Region:Asia

Author(s):Rebecca

Product Code:KRAC0229

Pages:82

Published On:August 2025

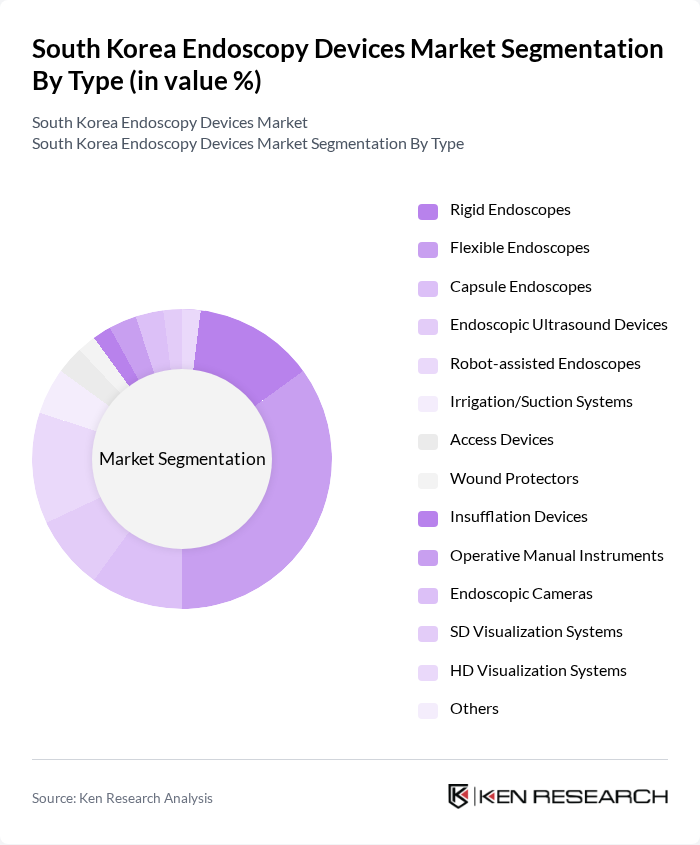

By Type:The endoscopy devices market can be segmented into various types, including rigid endoscopes, flexible endoscopes, capsule endoscopes, endoscopic ultrasound devices, robot-assisted endoscopes, irrigation/suction systems, access devices, wound protectors, insufflation devices, operative manual instruments, endoscopic cameras, SD visualization systems, HD visualization systems, and others. Among these, flexible endoscopes are leading the market due to their versatility, superior imaging capabilities, and widespread use in both diagnostic and therapeutic medical applications. The emergence of capsule endoscopes and robot-assisted endoscopes is also contributing to segment growth, particularly for minimally invasive procedures and complex interventions .

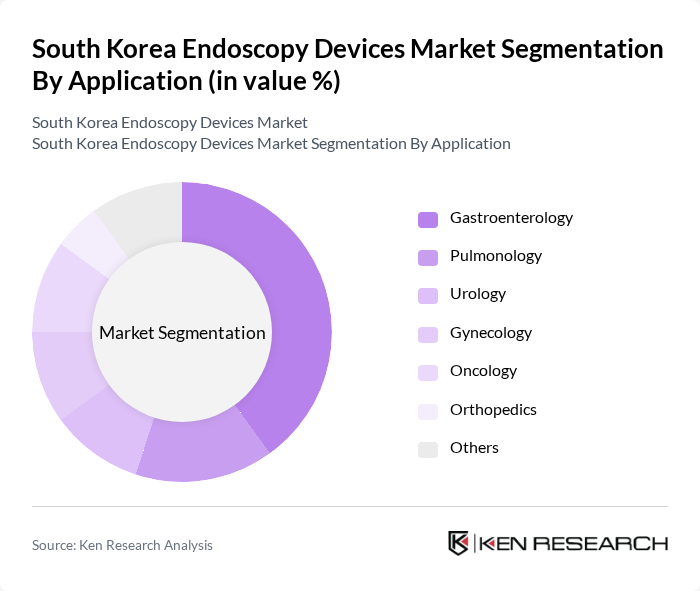

By Application:The applications of endoscopy devices span across various medical fields, including gastroenterology, pulmonology, urology, gynecology, oncology, orthopedics, and others. Gastroenterology remains the leading application area, driven by the high incidence of gastrointestinal disorders such as gastric cancer and colorectal cancer, and the increasing adoption of endoscopic procedures for early diagnosis and minimally invasive treatment. Pulmonology and oncology are also significant segments, reflecting the growing use of advanced endoscopic technologies for respiratory and cancer care .

The South Korea Endoscopy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, Medtronic plc, Boston Scientific Corporation, Stryker Corporation, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, Hoya Corporation (Pentax Medical), Conmed Corporation, EndoChoice, Inc., Richard Wolf GmbH, Ambu A/S, Cook Medical Incorporated, B. Braun Melsungen AG, Teleflex Incorporated, Merit Medical Systems, Inc., Taewoong Medical Co., Ltd., M.I. Tech Co., Ltd., IntroMedic Co., Ltd., Medyssey Co., Ltd., InnoVision Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea endoscopy devices market is poised for significant growth, driven by technological advancements and an increasing focus on patient-centric care. As healthcare providers adopt outpatient procedures, the demand for innovative endoscopic solutions will rise. Additionally, the integration of artificial intelligence in diagnostics is expected to enhance procedural efficiency. With ongoing investments in healthcare infrastructure, the market is likely to witness a transformation that prioritizes accessibility and quality in endoscopic care.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Endoscopes Flexible Endoscopes Capsule Endoscopes Endoscopic Ultrasound Devices Robot-assisted Endoscopes Irrigation/Suction Systems Access Devices Wound Protectors Insufflation Devices Operative Manual Instruments Endoscopic Cameras SD Visualization Systems HD Visualization Systems Others |

| By Application | Gastroenterology Pulmonology Urology Gynecology Oncology Orthopedics Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Cancer Centers Research Institutions Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Seoul Busan Incheon Daegu Others |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Traditional Endoscopy Digital Endoscopy Robotic Endoscopy Single-use Endoscopy AI-assisted Endoscopy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 60 | Gastroenterologists, Clinic Managers |

| General Hospitals | 50 | Surgeons, Procurement Officers |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

| Research Institutions | 40 | Clinical Researchers, Medical Analysts |

The South Korea Endoscopy Devices Market is valued at approximately USD 1.2 billion, driven by the rising prevalence of gastrointestinal and oncological diseases, advancements in endoscopic technology, and a preference for minimally invasive surgical procedures.