Region:Asia

Author(s):Geetanshi

Product Code:KRAA0313

Pages:82

Published On:August 2025

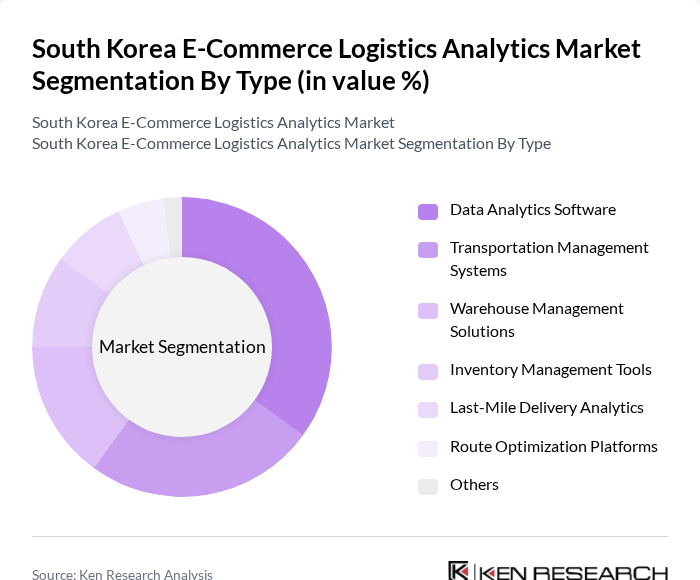

By Type:The market is segmented into various types, including Data Analytics Software, Transportation Management Systems, Warehouse Management Solutions, Inventory Management Tools, Last-Mile Delivery Analytics, Route Optimization Platforms, and Others. Among these, Data Analytics Software is currently leading the market due to its critical role in providing actionable insights that enhance decision-making and operational efficiency. The increasing reliance on data-driven strategies and real-time analytics by logistics providers and e-commerce companies is propelling demand for this sub-segment, making it a focal point for investment and innovation .

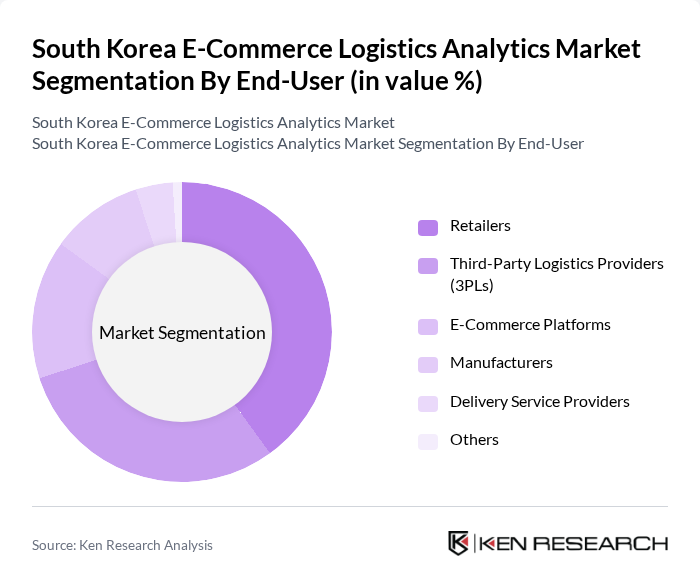

By End-User:This market is further segmented by end-users, including Retailers, Third-Party Logistics Providers (3PLs), E-Commerce Platforms, Manufacturers, Delivery Service Providers, and Others. The Retailers segment is currently the most significant contributor to the market, driven by the increasing need for efficient logistics solutions to meet consumer expectations for fast and reliable delivery. Retailers are increasingly adopting analytics tools to optimize their supply chains, improve inventory management, and enhance customer satisfaction in a highly competitive e-commerce environment .

The South Korea E-Commerce Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Hanjin Transportation, Lotte Global Logistics, Hyundai Glovis, Pantos Logistics, DHL Group Logistics, FedEx Logistics, SF Express, Logen, KCTC, Coupang, SSG.COM, 11st, Gmarket, and WeMakePrice contribute to innovation, geographic expansion, and service delivery in this space .

The South Korean e-commerce logistics analytics market is poised for significant transformation, driven by technological advancements and changing consumer behaviors. As companies increasingly adopt automation and AI technologies, operational efficiencies are expected to improve, leading to faster delivery times. Furthermore, the emphasis on sustainability will likely shape logistics strategies, prompting providers to innovate in eco-friendly practices. The integration of blockchain technology for enhanced transparency will also play a crucial role in building consumer trust and streamlining operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Analytics Software Transportation Management Systems Warehouse Management Solutions Inventory Management Tools Last-Mile Delivery Analytics Route Optimization Platforms Others |

| By End-User | Retailers Third-Party Logistics Providers (3PLs) E-Commerce Platforms Manufacturers Delivery Service Providers Others |

| By Delivery Method | Standard Delivery Express Delivery Same-Day Delivery Click and Collect Locker Delivery Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Applications IoT-Enabled Devices AI & Machine Learning Tools Others |

| By Industry Vertical | Fashion and Apparel Electronics Food and Beverage Health and Beauty Home & Living Others |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border Logistics Domestic Logistics Others |

| By Customer Segment | B2B B2C C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Strategies | 100 | Logistics Directors, Operations Managers |

| Last-Mile Delivery Solutions | 80 | Delivery Managers, Supply Chain Analysts |

| Returns Management Practices | 70 | Customer Service Managers, Returns Specialists |

| Warehouse Automation Trends | 50 | Warehouse Managers, Technology Officers |

| Cross-Border E-commerce Logistics | 60 | International Trade Managers, Compliance Officers |

The South Korea E-Commerce Logistics Analytics Market is valued at approximately USD 14.8 billion, driven by the rapid growth of the e-commerce sector and the increasing demand for efficient delivery services and advanced analytics technologies.