Region:Africa

Author(s):Geetanshi

Product Code:KRAB5165

Pages:93

Published On:October 2025

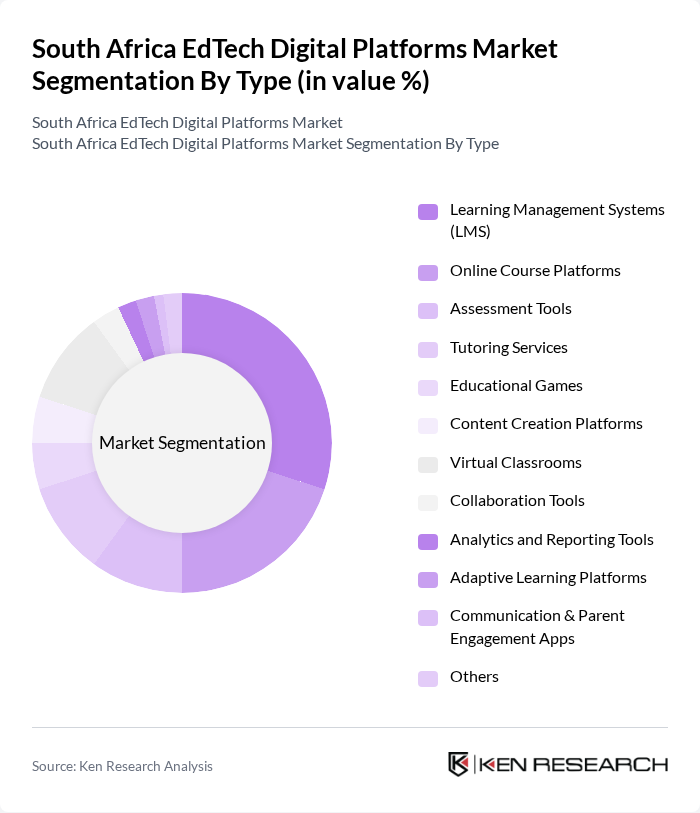

By Type:The EdTech market in South Africa is segmented into Learning Management Systems (LMS), Online Course Platforms, Assessment Tools, Tutoring Services, Educational Games, Content Creation Platforms, Virtual Classrooms, Collaboration Tools, Analytics and Reporting Tools, Adaptive Learning Platforms, Communication & Parent Engagement Apps, and Others. Among these, Learning Management Systems (LMS) have emerged as the dominant segment, supported by their ability to streamline educational processes and enhance the learning experience through centralized content management and student performance tracking. E-learning platforms and school administration solutions also account for a significant share, reflecting the sector’s focus on scalable, accessible digital education .

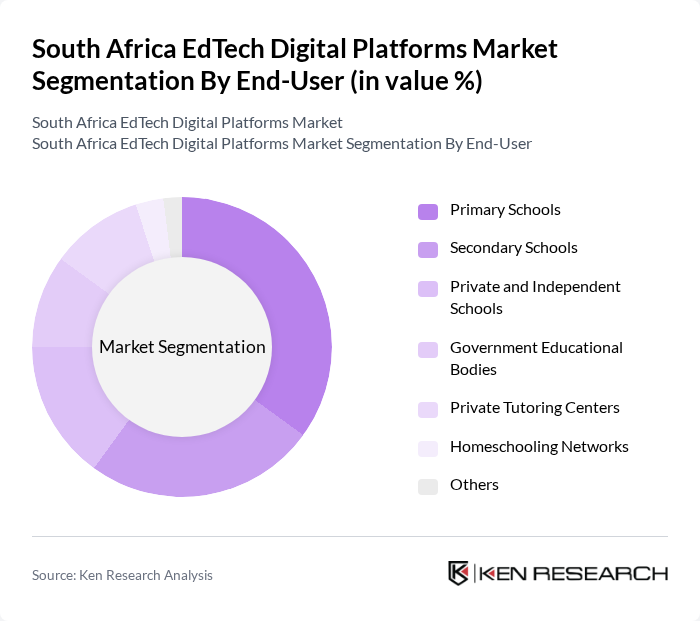

By End-User:The end-user segmentation of the EdTech market includes Primary Schools, Secondary Schools, Private and Independent Schools, Government Educational Bodies, Private Tutoring Centers, Homeschooling Networks, and Others. The primary schools segment is currently leading the market, driven by the increasing emphasis on foundational education and the integration of technology in early learning environments, which enhances student engagement and learning outcomes. K-12 (basic education) accounts for the largest share of the market, reflecting the sector’s focus on improving access and quality at the foundational level .

The South Africa EdTech Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as D6 School Communicator, GetSmarter, Siyavula Education, Snapplify, The Student Hub, FoondaMate, Mindset Learn, TeachMe2, iXperience, Digicampus, Eduvation, Enko Education, Valenture Institute, Reflective Learning, and Click Learning contribute to innovation, geographic expansion, and service delivery in this space.

The South African EdTech market is poised for significant transformation as technological advancements and educational reforms converge. With a focus on personalized learning experiences and the integration of AI, platforms are expected to evolve, catering to diverse learner needs. Additionally, the emphasis on data privacy and security will shape the development of new solutions. As partnerships between EdTech companies and educational institutions grow, the market will likely see innovative approaches to learning, enhancing accessibility and engagement for all students.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Online Course Platforms Assessment Tools Tutoring Services Educational Games Content Creation Platforms Virtual Classrooms Collaboration Tools Analytics and Reporting Tools Adaptive Learning Platforms Communication & Parent Engagement Apps Others |

| By End-User | Primary Schools Secondary Schools Private and Independent Schools Government Educational Bodies Private Tutoring Centers Homeschooling Networks Others |

| By Application | Curriculum Delivery Student Assessment Teacher Professional Development Parental Engagement School Administration & Reporting Others |

| By Distribution Channel | Direct Sales Online Marketplaces Resellers and Distributors Partnerships with Schools & Districts Telecom Bundling & Data Partnerships Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Licensing Fees Institutional Contracts Others |

| By Content Type | Textbooks and E-Books Video Content Interactive Simulations Quizzes and Assessments Gamified Content Others |

| By User Demographics | Age Group Learning Styles Socioeconomic Status Language Preference Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 EdTech Platforms | 120 | School Administrators, Teachers, EdTech Developers |

| Higher Education Digital Tools | 90 | University Faculty, IT Managers, Student Representatives |

| Vocational Training Solutions | 60 | Training Coordinators, Industry Experts, Learners |

| Parental Engagement Apps | 50 | Parents, Educational Consultants, App Developers |

| Corporate Learning Platforms | 70 | HR Managers, Learning & Development Specialists, Corporate Trainers |

The South Africa EdTech Digital Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing adoption of digital learning solutions and rising internet penetration across the country.