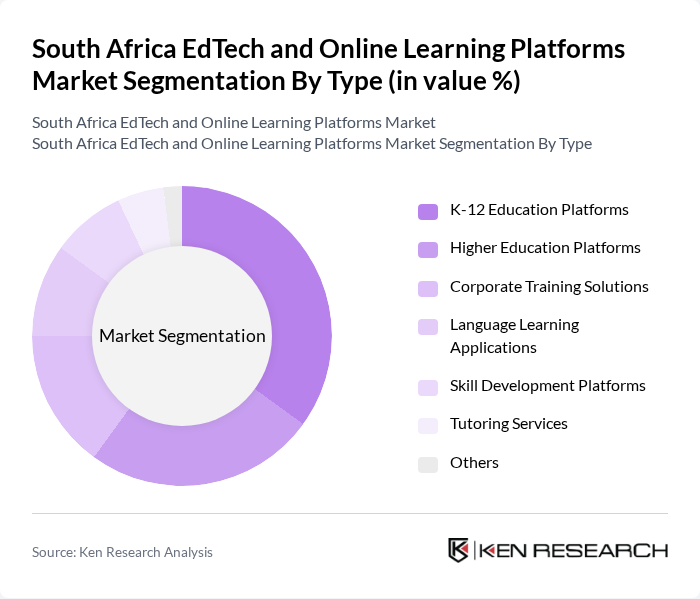

By Type:The market is segmented into various types, including K-12 Education Platforms, Higher Education Platforms, Corporate Training Solutions, Language Learning Applications, Skill Development Platforms, Tutoring Services, and Others. Among these, K-12 Education Platforms are currently leading the market due to the increasing demand for online learning resources among school-aged children. The shift towards blended learning models and the need for personalized education solutions are driving this segment's growth.

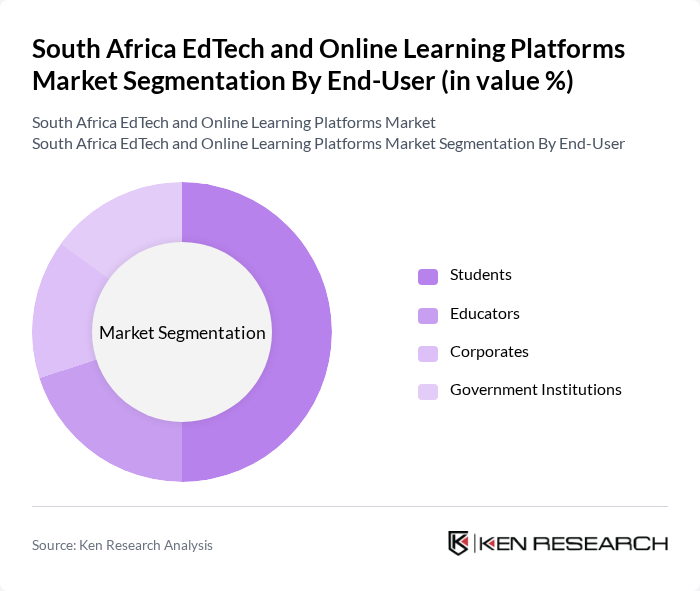

By End-User:The end-user segmentation includes Students, Educators, Corporates, and Government Institutions. The student segment is the largest, driven by the increasing number of learners seeking flexible and accessible education options. The rise in online courses and the need for supplementary learning resources have made this segment a focal point for EdTech providers, leading to significant investments in student-centric platforms.

The South Africa EdTech and Online Learning Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as GetSmarter, Coursera, Udemy, Skillshare, edX, Mzansi Online, Siyavula Education, TeachMe2, LearnX, Code Academy, FutureLearn, LinkedIn Learning, Pluralsight, Khan Academy, Brainly contribute to innovation, geographic expansion, and service delivery in this space.

The South African EdTech market is poised for significant transformation, driven by technological advancements and evolving educational needs. As internet penetration continues to rise, more learners will seek online solutions, fostering a robust ecosystem for digital education. The integration of AI and personalized learning experiences will further enhance engagement and effectiveness. Additionally, partnerships between EdTech companies and educational institutions will likely expand, creating innovative learning pathways that cater to diverse audiences and promote lifelong learning opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | K-12 Education Platforms Higher Education Platforms Corporate Training Solutions Language Learning Applications Skill Development Platforms Tutoring Services Others |

| By End-User | Students Educators Corporates Government Institutions |

| By Sales Channel | Direct Sales Online Marketplaces Partnerships with Educational Institutions Others |

| By Content Type | Video-Based Learning Interactive Quizzes and Assessments Text-Based Learning Materials Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Models Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Geographic Reach | National Regional International Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 150 | University Administrators, IT Directors |

| K-12 Schools | 120 | School Principals, Curriculum Coordinators |

| EdTech Startups | 100 | Founders, Product Managers |

| Corporate Training Programs | 80 | HR Managers, Training Coordinators |

| Online Learning Users | 200 | Students, Parents, Educators |

The South Africa EdTech and Online Learning Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital learning adoption and internet penetration, particularly accelerated by the COVID-19 pandemic.