Region:Asia

Author(s):Rebecca

Product Code:KRAB2984

Pages:90

Published On:October 2025

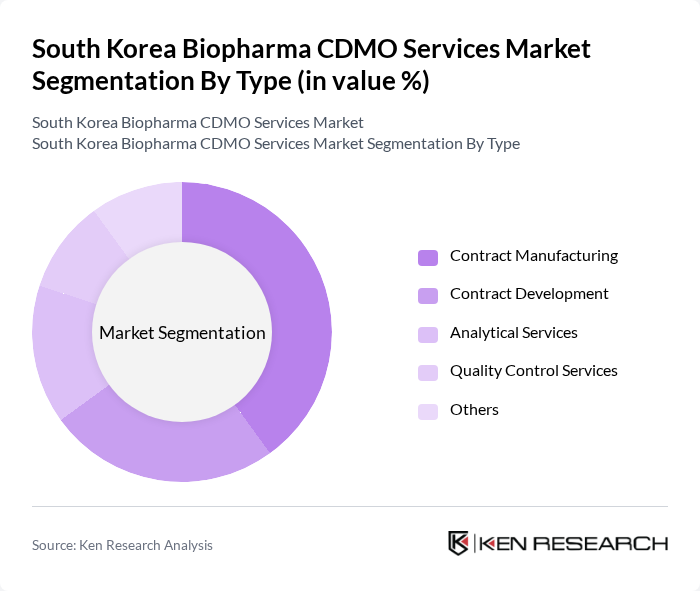

By Type:The market is segmented into various types, including Contract Manufacturing, Contract Development, Analytical Services, Quality Control Services, and Others. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and client needs driving their growth.

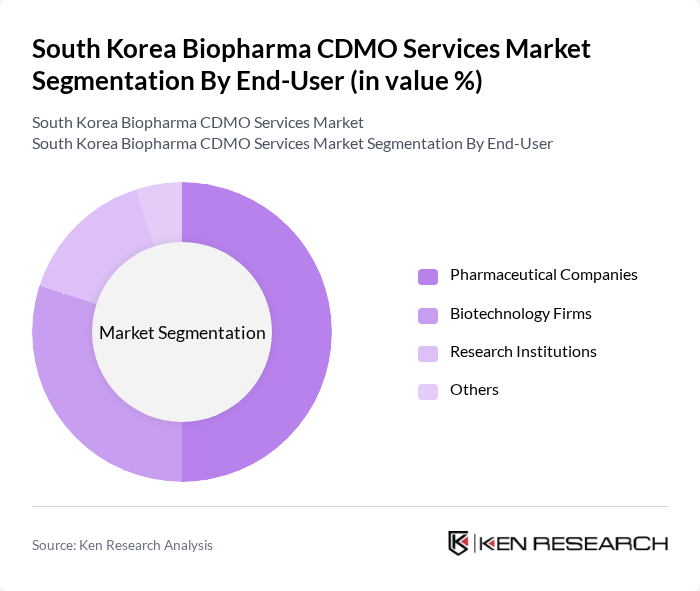

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Research Institutions, and Others. Each segment has distinct requirements and contributes differently to the market, influenced by the nature of their operations and the specific services they seek from CDMOs.

The South Korea Biopharma CDMO Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Biologics, SK Biopharmaceuticals, Celltrion, LG Chem, Hanmi Pharmaceutical, Daewoong Pharmaceutical, CJ CheilJedang, Genexine, Medytox, Green Cross Corporation, PharmAbcine, Yuhan Corporation, Ildong Pharmaceutical, Dong-A ST, Hanall Biopharma contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea biopharma CDMO services market is poised for significant evolution, driven by technological advancements and increasing collaboration between biopharma companies and CDMOs. The integration of artificial intelligence and automation in bioprocessing is expected to enhance efficiency and reduce costs. Additionally, the growing trend towards personalized medicine will necessitate more tailored CDMO services, creating a dynamic environment for innovation and growth. As the market matures, strategic partnerships will become essential for navigating regulatory complexities and meeting diverse client needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Contract Manufacturing Contract Development Analytical Services Quality Control Services Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Research Institutions Others |

| By Service Model | Full-Service CDMO Specialized CDMO Hybrid CDMO |

| By Product Type | Monoclonal Antibodies Vaccines Recombinant Proteins Others |

| By Region | Seoul Busan Incheon Others |

| By Client Type | Large Enterprises SMEs Startups |

| By Contract Duration | Short-Term Contracts Long-Term Contracts Project-Based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharma CDMO Service Providers | 100 | CEOs, Business Development Managers |

| Pharmaceutical Manufacturers | 80 | Procurement Managers, R&D Directors |

| Regulatory Affairs Experts | 60 | Regulatory Managers, Compliance Officers |

| Quality Control and Assurance | 70 | Quality Managers, Lab Directors |

| Market Analysts and Consultants | 50 | Market Research Analysts, Industry Consultants |

The South Korea Biopharma CDMO Services Market is valued at approximately USD 1.5 billion, reflecting a robust growth trajectory driven by increasing demand for biopharmaceuticals and advancements in biotechnology.