Region:Asia

Author(s):Dev

Product Code:KRAD0400

Pages:84

Published On:August 2025

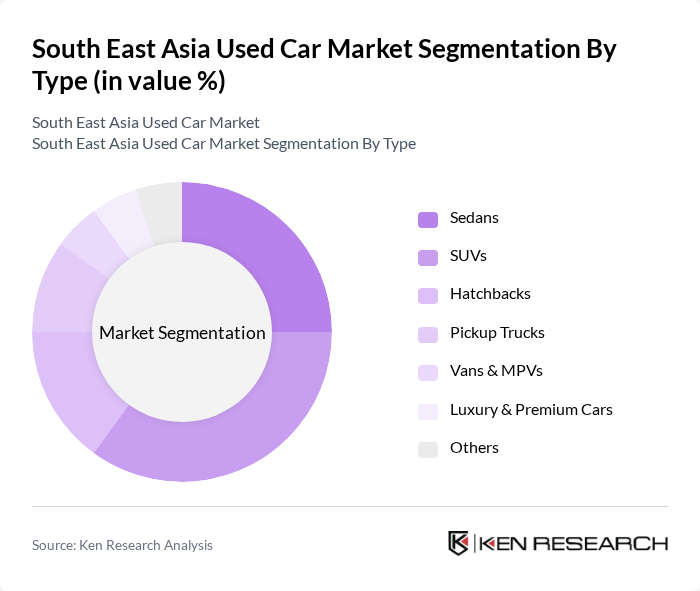

By Type:The used car market in South East Asia is segmented into various types, including Sedans, SUVs, Hatchbacks, Pickup Trucks, Vans & MPVs, Luxury & Premium Cars, and Others. Among these, SUVs have gained significant popularity due to their versatility and spaciousness, appealing to families and adventure seekers alike. Sedans also maintain a strong presence, favored for their fuel efficiency and comfort. The demand for Luxury & Premium Cars is growing, driven by an increasing affluent class in urban areas.

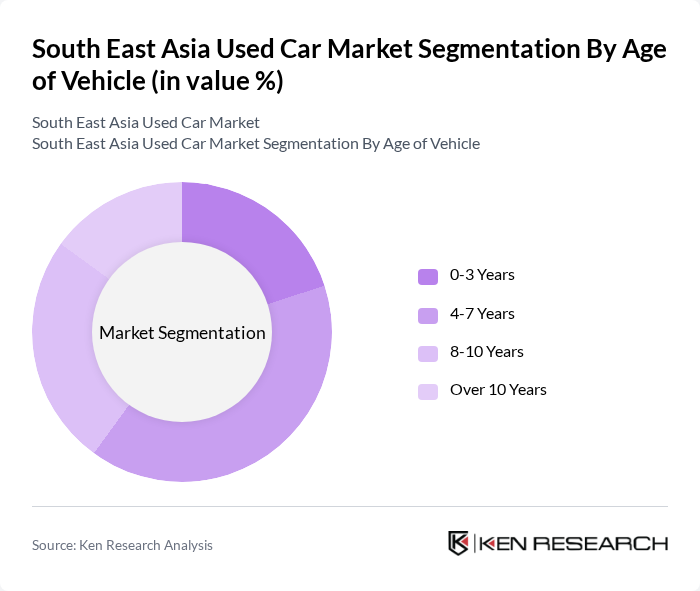

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0-3 Years, 4-7 Years, 8-10 Years, and Over 10 Years. The 4-7 Years segment is currently leading the market, as consumers often seek vehicles that are relatively new yet more affordable than brand-new options. This age range typically offers a balance of reliability and cost-effectiveness, making it attractive to budget-conscious buyers.

The South East Asia Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carsome Group, Carro (Trusty Cars Pte. Ltd.), OLX Autos Indonesia (former, wind-down assets and residual market presence), BeliMobilGue.co.id (BMGO) / OLX Autos legacy network, One2Car (Thailand) – iCar Asia, iCar Asia (Malaysia/Thailand/Indonesia), oto.com (Indonesia) – Carbay, mobil123.com (Indonesia), Carmudi Philippines, ZigWheels Philippines, sgCarMart (Singapore Press Holdings Media Trust), AutoDeal (Philippines), myTukar (Malaysia) – a Carro company, CarsDB (Myanmar), Chobrod (Thailand), BidCar (regional auctions) / Pickles Asia (Malaysia), Toyota Certified Used Cars (regional OEM CPO), Honda Certified Used Cars (regional OEM CPO), Mitsubishi Motors Certified Pre-Owned (regional OEM CPO), Nissan Intelligent Choice (regional OEM CPO) contribute to innovation, geographic expansion, and service delivery in this space.

The Southeast Asia used car market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As digital platforms gain traction, online sales are expected to increase, enhancing accessibility for buyers. Additionally, the growing interest in electric vehicles will likely reshape the market landscape, with more consumers seeking affordable electric used cars. These trends indicate a dynamic future, where innovation and sustainability will play pivotal roles in shaping market growth and consumer choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedans SUVs Hatchbacks Pickup Trucks Vans & MPVs Luxury & Premium Cars Others |

| By Age of Vehicle | 3 Years 7 Years 10 Years Over 10 Years |

| By Sales Channel | Franchised Dealerships (OEM-backed) Independent Dealers Online Platforms/Marketplaces Peer-to-Peer/Private Sales Auctions & Fleet/Lease Remarketing |

| By Financing Options | Cash Purchases Bank & NBFC Loans Dealer/OEM Financing In-house/Fintech BNPL & Subscription |

| By Geographic Distribution | Indonesia Thailand Malaysia Vietnam Philippines Singapore Others (Cambodia, Laos, Myanmar, Brunei) |

| By Condition | Certified Pre-Owned (CPO) Non-Certified Used Cars Damaged/Salvage & Repossessed Vehicles |

| By Brand Origin | Japanese Brands Korean & Chinese Brands European & American Brands Domestic/Local Assemblers |

| By Fuel Type | Gasoline Diesel Hybrid (HEV/PHEV) Battery Electric Vehicles (BEV) Others (CNG/LPG) |

| By End Use | Personal Use Commercial/Fleet Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 120 | Dealership Owners, Sales Managers |

| Consumer Purchases | 140 | Recent Used Car Buyers, First-time Buyers |

| Online Marketplaces | 100 | Platform Managers, Marketing Managers |

| Automotive Financing | 80 | Loan Officers, Finance Managers |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

The South East Asia Used Car Market is valued at approximately USD 36 billion, driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for affordable transportation options.