Region:Africa

Author(s):Rebecca

Product Code:KRAB5375

Pages:96

Published On:October 2025

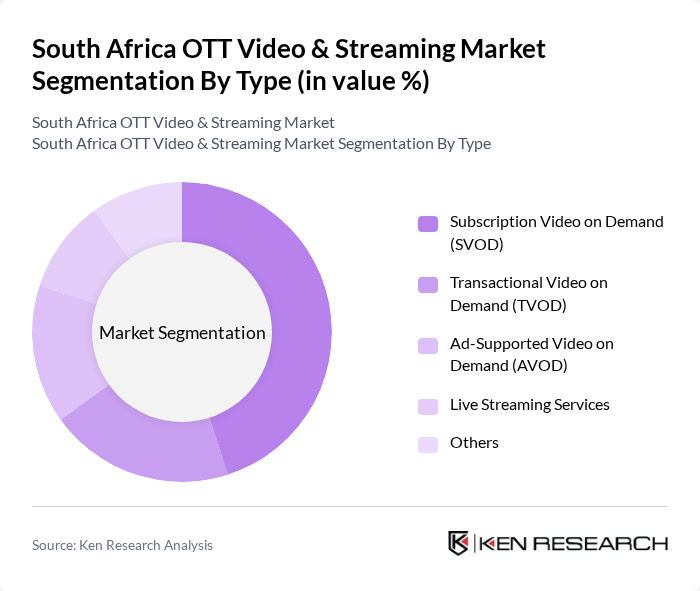

By Type:The OTT Video & Streaming Market can be segmented into various types, including Subscription Video on Demand (SVOD), Transactional Video on Demand (TVOD), Ad-Supported Video on Demand (AVOD), Live Streaming Services, and Others. Among these, Subscription Video on Demand (SVOD) has emerged as the leading segment, driven by the increasing popularity of platforms like Netflix and Showmax. Consumers are increasingly favoring subscription models for their convenience and extensive content libraries, leading to a significant share of the market.

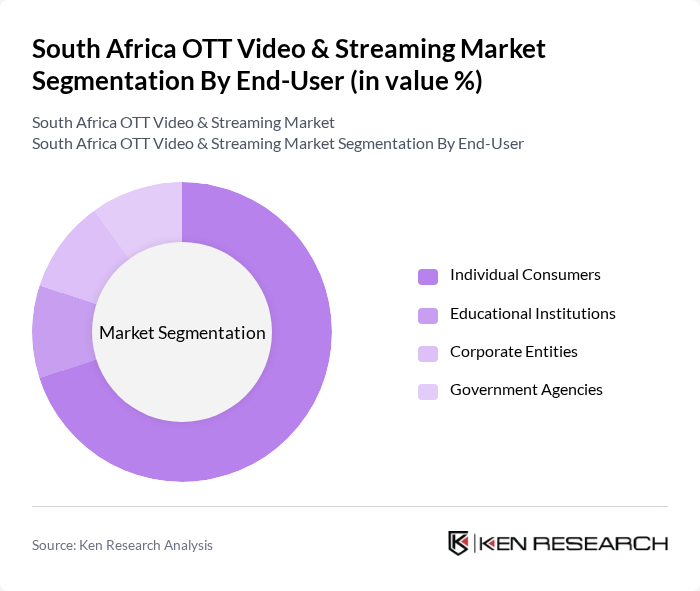

By End-User:The market can also be segmented by end-user categories, including Individual Consumers, Educational Institutions, Corporate Entities, and Government Agencies. Individual Consumers represent the largest segment, as the majority of OTT video consumption is driven by personal viewing preferences. The increasing trend of binge-watching and the demand for diverse content options have made this segment a key driver of market growth.

The South Africa OTT Video & Streaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Inc., Showmax, DStv Now, Amazon Prime Video, YouTube Premium, Apple TV+, ViacomCBS, Hulu, Starz Play, Google Play Movies & TV, Viu, BritBox, Tencent Video, iFlix, M-Net contribute to innovation, geographic expansion, and service delivery in this space.

The South African OTT video and streaming market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As mobile streaming becomes increasingly prevalent, platforms will likely invest in optimizing content for mobile devices. Additionally, the integration of AI for personalized content recommendations will enhance user experiences. The growth of local content production will further attract viewers, fostering a more competitive environment that encourages innovation and diverse offerings in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription Video on Demand (SVOD) Transactional Video on Demand (TVOD) Ad-Supported Video on Demand (AVOD) Live Streaming Services Others |

| By End-User | Individual Consumers Educational Institutions Corporate Entities Government Agencies |

| By Content Genre | Movies Series Documentaries Sports Others |

| By Distribution Channel | Direct-to-Consumer Platforms Third-Party Aggregators Telecom Partnerships Others |

| By Pricing Model | Subscription-Based Pay-Per-View Freemium Others |

| By Device Type | Smart TVs Mobile Devices Laptops and Desktops Gaming Consoles |

| By User Demographics | Age Groups Income Levels Geographic Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OTT Platform Subscribers | 150 | Regular Users, Occasional Viewers |

| Content Producers | 100 | Producers, Directors, Scriptwriters |

| Advertising Agencies | 80 | Media Buyers, Account Managers |

| Telecom Service Providers | 70 | Product Managers, Marketing Directors |

| Consumer Insights Specialists | 60 | Market Researchers, Data Analysts |

The South Africa OTT Video & Streaming Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet access, smart device proliferation, and a shift towards on-demand content consumption.