South America Food Hydrocolloids Market Overview

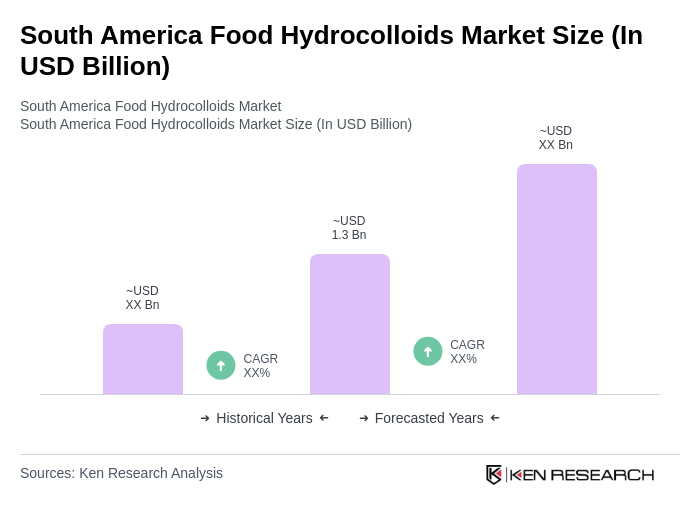

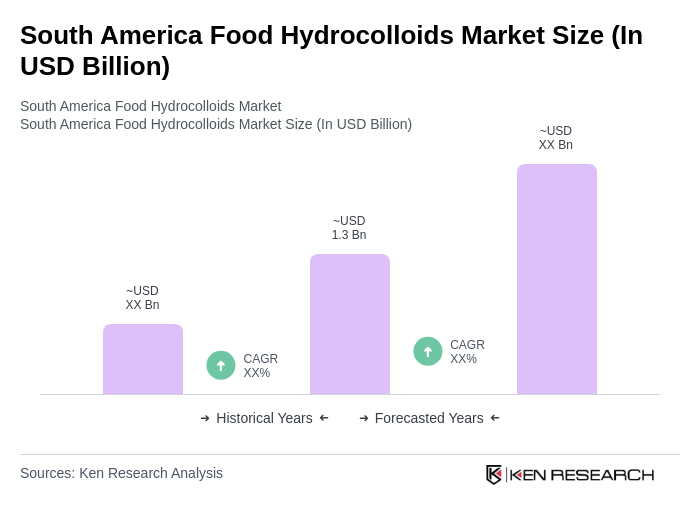

- The South America Food Hydrocolloids Market is valued at USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for natural and plant-based food ingredients, rising consumer awareness regarding health and wellness, and the food industry’s shift towards clean label products, which has further propelled the adoption of hydrocolloids in various applications. The market is also supported by the expanding processed food sector and urbanization trends, as consumers seek convenient and functional food options that utilize hydrocolloids for improved texture, stability, and shelf life .

- Brazil and Argentina dominate the South America Food Hydrocolloids Market due to their robust agricultural sectors and established food processing industries. Brazil accounts for approximately 60% of the market share, with its large population and diverse food culture driving significant demand for hydrocolloids. Argentina holds around 25% market share, where the focus on meat and dairy products enhances the need for stabilizers and thickeners in these sectors .

- In 2023, the Brazilian government implemented regulations to promote the use of natural food additives, including hydrocolloids, in food products. This initiative is governed byRDC No. 778/2023 issued by the Brazilian Health Regulatory Agency (ANVISA), which sets standards for the use of food additives and technological adjuvants, aiming to enhance food safety and quality while encouraging manufacturers to reduce synthetic additives. The regulation establishes permissible hydrocolloid types, maximum usage levels, and labeling requirements, thereby supporting the growth of the food hydrocolloids market .

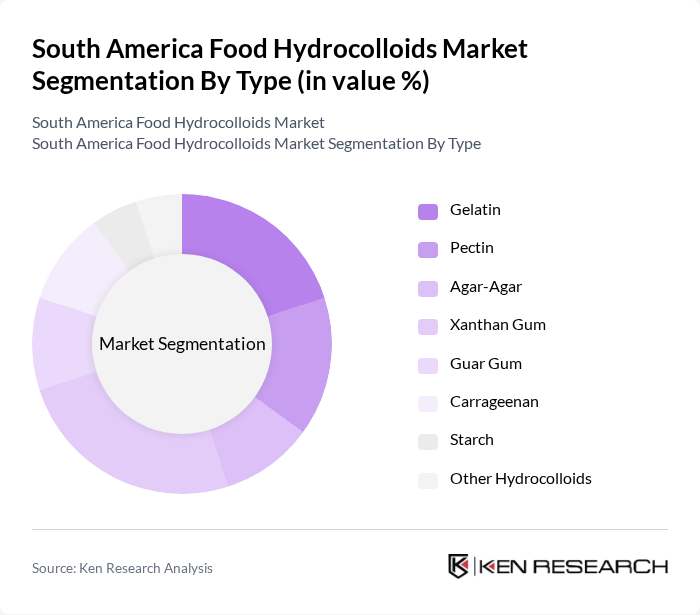

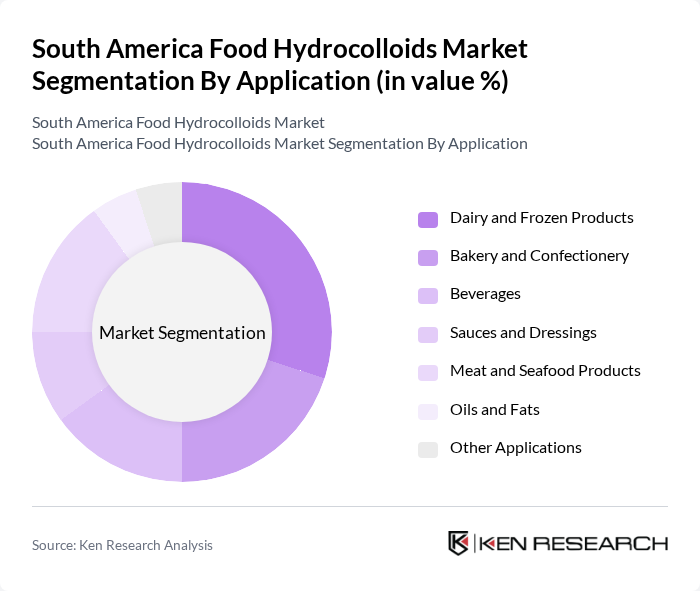

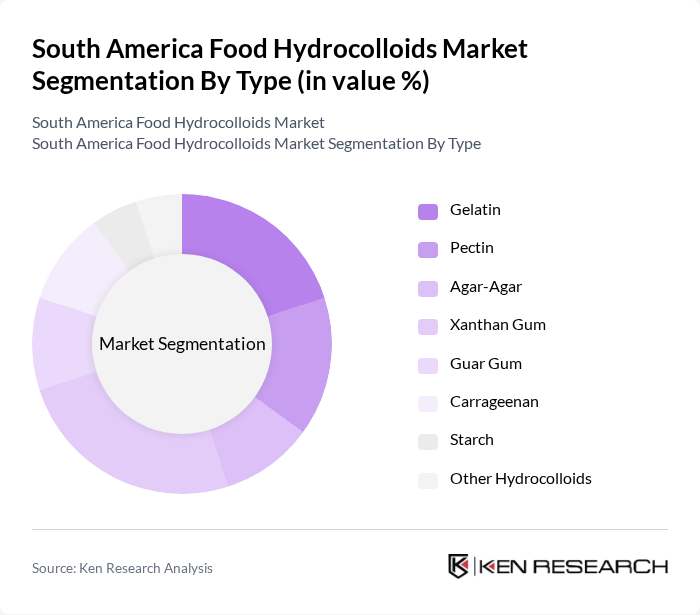

South America Food Hydrocolloids Market Segmentation

By Type:The market is segmented into various types of hydrocolloids, includingGelatin, Pectin, Agar-Agar, Xanthan Gum, Guar Gum, Carrageenan, Starch, and Other Hydrocolloids. Each type serves distinct functions in food applications, such as gelling, thickening, stabilizing, and emulsifying. Gelatin and pectin are widely used in confectionery and dairy, agar-agar and carrageenan in desserts and dairy, xanthan gum and guar gum in sauces and dressings, and starch in bakery and processed foods .

By Application:The applications of hydrocolloids in the food industry includeDairy and Frozen Products, Bakery and Confectionery, Beverages, Sauces and Dressings, Meat and Seafood Products, Oils and Fats, and Other Applications. Hydrocolloids are used to enhance texture, stability, and shelf life in these segments. Dairy and frozen products utilize hydrocolloids for creaminess and structure, bakery and confectionery for moisture retention and gelling, beverages for suspension and mouthfeel, sauces and dressings for viscosity, meat and seafood for binding and juiciness, and oils and fats for emulsification .

South America Food Hydrocolloids Market Competitive Landscape

The South America Food Hydrocolloids Market is characterized by a dynamic mix of regional and international players. Leading participants such asDuPont de Nemours, Inc., Kerry Group plc, Ingredion Incorporated, Cargill, Incorporated, Ashland Global Holdings Inc., Tate & Lyle PLC, DSM Nutritional Products, Fufeng Group Company Limited, CP Kelco U.S., Inc., Naturex S.A. (a Givaudan company), Givaudan SA, Wacker Chemie AG, Gelita AG, Emsland Group, CEAMSA (Compañía Española de Algas Marinas S.A.), Rico Carrageenan, Hispanagar S.A.contribute to innovation, geographic expansion, and service delivery in this space .

South America Food Hydrocolloids Market Industry Analysis

Growth Drivers

- Increasing Demand for Natural Food Additives:The South American food hydrocolloids market is experiencing a surge in demand for natural food additives, driven by consumer preferences for healthier options. In future, the natural food additives market is projected to reach $1.5 billion, reflecting a 10% increase from the previous year. This shift is largely influenced by the growing awareness of the health benefits associated with natural ingredients, as consumers increasingly seek products free from synthetic additives, aligning with global trends towards clean label products.

- Rising Health Consciousness Among Consumers:Health consciousness is significantly impacting the food hydrocolloids market in South America. According to the World Health Organization, approximately 60% of South American consumers are actively seeking healthier food options. This trend is expected to drive the demand for hydrocolloids, which are often perceived as healthier alternatives to traditional thickeners and stabilizers. The increasing prevalence of lifestyle-related diseases further emphasizes the need for healthier food formulations, propelling market growth.

- Expansion of the Food and Beverage Industry:The food and beverage industry in South America is projected to grow at a rate of 8% annually, reaching $500 billion in future. This expansion is a key driver for the food hydrocolloids market, as manufacturers seek to enhance product quality and shelf life. The rise in disposable income and urbanization is leading to increased consumption of processed foods, thereby boosting the demand for hydrocolloids as essential ingredients in various food applications.

Market Challenges

- Fluctuating Raw Material Prices:The South American food hydrocolloids market faces challenges due to fluctuating raw material prices, particularly for key ingredients like guar gum and xanthan gum. In future, guar gum prices are expected to rise by 15% due to supply chain disruptions and climatic factors affecting production. This volatility can lead to increased production costs for manufacturers, impacting profit margins and pricing strategies in the competitive landscape.

- Stringent Regulatory Requirements:Stringent regulatory requirements pose significant challenges for the food hydrocolloids market in South America. The region's food safety regulations, enforced by agencies such as ANVISA in Brazil, require rigorous testing and compliance for food additives. In future, compliance costs are projected to increase by 20%, placing additional financial burdens on manufacturers. This can hinder innovation and slow down the introduction of new hydrocolloid products into the market.

South America Food Hydrocolloids Market Future Outlook

The future of the South American food hydrocolloids market appears promising, driven by evolving consumer preferences and technological advancements. The shift towards clean label products and plant-based alternatives is expected to create new avenues for growth. Additionally, the increasing focus on sustainability will likely encourage the development of eco-friendly hydrocolloid solutions. As the food and beverage industry continues to expand, manufacturers will need to adapt to these trends to remain competitive and meet consumer demands effectively.

Market Opportunities

- Growth in the Organic Food Sector:The organic food sector in South America is projected to grow by 12% annually, reaching $10 billion in future. This growth presents significant opportunities for hydrocolloid manufacturers to develop organic-certified products, catering to the increasing consumer demand for organic ingredients in food formulations.

- Increasing Applications in the Pharmaceutical Industry:The pharmaceutical industry in South America is expected to expand by 9% in future, creating opportunities for hydrocolloids in drug formulation and delivery systems. The versatility of hydrocolloids in enhancing drug stability and bioavailability positions them as valuable components in pharmaceutical applications, driving market growth.