Region:Africa

Author(s):Rebecca

Product Code:KRAA5867

Pages:92

Published On:September 2025

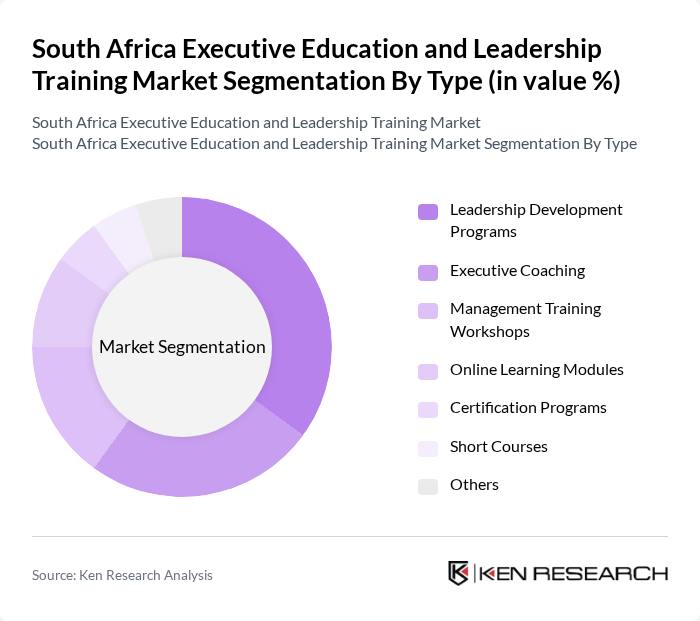

By Type:

The market is segmented into various types, including Leadership Development Programs, Executive Coaching, Management Training Workshops, Online Learning Modules, Certification Programs, Short Courses, and Others. Among these, Leadership Development Programs are the most dominant, as organizations increasingly recognize the need for effective leadership to navigate complex business environments. The demand for tailored programs that address specific leadership challenges has surged, reflecting a shift towards personalized learning experiences. This trend is further supported by the growing emphasis on soft skills and emotional intelligence in leadership roles.

By End-User:

The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporates represent the largest segment, driven by the need for continuous professional development and the enhancement of leadership skills within organizations. Companies are increasingly investing in training programs to foster a culture of learning and adaptability, which is essential for maintaining competitive advantage in a rapidly changing business landscape. This trend is particularly evident in sectors such as finance, technology, and healthcare, where leadership capabilities are critical for success.

The South Africa Executive Education and Leadership Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Cape Town Graduate School of Business, Wits Business School, Gordon Institute of Business Science, Henley Business School, Stellenbosch Business School, University of Pretoria - Gordon Institute of Business Science, Milpark Education, The Da Vinci Institute, MANCOSA, University of Johannesburg - College of Business and Economics, South African Institute of Management, The Business School at the University of Cape Town, University of the Western Cape - School of Business and Finance, University of the Free State - Business School, North-West University - Potchefstroom Business School contribute to innovation, geographic expansion, and service delivery in this space.

The South African executive education market is poised for significant transformation, driven by technological advancements and evolving workforce needs. As organizations increasingly prioritize leadership development, the integration of innovative learning methods will become essential. The focus on personalized learning experiences and the adoption of data analytics to measure training effectiveness will shape future offerings. Additionally, the emphasis on soft skills and emotional intelligence will redefine curricula, ensuring that training programs remain relevant and impactful in a dynamic business environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Executive Coaching Management Training Workshops Online Learning Modules Certification Programs Short Courses Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Virtual Training Hybrid Training On-Demand Learning Others |

| By Duration | Short-Term Programs (Less than 1 month) Medium-Term Programs (1-3 months) Long-Term Programs (More than 3 months) Others |

| By Industry Focus | Finance and Banking Healthcare Technology Manufacturing Retail Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Professional Development Units (PDUs) Others |

| By Pricing Tier | Premium Programs Mid-Range Programs Budget Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Leadership Training Programs | 150 | HR Directors, Training Managers |

| Public Sector Executive Education | 100 | Government Officials, Policy Makers |

| Non-Profit Leadership Development | 80 | NGO Managers, Program Coordinators |

| Industry-Specific Training Initiatives | 70 | Industry Experts, Training Consultants |

| Online Executive Education Platforms | 90 | eLearning Managers, Content Developers |

The South Africa Executive Education and Leadership Training Market is valued at approximately USD 1.2 billion, reflecting a significant demand for skilled leadership across various sectors and the rise of digital learning platforms that enhance accessibility for professionals.