South Korea OTT Entertainment and K-Content Market Overview

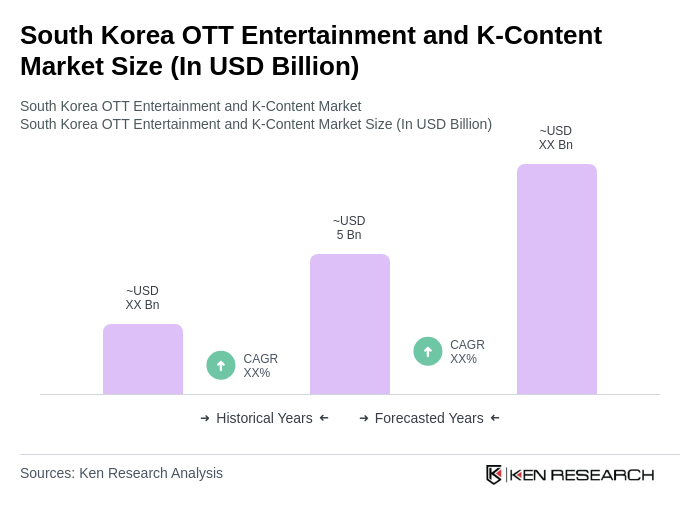

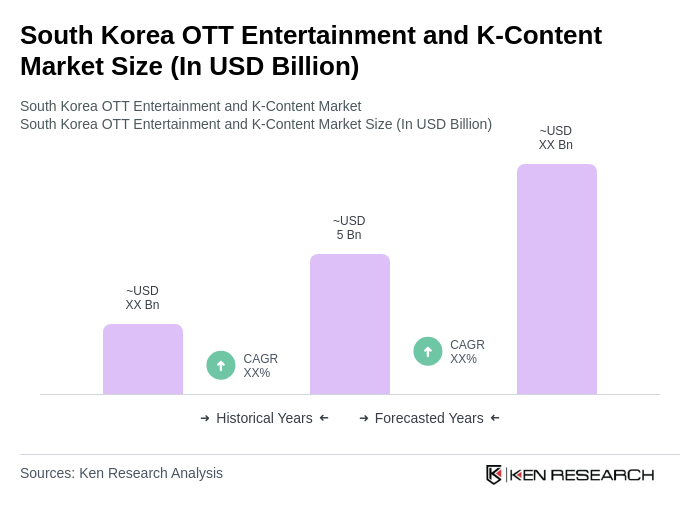

- The South Korea OTT Entertainment and K-Content Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for digital content consumption, particularly among younger demographics, and the rise of mobile internet penetration. The proliferation of smartphones and smart TVs has further facilitated access to a wide array of content, enhancing user engagement and subscription rates.

- Seoul, the capital city, is the dominant hub for the OTT entertainment and K-content market due to its advanced technological infrastructure and high population density. Other significant cities include Busan and Incheon, which also contribute to the market's growth through local content production and distribution. The cultural influence of K-pop and K-dramas has further solidified South Korea's position as a leader in the global entertainment landscape.

- In 2023, the South Korean government implemented regulations to promote fair competition in the OTT market. This includes a mandate for transparency in content licensing agreements and a requirement for platforms to invest a portion of their revenue back into local content production. These regulations aim to support domestic creators and ensure a diverse range of content is available to consumers.

South Korea OTT Entertainment and K-Content Market Segmentation

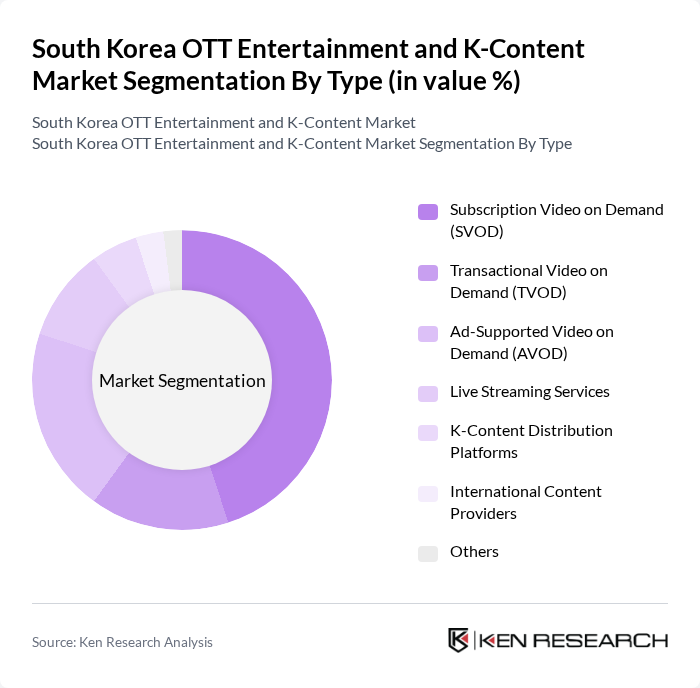

By Type:The market is segmented into various types, including Subscription Video on Demand (SVOD), Transactional Video on Demand (TVOD), Ad-Supported Video on Demand (AVOD), Live Streaming Services, K-Content Distribution Platforms, International Content Providers, and Others. Among these, SVOD has emerged as the leading segment due to its convenience and the growing preference for binge-watching series and films.

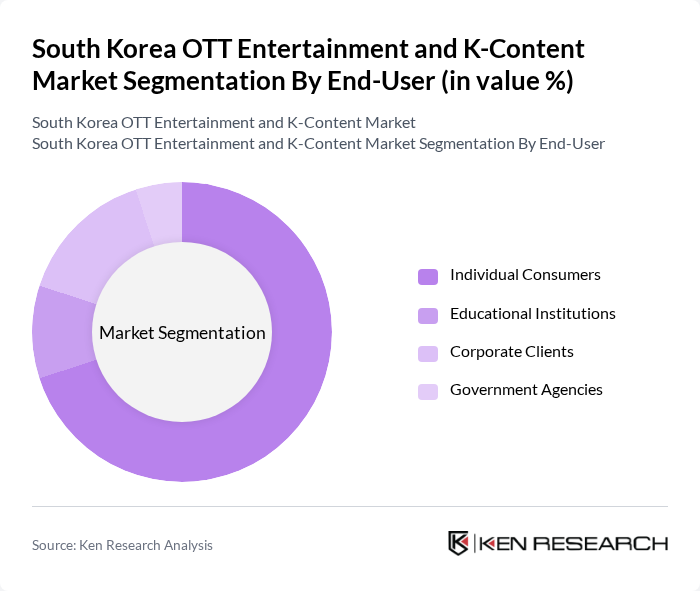

By End-User:The end-user segmentation includes Individual Consumers, Educational Institutions, Corporate Clients, and Government Agencies. Individual Consumers dominate the market, driven by the increasing trend of personalized content consumption and the convenience of accessing a wide range of entertainment options from home.

South Korea OTT Entertainment and K-Content Market Competitive Landscape

The South Korea OTT Entertainment and K-Content Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Inc., Wavve Corp., Tving Corp., Coupang Play, Naver Corporation, Kakao Entertainment, Disney+ (The Walt Disney Company), Amazon Prime Video, iQIYI, Inc., Viki, Inc., Apple TV+, YouTube Premium, Daum Kakao Corp., SBS Contents Hub, and JTBC Studios contribute to innovation, geographic expansion, and service delivery in this space.

South Korea OTT Entertainment and K-Content Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, South Korea boasts an internet penetration rate of approximately 98%, with over 50 million users accessing online content regularly. This high connectivity facilitates the consumption of OTT services, driving user engagement. The country’s advanced telecommunications infrastructure, including 5G networks, supports seamless streaming experiences, further enhancing the appeal of OTT platforms. With the average internet speed reaching 29.5 Mbps, users can enjoy high-quality content without interruptions, significantly contributing to market growth.

- Rising Demand for Mobile Content:In future, mobile devices account for over 70% of all internet traffic in South Korea, reflecting a significant shift towards mobile content consumption. The increasing use of smartphones, with over 45 million units sold in future, has led to a surge in demand for mobile-optimized OTT services. This trend is supported by the growing availability of affordable data plans, with average monthly mobile data usage reaching 10 GB per user, enabling consumers to access K-content anytime, anywhere, thus driving market expansion.

- Popularity of K-Dramas and K-Pop:The global appeal of K-dramas and K-Pop continues to rise, with K-drama viewership increasing by 30% year-on-year in future. This popularity has led to a significant increase in subscriptions to OTT platforms, with over 15 million new subscribers reported in the last year alone. The success of series like "Squid Game" and the global tours of K-Pop groups have solidified South Korea's position as a cultural powerhouse, driving international interest and investment in K-content production and distribution.

Market Challenges

- Intense Competition:The South Korean OTT market is characterized by fierce competition, with over 20 platforms vying for consumer attention. Major players like Netflix and local services such as Wavve and Tving are investing heavily in original content, leading to a fragmented market. In future, the average consumer subscribes to at least three different services, complicating brand loyalty and increasing customer acquisition costs. This competitive landscape poses significant challenges for new entrants and existing players alike.

- Content Piracy:Content piracy remains a significant challenge in South Korea, with estimates suggesting that over 30% of online content is accessed illegally. This not only undermines revenue for legitimate OTT platforms but also affects the overall quality of available content. In future, the South Korean government reported losses exceeding $1 billion due to piracy, prompting calls for stricter enforcement of copyright laws. The ongoing battle against piracy complicates the market dynamics and threatens the sustainability of content production.

South Korea OTT Entertainment and K-Content Market Future Outlook

The South Korean OTT entertainment and K-content market is poised for continued growth, driven by technological advancements and evolving consumer preferences. As 5G technology becomes more widespread, streaming quality will improve, enhancing user experiences. Additionally, the increasing integration of AI in content recommendations will personalize viewing experiences, attracting more subscribers. The market is likely to see a rise in collaborations between local and international platforms, further expanding the reach of K-content globally, while niche content platforms will cater to diverse audience segments.

Market Opportunities

- Growth in International Markets:South Korean OTT platforms have significant opportunities to expand into international markets, particularly in Southeast Asia and North America. With K-content gaining traction globally, platforms can leverage this trend to attract new subscribers. In future, international revenues from K-content are projected to exceed $500 million, highlighting the potential for growth in overseas markets.

- Investment in Original Content:There is a growing opportunity for OTT platforms to invest in original K-content, which has proven to attract and retain subscribers. In future, original series accounted for 60% of total viewership on major platforms. By future, platforms that prioritize original content production are expected to see a 25% increase in subscriber retention, making this a strategic focus for future growth.