Region:Asia

Author(s):Dev

Product Code:KRAB5498

Pages:87

Published On:October 2025

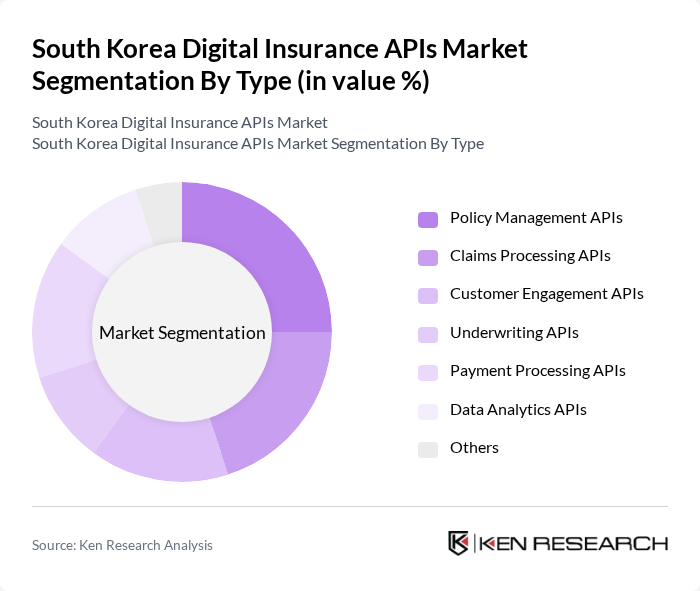

By Type:The market is segmented into various types of APIs that cater to different operational needs within the insurance industry. The key subsegments include Policy Management APIs, Claims Processing APIs, Customer Engagement APIs, Underwriting APIs, Payment Processing APIs, Data Analytics APIs, and Others. Each of these subsegments plays a crucial role in streamlining processes and enhancing customer interactions.

The Policy Management APIs subsegment is currently dominating the market due to the increasing need for efficient policy administration and management. These APIs enable insurance companies to automate policy issuance, renewals, and modifications, significantly reducing operational costs and improving customer satisfaction. The growing trend of digitalization in the insurance sector has led to a higher adoption rate of these APIs, as they facilitate seamless integration with other digital platforms.

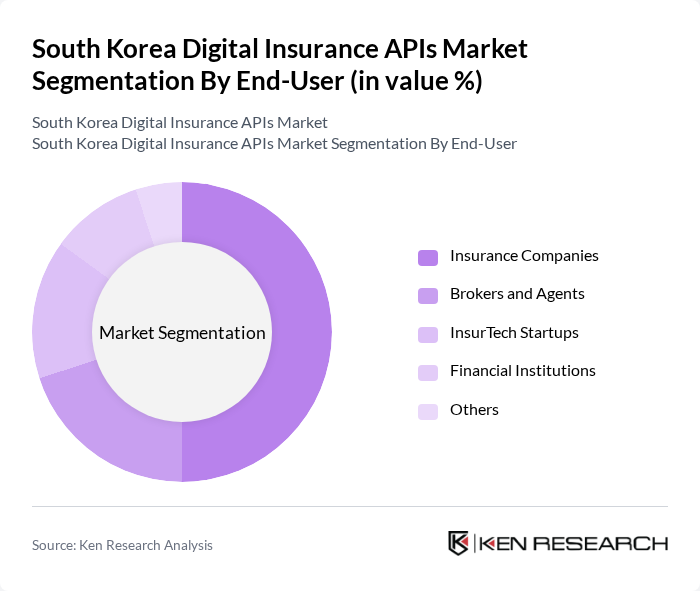

By End-User:The market is segmented based on the end-users utilizing digital insurance APIs. The primary subsegments include Insurance Companies, Brokers and Agents, InsurTech Startups, Financial Institutions, and Others. Each of these end-users has unique requirements and benefits from the integration of digital APIs into their operations.

Insurance Companies are the leading end-users of digital insurance APIs, accounting for a significant portion of the market. This dominance is attributed to their need for efficient operations, improved customer service, and the ability to leverage data analytics for better decision-making. The integration of APIs allows these companies to streamline their processes, enhance customer engagement, and offer personalized insurance products, thereby driving their growth in the digital insurance landscape.

The South Korea Digital Insurance APIs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Fire & Marine Insurance Co., Ltd., Hanwha General Insurance Co., Ltd., DB Insurance Co., Ltd., Hyundai Marine & Fire Insurance Co., Ltd., KB Insurance Co., Ltd., Meritz Fire & Marine Insurance Co., Ltd., Lotte Insurance Co., Ltd., AIG Korea Insurance Co., Ltd., Allianz Global Corporate & Specialty SE, AXA Korea Insurance Co., Ltd., The Korea Life Insurance Association, Samsung Life Insurance Co., Ltd., Kyobo Life Insurance Co., Ltd., Mirae Asset Life Insurance Co., Ltd., Shinhan Life Insurance Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean Digital Insurance APIs market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As insurers increasingly adopt AI and machine learning, underwriting processes will become more efficient, enhancing risk assessment capabilities. Additionally, the growing trend of personalized insurance products will create new avenues for innovation, allowing insurers to cater to diverse customer needs while improving overall service delivery in the digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Policy Management APIs Claims Processing APIs Customer Engagement APIs Underwriting APIs Payment Processing APIs Data Analytics APIs Others |

| By End-User | Insurance Companies Brokers and Agents InsurTech Startups Financial Institutions Others |

| By Application | Personal Insurance Commercial Insurance Health Insurance Auto Insurance Others |

| By Distribution Channel | Direct Sales Online Platforms Brokers Agents Others |

| By Integration Type | Cloud-based Integration On-premise Integration Hybrid Integration Others |

| By Customer Segment | Individual Customers Small and Medium Enterprises (SMEs) Large Enterprises Others |

| By Pricing Model | Subscription-based Pricing Pay-per-use Pricing Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Digital API Usage | 100 | Product Managers, IT Directors |

| Health Insurance Digital Solutions | 80 | Operations Managers, Compliance Officers |

| Property Insurance API Integration | 70 | Business Analysts, Software Developers |

| Consumer Insights on Digital Insurance | 90 | End-users, Customer Experience Managers |

| Regulatory Impact on Digital Insurance | 60 | Legal Advisors, Risk Management Professionals |

The South Korea Digital Insurance APIs Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies in the insurance sector, enhancing operational efficiency and customer engagement.