Region:Central and South America

Author(s):Dev

Product Code:KRAB0624

Pages:88

Published On:August 2025

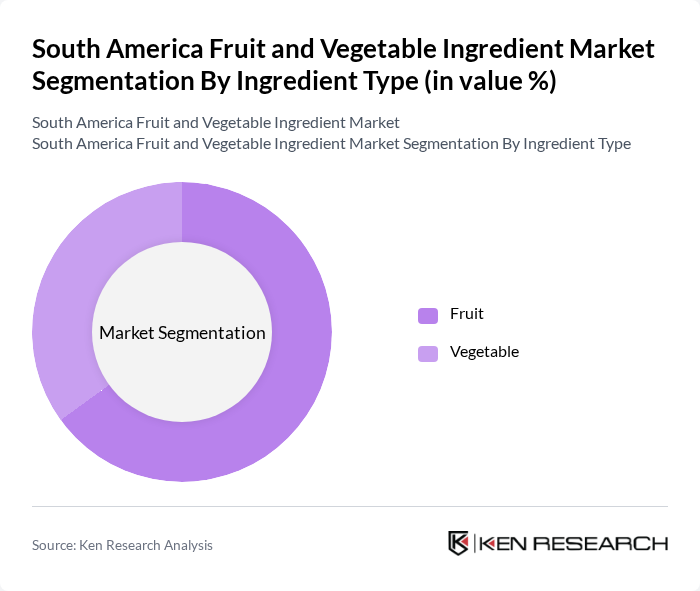

By Ingredient Type:

The ingredient type segmentation includes two primary subsegments: fruit and vegetable. The fruit segment is currently dominating the market due to the increasing consumer preference for fruit-based products, which are perceived as healthier and more nutritious. This trend is evident in the rising demand for fruit concentrates and purees in beverages and desserts. Vegetables, while also significant, are often used in processed foods and sauces, which limits their market share compared to fruits. The growing trend of incorporating fruits into various food applications, such as smoothies and snacks, further solidifies the fruit segment's leadership.

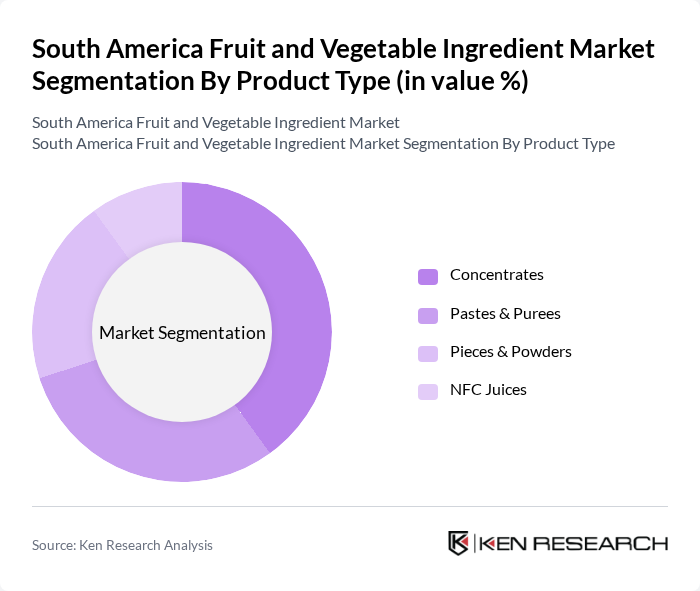

By Product Type:

The product type segmentation encompasses concentrates, pastes & purees, pieces & powders, and NFC juices. Concentrates are leading the market due to their versatility and ease of use in various applications, including beverages and sauces. The demand for pastes and purees is also significant, driven by the growing trend of ready-to-eat meals and convenience foods. Pieces and powders are gaining traction as consumers seek more natural and less processed options. NFC juices are popular among health-conscious consumers, contributing to the overall growth of the product type segment.

The South America Fruit and Vegetable Ingredient Market is characterized by a dynamic mix of regional and international players. Leading participants such as Döhler Group, Ingredion Incorporated, Cargill, Inc., Archer Daniels Midland Company, Olam Food Ingredients (OFI), Kerry Group, Diana Food (Symrise AG), SVZ International B.V., Citrosuco S.A., Cutrale Group, Agrozzi (Grupo Concha y Toro), Frutco AG, SunOpta Inc., Agroindustrias AIB S.A., Frutarom (IFF) contribute to innovation, geographic expansion, and service delivery in this space.

The South American fruit and vegetable ingredient market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative, natural products will likely increase. Additionally, the integration of sustainable practices in production and processing will become essential. Companies that adapt to these trends and invest in research and development will be well-positioned to capture emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Ingredient Type | Fruit Vegetable |

| By Product Type | Concentrates Pastes & Purees Pieces & Powders NFC Juices |

| By Application | Beverages Confectionery Products Bakery Products Soups & Sauces Dairy Products Ready-to-Eat (RTE) Products Others (Spreads, Dips, Toppings, Dressings, Puddings) |

| By End-User | Food Manufacturers Beverage Companies Retailers Food Service Providers Others |

| By Distribution Channel | Direct Sales Online Retail Supermarkets and Hypermarkets Specialty Stores Others |

| By Geography | Brazil Argentina Chile Colombia Peru Rest of South America |

| By Price Range | Economy Mid-Range Premium Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fruit Ingredient Manufacturers | 60 | Production Managers, Quality Control Supervisors |

| Vegetable Ingredient Suppliers | 50 | Supply Chain Managers, Procurement Officers |

| Food Product Developers | 45 | R&D Managers, Product Innovation Leads |

| Retail Buyers of Fresh Produce | 55 | Category Managers, Purchasing Agents |

| Consumers of Processed Food Products | 70 | Household Decision Makers, Health-Conscious Shoppers |

The South America Fruit and Vegetable Ingredient Market is valued at approximately USD 6 billion, driven by increasing health consciousness, demand for natural products, and the growth of the food and beverage industry in the region.