Region:Africa

Author(s):Geetanshi

Product Code:KRAB5146

Pages:98

Published On:October 2025

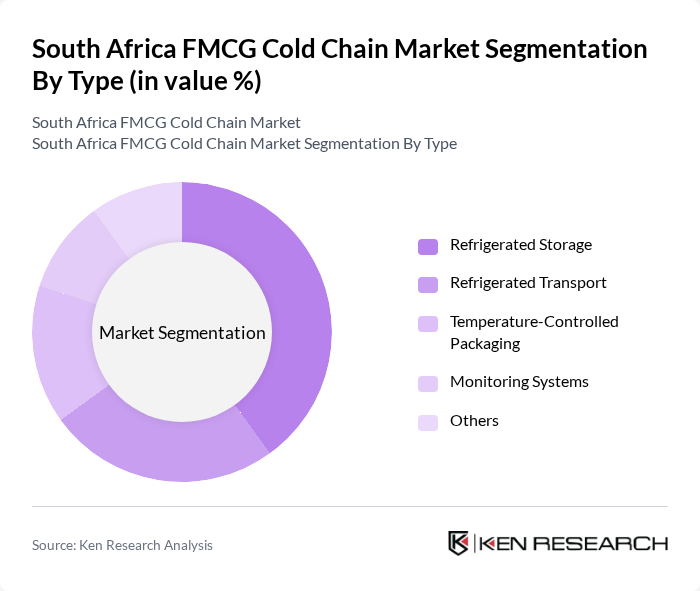

By Type:The market is segmented into various types, including Refrigerated Storage, Refrigerated Transport, Temperature-Controlled Packaging, Monitoring Systems, and Others. Among these, Refrigerated Storage is the leading sub-segment due to the increasing need for efficient storage solutions for perishable goods. The demand for advanced storage facilities that maintain optimal temperatures is driven by the growing food and beverage sector, which prioritizes quality and safety in product handling. Transportation is the fastest-growing segment, supported by investments in refrigerated vehicles and multimodal logistics networks.

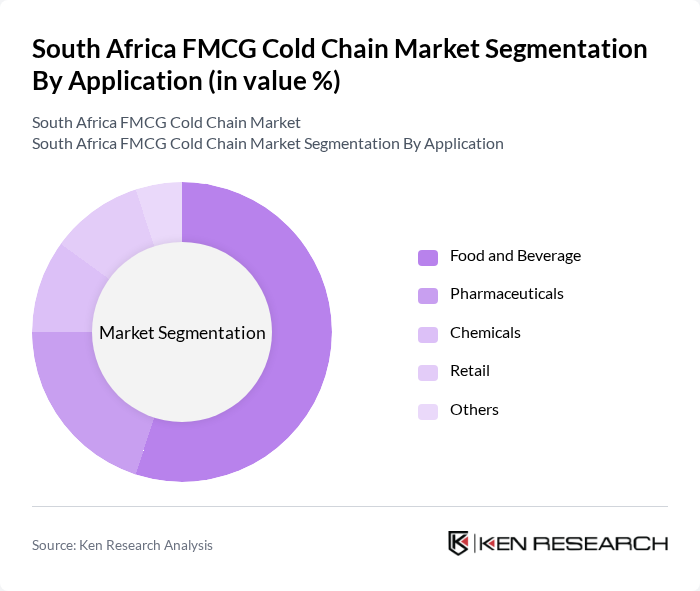

By Application:The applications of cold chain logistics in the market include Food and Beverage, Pharmaceuticals, Chemicals, Retail, and Others. The Food and Beverage sector is the dominant application, driven by the increasing consumption of fresh and frozen products. The rising health consciousness among consumers and the demand for high-quality food products have led to a surge in the need for efficient cold chain solutions in this segment. The pharmaceutical sector is also a significant contributor, with strict regulatory requirements for temperature-sensitive medicines amplifying demand for reliable cold chain services.

The South Africa FMCG Cold Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Group Limited, Imperial Logistics Limited, CCS Logistics (a division of Oceana Group), Africold Logistics, Kuehne + Nagel, DHL Supply Chain, RCL Foods Limited, Unitrans Supply Chain Solutions, Transnet Freight Rail, SAA Cargo, Value Logistics, Grindrod Intermodal, Barloworld Logistics, Vector Logistics, Pick n Pay Stores Limited contribute to innovation, geographic expansion, and service delivery in this space.

The South Africa FMCG cold chain market is poised for transformative growth, driven by technological innovations and evolving consumer behaviors. As e-commerce continues to expand, the demand for efficient cold chain solutions will intensify, prompting investments in infrastructure and technology. Additionally, sustainability initiatives will shape operational practices, with a focus on reducing carbon footprints. The integration of smart technologies will enhance supply chain transparency, ensuring food safety and quality, ultimately benefiting consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Storage Refrigerated Transport Temperature-Controlled Packaging Monitoring Systems Others |

| By Application | Food and Beverage Pharmaceuticals Chemicals Retail Others |

| By Temperature Type | Chilled (0°C to 5°C) Frozen (-18°C and below) Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics Hybrid Distribution Others |

| By Product Category | Dairy & Frozen Desserts Meat, Fish and Seafood Products Fruits & Vegetables Bakery & Confectionery Products Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FMCG Cold Chain Logistics | 120 | Logistics Managers, Supply Chain Executives |

| Temperature-Controlled Warehousing | 90 | Warehouse Managers, Operations Directors |

| Distribution of Perishable Goods | 60 | Distribution Managers, Product Managers |

| Retail Cold Chain Management | 50 | Retail Operations Managers, Supply Chain Analysts |

| Food Safety Compliance in Cold Chain | 40 | Quality Assurance Managers, Compliance Officers |

The South Africa FMCG Cold Chain Market is valued at approximately USD 1.0 billion, driven by the increasing demand for perishable goods and advancements in refrigeration technology. This market is expected to grow significantly due to rising consumer preferences for fresh and frozen food products.