South Korea E-Sports & Gaming Ecosystem Market Overview

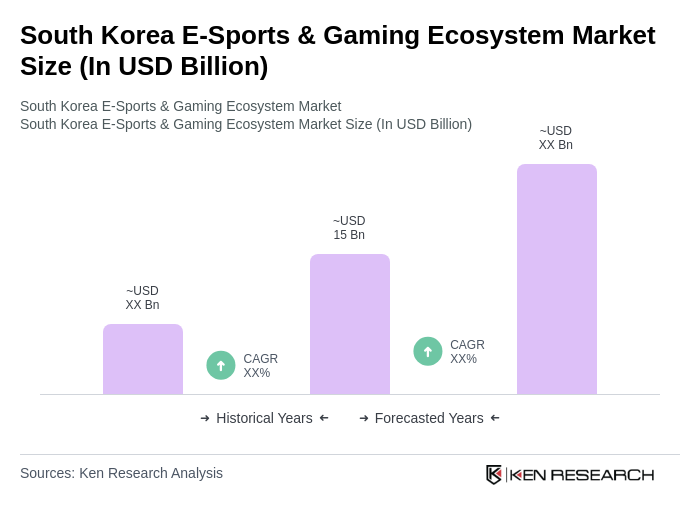

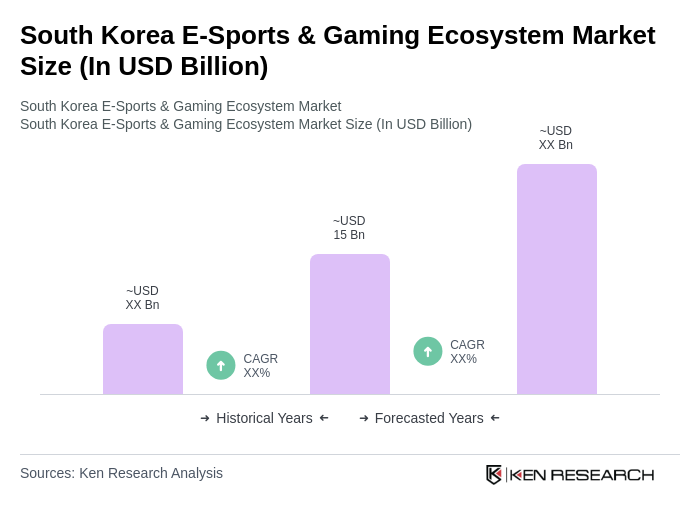

- The South Korea E-Sports & Gaming Ecosystem Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing popularity of mobile gaming, the rise of e-sports as a mainstream entertainment option, and the expansion of game streaming services. The market has seen a surge in user engagement and monetization strategies, contributing to its robust financial performance.

- Key players in this market include Seoul, Busan, and Incheon, which dominate due to their advanced technological infrastructure, high internet penetration rates, and a vibrant gaming culture. These cities host numerous gaming events and tournaments, attracting both local and international audiences, thereby solidifying their positions as gaming hubs in the region.

- In 2023, the South Korean government implemented regulations to promote fair play and transparency in the gaming industry. This includes the establishment of guidelines for e-sports tournaments and the enforcement of age restrictions for certain games, aimed at protecting younger audiences and ensuring a safe gaming environment.

South Korea E-Sports & Gaming Ecosystem Market Segmentation

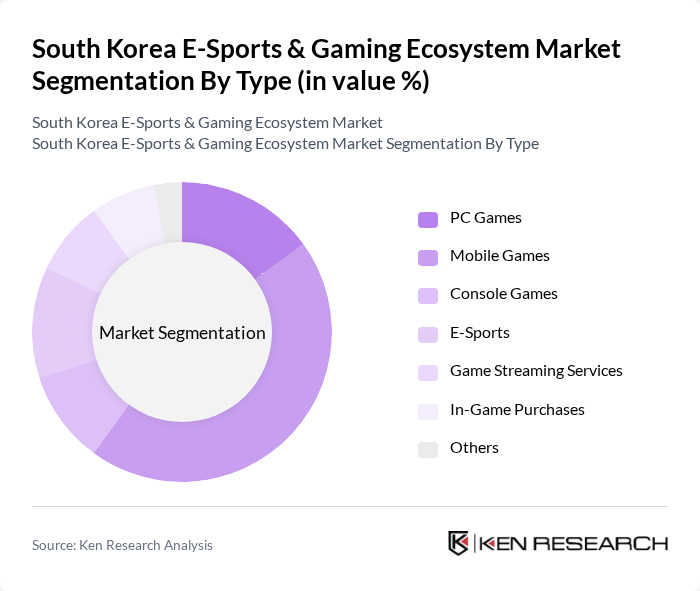

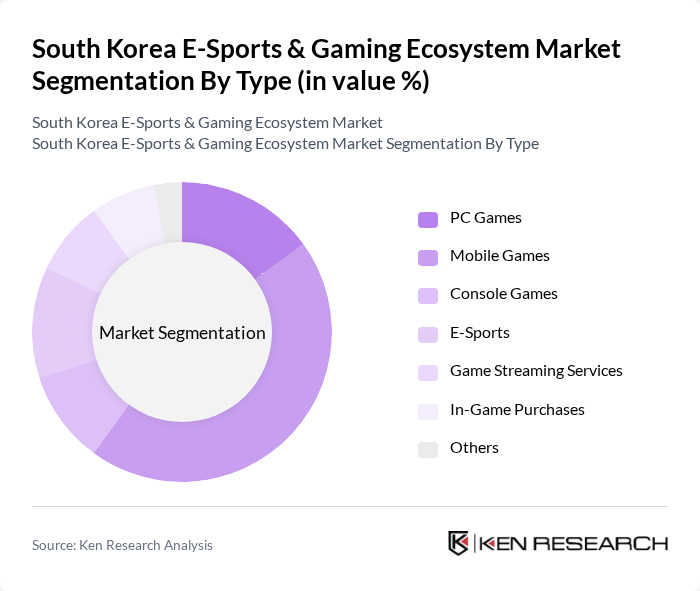

By Type:The market is segmented into various types, including PC Games, Mobile Games, Console Games, E-Sports, Game Streaming Services, In-Game Purchases, and Others. Among these, Mobile Games have emerged as the dominant segment due to their accessibility and the growing number of smartphone users. The convenience of mobile gaming has led to a significant increase in user engagement, making it a preferred choice for casual gamers. The rise of social gaming and in-game purchases further enhances the revenue potential of this segment.

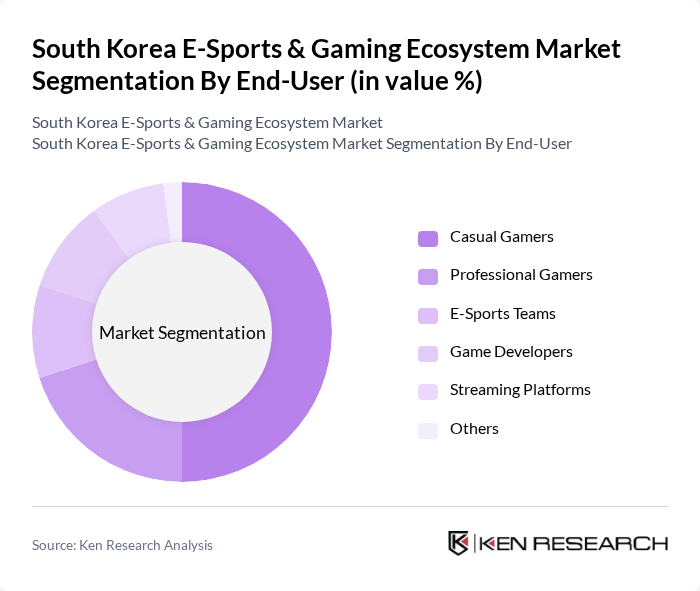

By End-User:The end-user segmentation includes Casual Gamers, Professional Gamers, E-Sports Teams, Game Developers, Streaming Platforms, and Others. Casual Gamers represent the largest segment, driven by the increasing availability of free-to-play games and the rise of mobile gaming. This demographic is characterized by a preference for short gaming sessions and social interaction, which has led to a surge in casual gaming platforms and community-driven content.

South Korea E-Sports & Gaming Ecosystem Market Competitive Landscape

The South Korea E-Sports & Gaming Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nexon Co., Ltd., Riot Games, Inc., Krafton, Inc., NCSoft Corporation, Blizzard Entertainment, Inc., Smilegate Holdings, Inc., PUBG Corporation, HanbitSoft Inc., Gamevil Inc., Com2uS Holdings Corporation, Netmarble Games Corp., Daum Games, Webzen Inc., T1 Entertainment & Sports, AfreecaTV Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

South Korea E-Sports & Gaming Ecosystem Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:South Korea boasts an internet penetration rate of approximately 98%, one of the highest globally. This extensive connectivity facilitates seamless online gaming experiences, attracting a larger audience. The country had around 46 million internet users in the future, with a significant portion engaging in gaming activities. The robust infrastructure supports high-speed connections, enabling gamers to participate in real-time multiplayer games and e-sports tournaments, thus driving market growth.

- Rise of Mobile Gaming:The mobile gaming sector in South Korea generated approximately $3.6 billion in revenue in the future, reflecting a growing trend among gamers who prefer mobile platforms. With over 31 million mobile gamers, the convenience and accessibility of mobile devices have significantly contributed to this growth. The proliferation of smartphones, with over 91% of the population owning one, has further fueled the demand for mobile gaming, making it a key driver in the e-sports and gaming ecosystem.

- Growing Popularity of E-Sports Tournaments:E-sports tournaments in South Korea attracted over 11 million viewers in the future, showcasing the increasing interest in competitive gaming. Major events like the League of Legends World Championship and Overwatch League have drawn significant crowds, both online and offline. The total prize pool for e-sports tournaments reached approximately $32 million, highlighting the financial viability and popularity of competitive gaming, which continues to drive investment and participation in the sector.

Market Challenges

- Regulatory Restrictions:The South Korean government has implemented strict regulations on gaming, including age restrictions and limitations on gaming hours for minors. In the future, approximately 21% of gaming companies reported challenges in compliance with these regulations, which can hinder market growth. These restrictions aim to address concerns about gaming addiction and its impact on youth, but they also create barriers for developers and players, potentially stifling innovation and participation.

- High Competition Among Players:The South Korean gaming market is characterized by intense competition, with over 510 game development companies vying for market share. This saturation leads to challenges in differentiation and profitability. In the future, around 61% of new game releases failed to achieve significant market traction, indicating the difficulty of capturing consumer attention. As established franchises dominate, new entrants face uphill battles to gain visibility and establish a loyal player base.

South Korea E-Sports & Gaming Ecosystem Market Future Outlook

The South Korean e-sports and gaming ecosystem is poised for continued evolution, driven by technological advancements and changing consumer preferences. The integration of augmented reality (AR) and virtual reality (VR) technologies is expected to enhance gaming experiences, attracting new players. Additionally, the increasing collaboration between gaming and traditional sports is likely to create new revenue streams and broaden audience engagement. As the market matures, a focus on mental health and responsible gaming practices will also shape future developments, ensuring sustainable growth.

Market Opportunities

- Investment in Infrastructure:The South Korean government plans to invest approximately $210 million in e-sports infrastructure in the future. This investment aims to enhance facilities and support local tournaments, fostering a more robust competitive environment. Improved infrastructure will attract international events, boosting tourism and local economies while providing gamers with better resources and opportunities to excel.

- Collaborations with Traditional Sports:Collaborations between e-sports and traditional sports leagues are gaining traction, with partnerships like the Korean Baseball Organization (KBO) exploring e-sports initiatives. These collaborations can tap into existing fan bases, potentially increasing viewership and participation. By leveraging traditional sports' popularity, e-sports can expand its reach and create new revenue opportunities through cross-promotional events and merchandise.