Region:Asia

Author(s):Shubham

Product Code:KRAC0628

Pages:89

Published On:August 2025

By Type:The market is segmented into various types of POS terminals, including Fixed POS Terminals, Mobile/Portable POS Terminals, Smart POS/Android POS, Self-Service Kiosks, Cloud-Based POS Software, and Others. Each of these sub-segments caters to different business needs and consumer preferences, with specific features and functionalities that enhance the payment experience. Recent market analyses note strong uptake of mobile/portable and smart POS, driven by contactless payments, software integration, and operational efficiency in retail and hospitality.

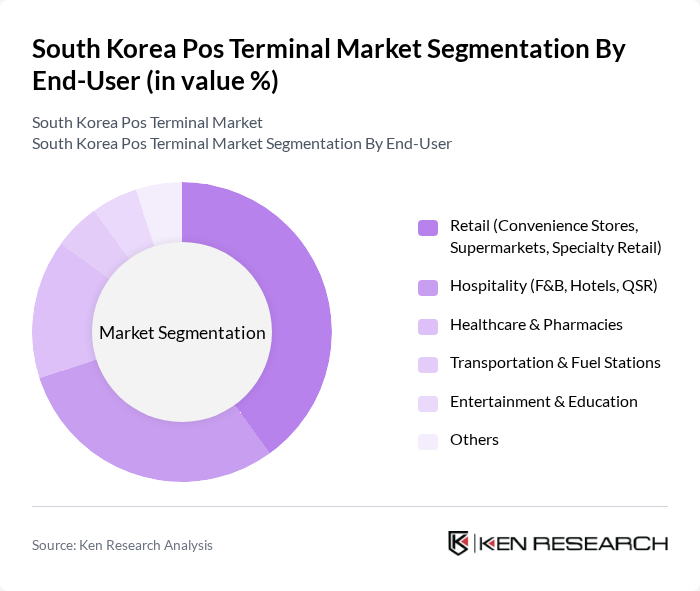

By End-User:The end-user segmentation includes Retail (Convenience Stores, Supermarkets, Specialty Retail), Hospitality (F&B, Hotels, QSR), Healthcare & Pharmacies, Transportation & Fuel Stations, Entertainment & Education, and Others. Each segment has unique requirements for POS systems, influencing the choice of technology and features. Retail maintains the largest share supported by high transaction volumes and rapid rollout of contactless/NFC and e-wallet acceptance across stores; hospitality and healthcare are also expanding POS adoption for omnichannel, table-side/mobile payments, and integration with management systems.

The South Korea POS terminal market is characterized by a dynamic mix of regional and international players. Leading participants such as Toshiba Global Commerce Solutions (Korea), Fujitsu Korea Limited, HANASIS Co., Ltd., EES Corp Co., Ltd., Hwasung System Co., Ltd., Posbank Co., Ltd., SAM4S (Shinheung Precision Co., Ltd.), Kwangwoo I&C Co., Ltd., Bluebird Inc., BIXOLON Co., Ltd., NICE TCM Co., Ltd. (NICE Group), KB Kookmin Card (Merchant Acquiring/Terminals), BC Card Co., Ltd., Shinhan Card Co., Ltd., Korea Cyber Payment (KCP, KG Inicis/KG Mobilians Affiliates) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean POS terminal market is poised for significant transformation as technological advancements and consumer preferences evolve. The integration of AI and machine learning into payment systems is expected to enhance transaction security and user experience. Additionally, the ongoing shift towards mobile payment solutions will likely drive further innovation in POS technology. As businesses adapt to these changes, regulatory compliance will become increasingly critical, ensuring that consumer protection and data security remain at the forefront of market developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed POS Terminals Mobile/Portable POS Terminals Smart POS/Android POS Self-Service Kiosks Cloud-Based POS Software Others |

| By End-User | Retail (Convenience Stores, Supermarkets, Specialty Retail) Hospitality (F&B, Hotels, QSR) Healthcare & Pharmacies Transportation & Fuel Stations Entertainment & Education Others |

| By Sales Channel | Direct (OEM/ISV) Distributors/Resellers (VARs, System Integrators) Online/E-commerce Telecom/Fintech Partnerships Others |

| By Payment Method | Credit/Debit Cards (EMV) Mobile Wallets (Samsung Pay, Naver Pay, Kakao Pay, Apple Pay) Contactless/NFC (Including QR) Bank Transfer/Account-Link (Open Banking) Others |

| By Industry Vertical | Food and Beverage Retail and E-commerce Healthcare & Beauty Transportation & Logistics Entertainment & Leisure Others |

| By Region | Seoul Busan Incheon Daegu Daejeon Gyeonggi-do Others |

| By Price Range | Entry-Level Mid-Range Premium/Enterprise Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail POS Terminal Usage | 150 | Store Managers, IT Directors |

| Hospitality Sector Payment Solutions | 100 | Operations Managers, Front Desk Supervisors |

| Transportation Payment Systems | 80 | Fleet Managers, Ticketing System Administrators |

| Small Business POS Adoption | 70 | Small Business Owners, Financial Officers |

| Consumer Preferences in Payment Methods | 120 | End-users, Frequent Shoppers |

The South Korea POS terminal market is valued at approximately USD 2.1 billion, reflecting a comprehensive analysis of historical data and recent industry reports regarding market size and growth trends.