Region:Africa

Author(s):Rebecca

Product Code:KRAB4128

Pages:92

Published On:October 2025

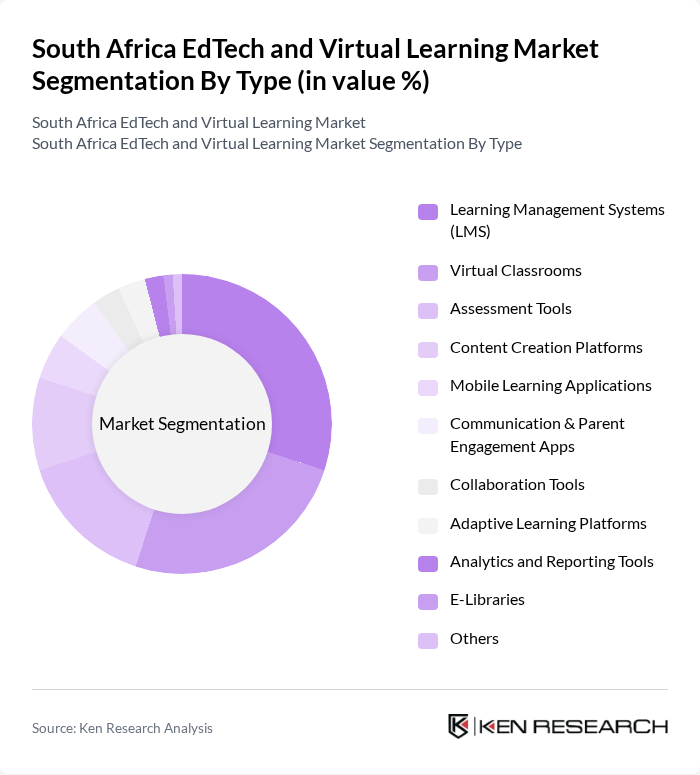

By Type:The market is segmented into various types, including Learning Management Systems (LMS), Virtual Classrooms, Assessment Tools, Content Creation Platforms, Mobile Learning Applications, Communication & Parent Engagement Apps, Collaboration Tools, Adaptive Learning Platforms, Analytics and Reporting Tools, E-Libraries, and Others. Each of these sub-segments plays a crucial role in enhancing the educational experience and meeting the diverse needs of learners and educators. Learning Management Systems and e-learning platforms are the largest contributors, driven by widespread adoption in K-12 and higher education, while mobile learning applications are rapidly gaining traction due to South Africa’s mobile-first digital ecosystem .

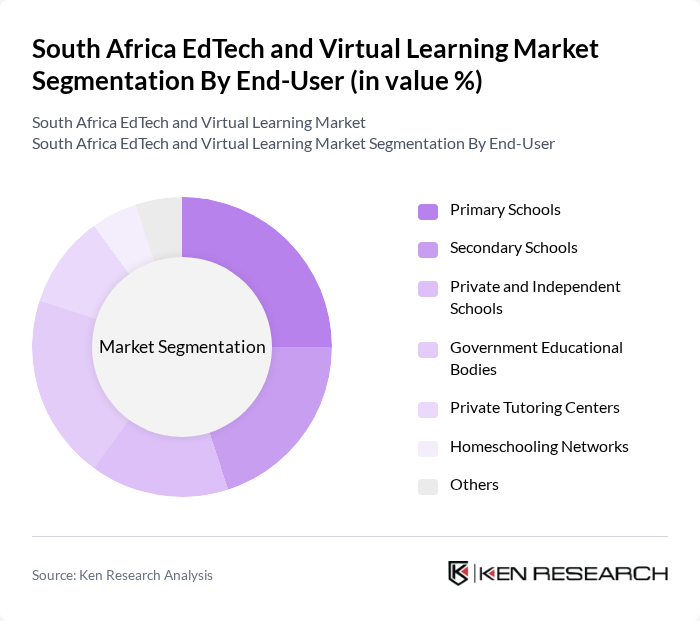

By End-User:The end-user segmentation includes Primary Schools, Secondary Schools, Private and Independent Schools, Government Educational Bodies, Private Tutoring Centers, Homeschooling Networks, and Others. This segmentation highlights the diverse applications of EdTech solutions across different educational levels and types of institutions. K-12 education (primary and secondary schools) represents the largest end-user group, reflecting the government’s focus on digital transformation in basic education. Higher education and private tutoring centers are also significant adopters, particularly for upskilling and exam preparation .

The South Africa EdTech and Virtual Learning Market is characterized by a dynamic mix of regional and international players. Leading participants such as D6 School Communicator, GetSmarter, Siyavula Education, Snapplify, The Student Hub, FoondaMate, Mindset Learn, iXperience, Enko Education, TeachMe2, The Digital School, EduOne, Valenture Institute, Digicampus, Coursera, Udemy, LinkedIn Learning, FutureLearn contribute to innovation, geographic expansion, and service delivery in this space.

The South African EdTech market is poised for significant transformation as digital learning becomes increasingly integrated into traditional education systems. With ongoing government support and rising internet penetration, the landscape is evolving to accommodate diverse learning needs. Innovations such as AI-driven personalized learning and gamification are expected to enhance engagement and effectiveness. As corporate training programs expand, collaboration between educational institutions and technology providers will be crucial in developing tailored solutions that address local challenges and maximize educational outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Virtual Classrooms Assessment Tools Content Creation Platforms Mobile Learning Applications Communication & Parent Engagement Apps Collaboration Tools Adaptive Learning Platforms Analytics and Reporting Tools E-Libraries Others |

| By End-User | Primary Schools Secondary Schools Private and Independent Schools Government Educational Bodies Private Tutoring Centers Homeschooling Networks Others |

| By Application | Curriculum Delivery Student Assessment Teacher Professional Development Parental Engagement School Administration & Reporting Others |

| By Distribution Channel | Direct Sales Online Marketplaces Resellers and Distributors Partnerships with Schools & Districts Telecom Bundling & Data Partnerships Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Licensing Fees Institutional Contracts Others |

| By Content Type | Textbooks and E-Books Video Content Interactive Simulations Quizzes and Assessments Gamified Content Others |

| By User Demographics | Age Group Learning Styles Socioeconomic Status Language Preference Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Primary Education EdTech Adoption | 100 | Primary School Teachers, School Administrators |

| Secondary Education Virtual Learning Tools | 80 | High School Teachers, Curriculum Developers |

| Tertiary Education Online Learning Platforms | 60 | University Lecturers, Educational Technologists |

| EdTech Startups and Innovations | 50 | Founders, Product Managers |

| Student Engagement in Virtual Learning | 70 | High School and University Students |

The South Africa EdTech and Virtual Learning Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased adoption of digital learning solutions and rising internet penetration, particularly in urban areas.