South East Asia Travel And Tourism Industry Market Overview

- The South East Asia Travel and Tourism Industry Market is valued at USD 59 billion, based on a five-year analysis of gross bookings and sector revenues. This growth is primarily driven by the region's rich cultural heritage, diverse landscapes, and increasing disposable incomes among the population, which have led to a surge in both domestic and international travel. The recovery from the pandemic has also played a significant role in revitalizing the sector, with a notable increase in tourist arrivals and spending .

- Countries such as Thailand, Indonesia, and Vietnam continue to dominate the South East Asia Travel and Tourism Industry Market due to their well-established tourism infrastructure, vibrant cultures, and natural attractions. Thailand is recognized for its world-class beaches and hospitality, Indonesia offers a unique blend of cultural experiences and natural beauty, and Vietnam is increasingly popular for its culinary tourism and heritage sites, making these destinations highly sought after by travelers .

- In 2023, the government of Thailand introduced a new tourism policy focused on promoting sustainable tourism practices. This initiative includes a budget allocation of approximately USD 200 million to enhance eco-friendly infrastructure and support local communities, ensuring that tourism development aligns with environmental conservation and cultural preservation efforts .

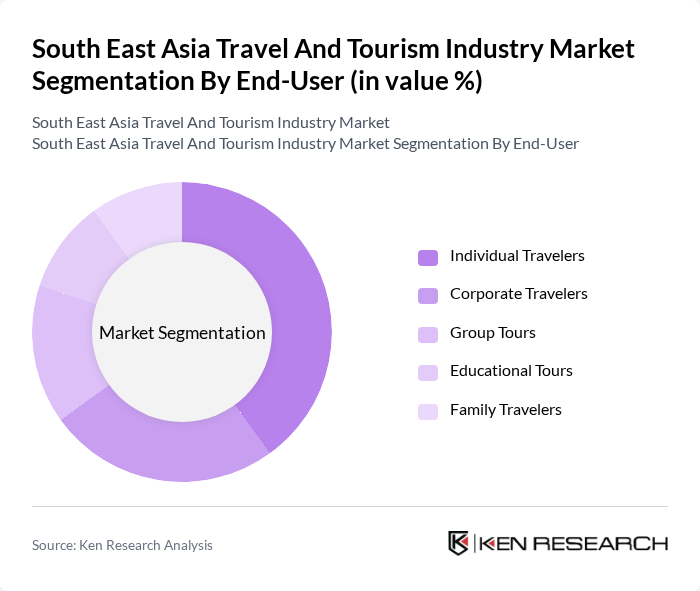

South East Asia Travel And Tourism Industry Market Segmentation

By Type:The market is segmented into various types of tourism, including Adventure Tourism, Cultural Tourism, Eco-Tourism, Medical Tourism, Luxury Tourism, Sports Tourism, Wellness Tourism, Culinary Tourism, and Others. Each segment caters to evolving traveler preferences, with notable growth in wellness, eco-friendly, and culinary tourism reflecting the region's shift toward experiential and sustainable travel options .

By End-User:The market is segmented based on end-users, including Individual Travelers, Corporate Travelers, Group Tours, Educational Tours, and Family Travelers. Each segment reflects distinct travel motivations and preferences, with individual and family travel showing strong growth due to pent-up demand and flexible travel options post-pandemic .

South East Asia Travel And Tourism Industry Market Competitive Landscape

The South East Asia Travel And Tourism Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Traveloka, Agoda, Booking.com, Expedia Group, AirAsia, Singapore Airlines, Cathay Pacific, Malaysia Airlines, VietJet Air, Intrepid Travel, Klook, Trip.com Group, TUI Group, Club Med, Hilton Worldwide, Banyan Tree Holdings, Minor Hotels, Capella Hotel Group, Pan Pacific Hotels Group, The Ascott Limited contribute to innovation, geographic expansion, and service delivery in this space.

South East Asia Travel And Tourism Industry Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The rise in disposable income across Southeast Asia is a significant growth driver for the travel and tourism industry. In future, the average disposable income in the region is projected to reach approximately $4,800 per capita, up from $4,500. This increase allows more individuals to afford travel, leading to a surge in domestic and international tourism. Countries like Indonesia and Vietnam are witnessing a notable increase in middle-class households, further boosting travel spending.

- Rise in International Tourism:Southeast Asia is experiencing a robust increase in international tourist arrivals, with numbers expected to exceed 160 million in future, compared to 150 million. This growth is driven by the region's diverse attractions, including cultural heritage sites and natural wonders. Countries like Thailand and Malaysia are particularly benefiting, as they attract millions of visitors from China, India, and Europe, contributing significantly to local economies and job creation in the tourism sector.

- Government Initiatives to Promote Tourism:Governments in Southeast Asia are actively implementing initiatives to enhance tourism. For instance, Thailand's "Amazing Thailand" campaign aims to attract 45 million visitors in future, up from 40 million. Additionally, countries like Singapore are investing over $1.2 billion in tourism infrastructure and marketing. These initiatives not only promote travel but also improve the overall visitor experience, making the region more appealing to tourists worldwide.

Market Challenges

- Political Instability in Certain Regions:Political instability remains a significant challenge for the Southeast Asia travel and tourism industry. Countries like Myanmar and Thailand have faced political unrest, leading to a decline in tourist confidence. In future, it is estimated that political issues could deter approximately 6 million potential tourists from visiting these regions, impacting local economies and tourism-related businesses that rely heavily on international visitors.

- Environmental Concerns and Sustainability Issues:The travel and tourism industry in Southeast Asia is increasingly challenged by environmental concerns. In future, it is projected that tourism-related activities will contribute to a 12% increase in carbon emissions in the region. This has raised alarms about sustainability, prompting calls for eco-friendly practices. Failure to address these issues could lead to stricter regulations and a potential decline in tourist numbers, as travelers become more environmentally conscious.

South East Asia Travel And Tourism Industry Market Future Outlook

The future outlook for the Southeast Asia travel and tourism industry appears promising, driven by increasing disposable incomes and a growing middle class. As international travel resumes post-pandemic, the region is expected to see a resurgence in tourist arrivals, particularly from neighboring countries. Additionally, the focus on sustainable and experiential travel will likely shape the industry's evolution, encouraging businesses to adapt to changing consumer preferences and invest in innovative solutions that enhance the travel experience.

Market Opportunities

- Growth in Eco-Tourism:The eco-tourism sector is poised for significant growth, with an estimated market value of $350 billion in future. This trend is driven by increasing consumer awareness of environmental issues and a desire for sustainable travel options. Countries like Indonesia and the Philippines are capitalizing on this opportunity by promoting eco-friendly destinations and practices, attracting environmentally conscious travelers.

- Expansion of Digital Travel Services:The digital travel services market is expected to grow substantially, with online travel bookings projected to reach $220 billion in future. This growth is fueled by the increasing use of mobile applications and online platforms for travel planning and booking. Companies that invest in technology and user-friendly interfaces will likely capture a larger share of the market, enhancing customer experiences and driving sales.