Region:Asia

Author(s):Dev

Product Code:KRAA1661

Pages:80

Published On:August 2025

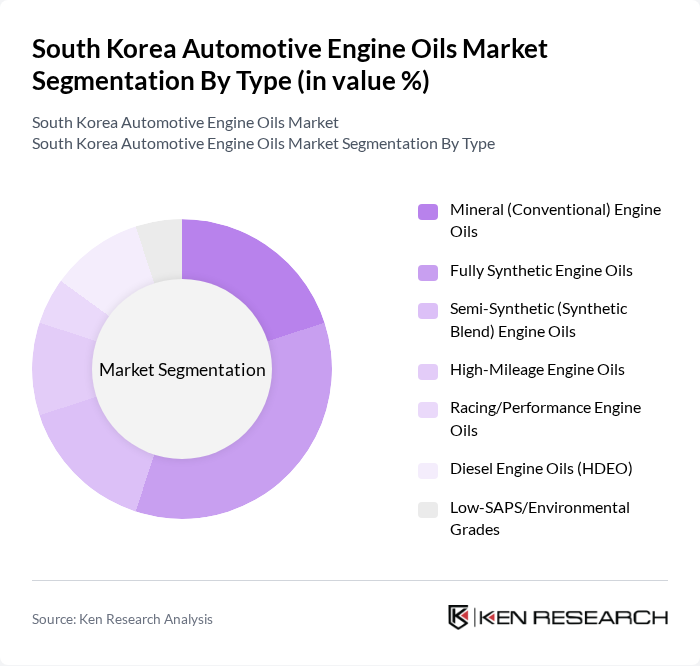

By Type:The market is segmented into various types of engine oils, including Mineral (Conventional), Fully Synthetic, Semi-Synthetic, High-Mileage, Racing/Performance, Diesel Engine Oils (HDEO), and Low-SAPS/Environmental Grades. Each type caters to different consumer needs and preferences, with fully synthetic oils gaining popularity due to their superior performance and longevity.

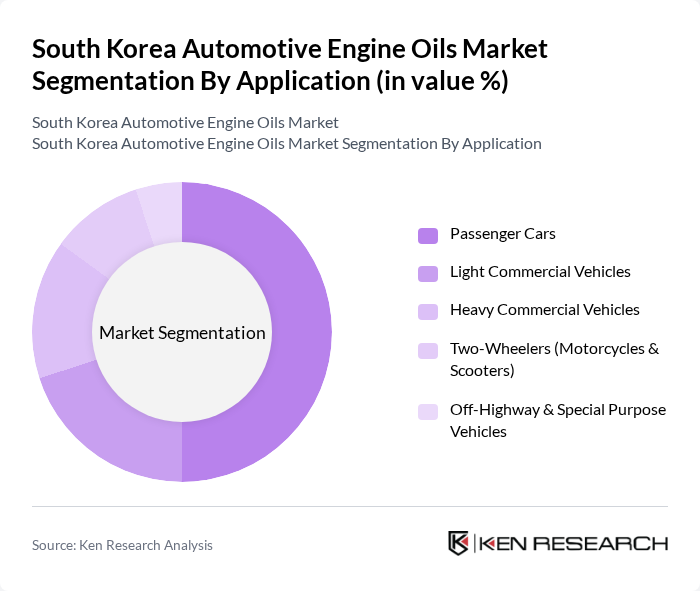

By Application:The automotive engine oils market is further segmented by application, which includes Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers, and Off-Highway & Special Purpose Vehicles. The passenger car segment is the largest due to the high number of personal vehicles in South Korea.

The South Korea Automotive Engine Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as SK Enmove Co., Ltd. (formerly SK Lubricants), GS Caltex Corporation, Hyundai Oilbank Co., Ltd., S-Oil Corporation, ExxonMobil Corporation (Mobil), Chevron Corporation (Havoline), Shell plc (Pennzoil/Quaker State), TotalEnergies SE, Castrol Limited (BP p.l.c.), Valvoline Inc., Motul S.A., FUCHS Petrolub SE, Idemitsu Kosan Co., Ltd., Eneos Corporation, Liqui Moly GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean automotive engine oils market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The shift towards electric vehicles (EVs) is expected to reshape the market landscape, prompting manufacturers to innovate and develop specialized products. Additionally, the increasing focus on sustainability will likely lead to a rise in eco-friendly engine oils, aligning with government initiatives aimed at reducing environmental impact. As these trends unfold, companies that adapt quickly will be well-positioned for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral (Conventional) Engine Oils Fully Synthetic Engine Oils Semi-Synthetic (Synthetic Blend) Engine Oils High-Mileage Engine Oils Racing/Performance Engine Oils Diesel Engine Oils (HDEO) Low-SAPS/Environmental Grades |

| By Application | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Two-Wheelers (Motorcycles & Scooters) Off-Highway & Special Purpose Vehicles |

| By End-User | OEM Service Networks (Authorized Workshops) Independent Garages & Quick-Lube Centers Retail Outlets & E-commerce Fleet Operators & Logistics Companies Government & Public Sector Fleets |

| By Distribution Channel | OEM/Authorized Service Centers Independent Aftermarket (Workshops/Quick Lubes) Retail & E-commerce B2B/Direct to Fleet Wholesalers/Distributors |

| By Brand Type | OEM-Recommended Brands Aftermarket Global Brands Private Labels & Retailer Brands Specialty/Niche Performance Brands |

| By Packaging Type | Small Packs (1L–5L) Drums (20L–210L) Bulk (IBC/Truckload) Pouches/Bag-in-Box |

| By Price Range | Economy Mid-Range Premium Ultra-Premium/Performance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Oil Retailers | 120 | Store Managers, Sales Representatives |

| Automotive Service Centers | 100 | Service Managers, Technicians |

| Oil Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Automotive Industry Experts | 60 | Consultants, Industry Analysts |

| End Consumers (Car Owners) | 140 | Car Owners, Fleet Managers |

The South Korea Automotive Engine Oils Market is valued at approximately USD 850 million, reflecting a five-year historical analysis. This growth is attributed to the increasing number of vehicles, consumer awareness of maintenance, and advancements in engine oil technology.