Region:Asia

Author(s):Rebecca

Product Code:KRAB5309

Pages:85

Published On:October 2025

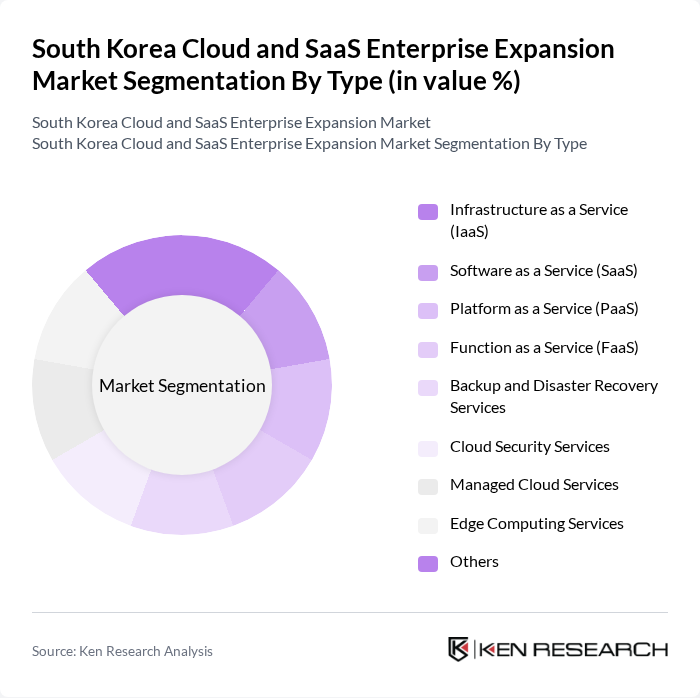

By Type:The market is segmented into various types, including Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS), Function as a Service (FaaS), Backup and Disaster Recovery Services, Cloud Security Services, Managed Cloud Services, Edge Computing Services, and Others. Among these, SaaS is the leading sub-segment, driven by the increasing demand for software solutions that offer flexibility, cost-effectiveness, and rapid deployment for businesses. SaaS adoption is further supported by the shift to subscription-based models and integrated analytics features .

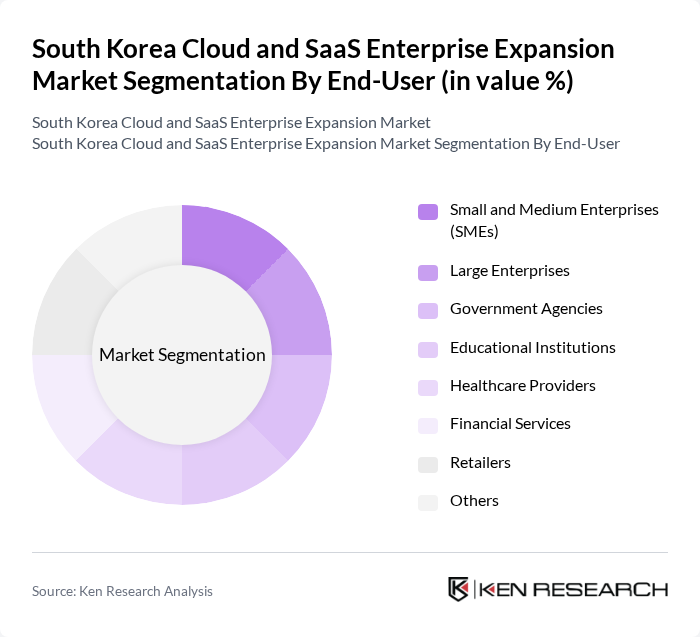

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, Financial Services, Retailers, and Others. Large Enterprises dominate the market due to their substantial IT budgets, complex operational requirements, and the need for robust, scalable cloud solutions. SMEs are rapidly increasing their adoption, supported by government subsidies covering up to 80% of cloud adoption costs and the need for affordable digital transformation .

The South Korea Cloud and SaaS Enterprise Expansion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, LG CNS, SK Telecom, Naver Cloud, KT Corporation, Kakao Enterprise, NHN Cloud, Microsoft Korea, Amazon Web Services Korea, Google Cloud Korea, IBM Korea, Oracle Korea, Alibaba Cloud Korea, VMware Korea, Megazone Cloud, Bespin Global, Douzone Bizon, TmaxSoft contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean cloud and SaaS market is poised for significant growth, driven by ongoing digital transformation efforts and the increasing reliance on remote work solutions. As businesses continue to embrace cloud technologies, the demand for innovative services will rise. Additionally, the government's commitment to enhancing digital infrastructure will further support market expansion. Companies that focus on developing tailored solutions and addressing security concerns will likely thrive in this evolving landscape, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Software as a Service (SaaS) Platform as a Service (PaaS) Function as a Service (FaaS) Backup and Disaster Recovery Services Cloud Security Services Managed Cloud Services Edge Computing Services Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Providers Financial Services Retailers Others |

| By Industry Vertical | IT and Telecommunications Retail Manufacturing Media and Entertainment Transportation and Logistics Energy and Utilities Healthcare Financial Services Public Sector Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud |

| By Service Model | Managed Services Professional Services Consulting Services Support and Maintenance Services |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Freemium |

| By Geographic Presence | Seoul Busan Incheon Daegu Gwangju Daejeon Ulsan Jeollanam-do Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 100 | IT Managers, CTOs, CIOs |

| SaaS Utilization in SMEs | 80 | Business Owners, Operations Managers |

| Sector-Specific SaaS Solutions | 60 | Industry Analysts, Product Managers |

| Cloud Security Concerns | 50 | Security Officers, Compliance Managers |

| Future Trends in Cloud Services | 40 | Market Researchers, Technology Consultants |

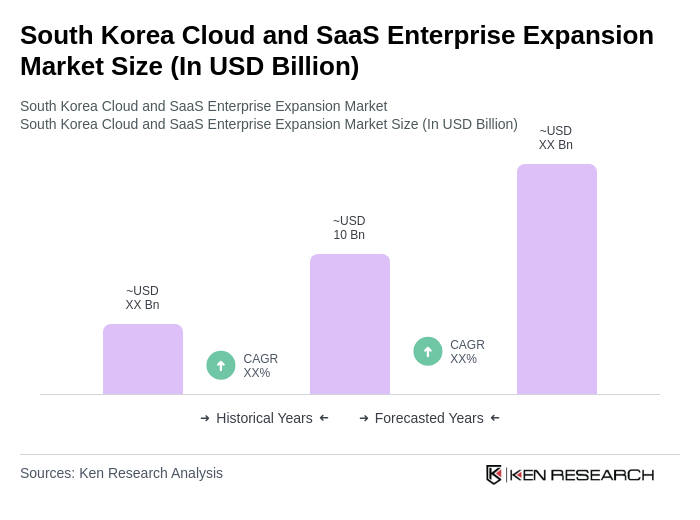

The South Korea Cloud and SaaS Enterprise Expansion Market is valued at approximately USD 10 billion, driven by digital transformation initiatives, AI/ML workload expansion, and increasing demand for scalable IT solutions.