Region:Asia

Author(s):Geetanshi

Product Code:KRAA3668

Pages:83

Published On:September 2025

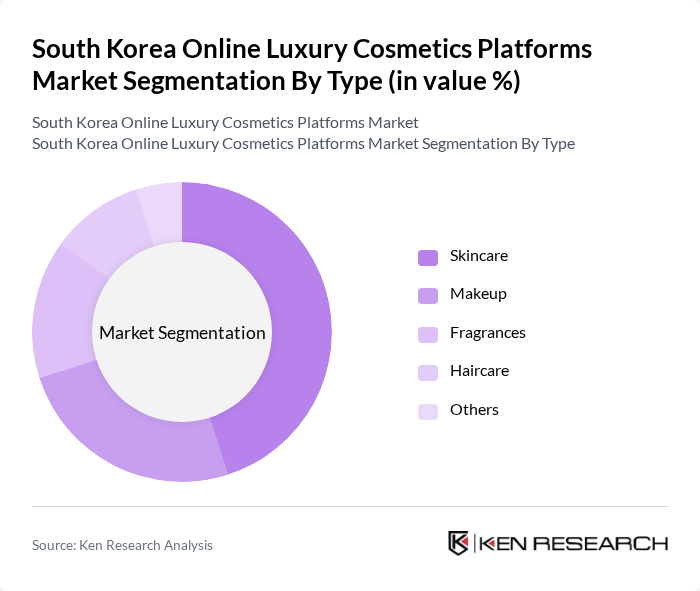

By Type:The market is segmented into Skincare, Makeup, Fragrances, Haircare, and Others. Among these, Skincare products dominate the market, reflecting high consumer engagement in multi-step routines and the popularity of K-beauty innovations. The demand for advanced, ingredient-focused skincare solutions—such as ampoules, serums, and microbiome-boosting creams—has led to a surge in online sales, making skincare the leading segment in the luxury cosmetics market. Ingredient transparency and scientific legitimacy are key drivers for this segment .

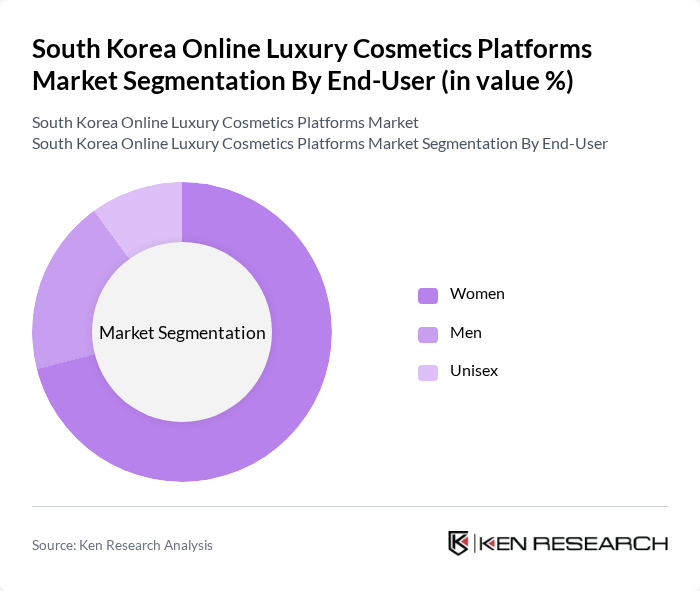

By End-User:The market is segmented by end-user demographics, including Women, Men, and Unisex. The Women segment holds the largest share, driven by high demand for luxury skincare and makeup products. South Korean women are increasingly investing in premium beauty products, influenced by social media trends, ingredient transparency, and the desire for high-performance cosmetics. The Men segment is rapidly expanding, with male consumers embracing luxury beauty and skincare as part of evolving social attitudes and personal style .

The South Korea Online Luxury Cosmetics Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amorepacific Corporation, LG Household & Health Care Ltd., The Face Shop, Innisfree, Etude House, Missha, Sulwhasoo, Laneige, HERA, SK-II, Dior, Chanel, Estée Lauder, Lancôme, Yves Saint Laurent (YSL) Beauty contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean online luxury cosmetics market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As personalization becomes a key focus, brands are expected to leverage data analytics to tailor offerings to individual consumers. Additionally, the integration of augmented reality in shopping experiences will enhance customer engagement, making online shopping more interactive. These trends indicate a dynamic market landscape where innovation and consumer-centric strategies will play crucial roles in shaping the future of luxury cosmetics.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Fragrances Haircare Others |

| By End-User | Women Men Unisex |

| By Sales Channel | Direct-to-Consumer (Brand-owned e-commerce) Online Marketplaces (e.g., Coupang, Naver Shopping, SSG.com) Brand Websites Social Commerce Platforms (e.g., KakaoTalk, Instagram Shopping) |

| By Price Range | Premium Mid-range Budget |

| By Brand Origin | Domestic Brands (e.g., Amorepacific, LG Household & Health Care, Sulwhasoo, Laneige, HERA) International Brands (e.g., Chanel, Dior, Estée Lauder, Lancôme, YSL Beauty, SK-II) |

| By Packaging Type | Eco-friendly Packaging Luxury Packaging Standard Packaging |

| By Distribution Mode | Home Delivery Click and Collect Subscription Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Skincare Purchases | 120 | Online Shoppers, Beauty Enthusiasts |

| Makeup Product Preferences | 100 | Makeup Artists, Influencers |

| Fragrance Buying Behavior | 80 | Retail Managers, Brand Ambassadors |

| Consumer Attitudes Towards Sustainability | 60 | Eco-conscious Consumers, Industry Experts |

| Online Shopping Experience Feedback | 80 | Frequent Online Shoppers, E-commerce Analysts |

The South Korea Online Luxury Cosmetics Platforms Market is valued at approximately USD 4.1 billion, reflecting significant growth driven by increasing demand for premium beauty products and the rapid expansion of e-commerce.