Region:Asia

Author(s):Dev

Product Code:KRAB0460

Pages:93

Published On:August 2025

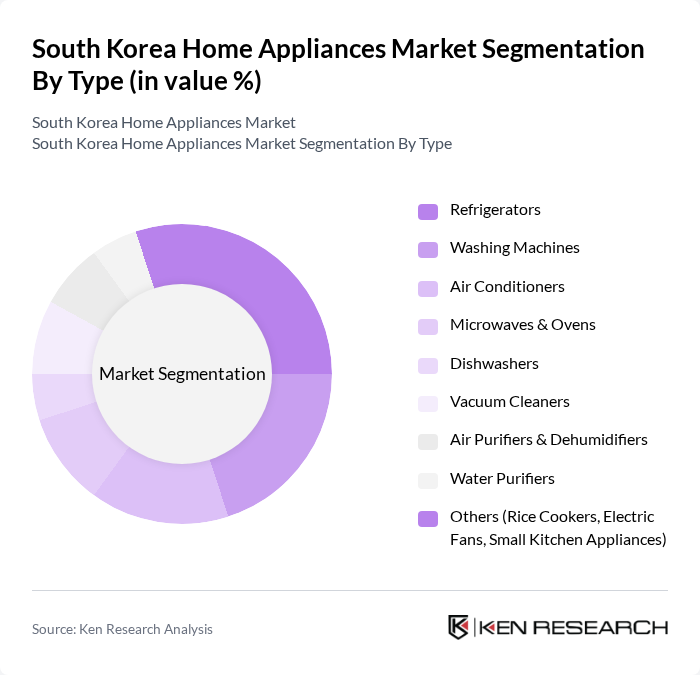

By Type:The home appliances market can be segmented into various types, including refrigerators, washing machines, air conditioners, microwaves & ovens, dishwashers, vacuum cleaners, air purifiers & dehumidifiers, water purifiers, and others such as rice cookers and electric fans. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their popularity.

The refrigerators segment is currently dominating the market due to the increasing demand for energy-efficient and smart models. Consumers are increasingly looking for features such as temperature control, smart connectivity, and space optimization. Premium, AI-enabled refrigerators lead category revenue, supported by strong brand competition and frequent product refresh cycles, and the category benefits from government-backed efficiency incentives that steer buyers toward Grade-1 models.

By End-User:The market can be segmented into residential, commercial (hospitality, offices, retail), and institutional (healthcare, education) end-users. Each segment has distinct requirements and purchasing behaviors, influencing the types of appliances that are in demand.

The residential segment is the largest in the home appliances market, driven by the growing number of households and the increasing disposable income of consumers. Homeowners are investing in modern appliances that enhance convenience and energy efficiency. Rapid uptake of smart-home ecosystems and mobile-first shopping has further boosted residential demand, with online channels expanding faster than offline retail.

The South Korea Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Winia Electronics Co., Ltd. (formerly Daewoo Electronics), Coway Co., Ltd., SK Magic Co., Ltd., Whirlpool Corporation, Panasonic Holdings Corporation, Electrolux AB, BSH Hausgeräte GmbH (Bosch & Siemens Home Appliances), Miele & Cie. KG, Sharp Corporation, Haier Smart Home Co., Ltd., Hisense Group, TCL Technology Group Corporation, Beko (Arçelik A.?.) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean home appliances market is poised for significant transformation driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for smart and energy-efficient appliances is expected to rise, with manufacturers focusing on integrating AI and IoT technologies. Additionally, sustainability will play a crucial role, as consumers increasingly prioritize eco-friendly products. These trends indicate a dynamic market landscape, where innovation and consumer-centric strategies will be key to capturing growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Washing Machines Air Conditioners Microwaves & Ovens Dishwashers Vacuum Cleaners Air Purifiers & Dehumidifiers Water Purifiers Others (Rice Cookers, Electric Fans, Small Kitchen Appliances) |

| By End-User | Residential Commercial (Hospitality, Offices, Retail) Institutional (Healthcare, Education) |

| By Sales Channel | Online Retail (Marketplaces, Brand D2C) Offline Retail (Brand Stores, Hypermarkets, Specialty Chains) Direct-to-Consumer Brand Stores Distributors/Dealers |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Brand | Domestic Brands (Samsung, LG, Winia, Coway, SK Magic) International Brands (Whirlpool, Panasonic, Bosch, Miele, Electrolux, Sharp) Private Labels (Retailer and E-commerce House Brands) |

| By Product Features | Smart/Connected (Wi?Fi, AI, IoT) Energy Efficiency (High-grade Efficiency Ratings) Health & Hygiene (HEPA, Sterilization, Filtration) Design and Aesthetics (Bespoke/Modular, Colors/Finishes) |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 120 | Product Managers, Retail Buyers |

| Washing Machine Consumer Preferences | 100 | Homeowners, Appliance Retail Staff |

| Air Conditioner Usage Trends | 90 | HVAC Technicians, Homeowners |

| Smart Appliance Adoption Rates | 110 | Tech-savvy Consumers, Product Developers |

| Energy Efficiency Awareness | 80 | Environmental Advocates, Homeowners |

The South Korea home appliances market is valued at approximately USD 12 billion, driven by technological advancements, consumer demand for energy-efficient products, and the adoption of smart home solutions.