Region:Africa

Author(s):Dev

Product Code:KRAA4658

Pages:89

Published On:September 2025

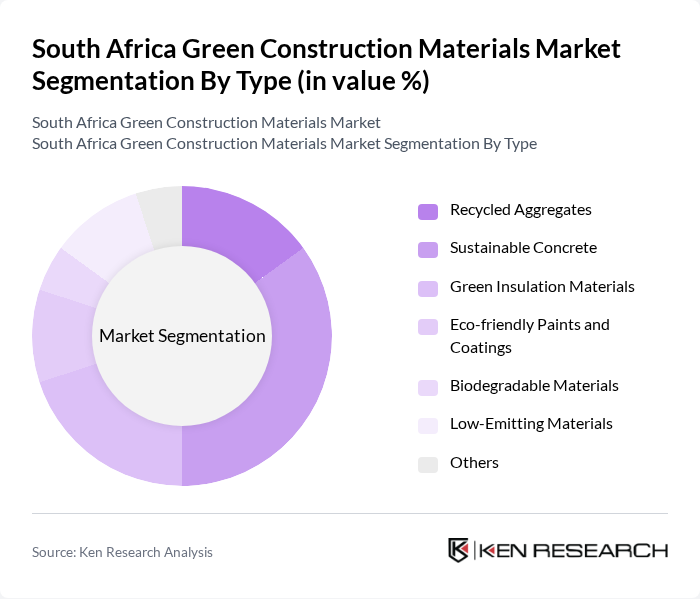

By Type:The market is segmented into various types of green construction materials, including Recycled Aggregates, Sustainable Concrete, Green Insulation Materials, Eco-friendly Paints and Coatings, Biodegradable Materials, Low-Emitting Materials, and Others. Among these, Sustainable Concrete is currently the leading subsegment due to its widespread application in both residential and commercial construction projects. The increasing focus on reducing the carbon footprint of buildings has led to a surge in demand for concrete that incorporates recycled materials and innovative additives, making it a preferred choice for builders and developers.

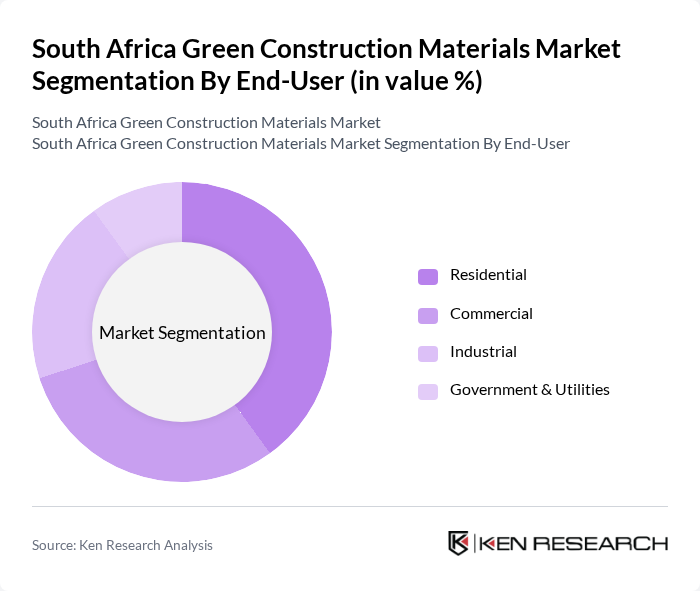

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the most significant contributor to the market, driven by a growing trend towards sustainable living and energy-efficient homes. Homeowners are increasingly opting for green materials to reduce energy costs and enhance indoor air quality, leading to a robust demand for eco-friendly construction solutions.

The South Africa Green Construction Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as AfriSam Group, PPC Ltd., Saint-Gobain Construction Products, Lafarge South Africa, Eco-Insulation, Green Building Council South Africa, Sika South Africa, Boral Limited, KNAUF Insulation, AECOM, Holcim South Africa, Bidvest Group, Mapei South Africa, RWC Group, Tiber Construction contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African green construction materials market appears promising, driven by increasing regulatory support and a growing consumer base that prioritizes sustainability. By future, the integration of smart technologies in construction is expected to enhance efficiency and reduce waste. Additionally, the expansion of green building certifications will likely encourage more developers to invest in sustainable practices, fostering innovation and collaboration within the industry, ultimately leading to a more sustainable construction landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Recycled Aggregates Sustainable Concrete Green Insulation Materials Eco-friendly Paints and Coatings Biodegradable Materials Low-Emitting Materials Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation Infrastructure Development Landscaping |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Outlets |

| By Price Range | Budget Mid-Range Premium |

| By Material Source | Locally Sourced Imported |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Green Building Projects | 100 | Architects, Home Builders, Project Managers |

| Commercial Eco-Friendly Developments | 80 | Construction Managers, Sustainability Consultants |

| Industrial Green Material Usage | 60 | Facility Managers, Procurement Specialists |

| Government Green Building Initiatives | 50 | Policy Makers, Urban Planners, Environmental Officers |

| Supplier Insights on Green Materials | 70 | Sales Managers, Product Development Leads |

The South Africa Green Construction Materials Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing environmental awareness and government initiatives promoting sustainable building practices.