Region:Asia

Author(s):Geetanshi

Product Code:KRAA0265

Pages:88

Published On:August 2025

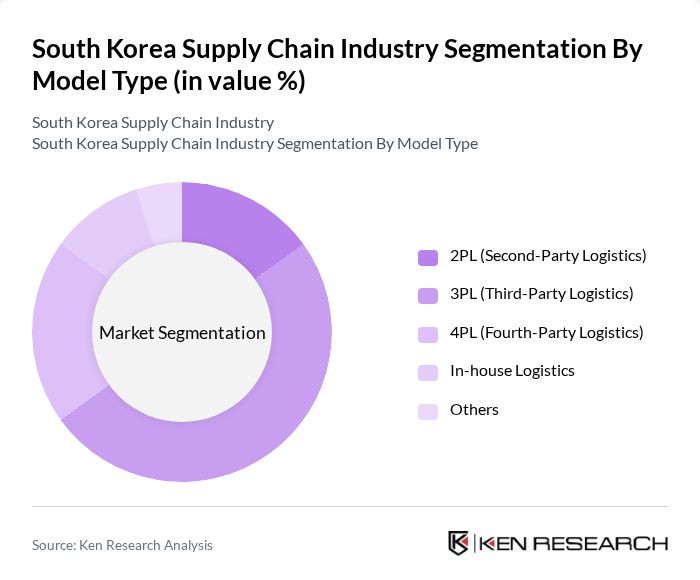

By Model Type:The South Korea Supply Chain Industry is segmented into various model types, including 2PL (Second-Party Logistics), 3PL (Third-Party Logistics), 4PL (Fourth-Party Logistics), In-house Logistics, and Others. Among these, 3PL is the most dominant segment, driven by the increasing complexity of supply chains and the need for specialized logistics services. Companies are increasingly outsourcing logistics functions to 3PL providers to enhance efficiency and focus on core business activities .

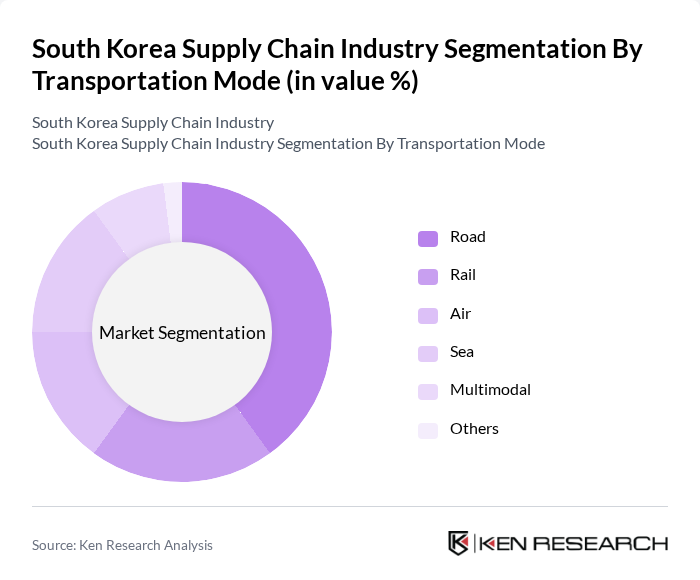

By Transportation Mode:The transportation modes in the South Korea Supply Chain Industry include Road, Rail, Air, Sea, Multimodal, and Others. The Road transportation mode is the most widely used due to its flexibility and ability to reach remote areas. The increasing demand for quick deliveries, especially in e-commerce, has led to a surge in road logistics, making it a critical component of the supply chain .

The South Korea Supply Chain Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Hyundai Glovis, Hanjin Transportation, Lotte Global Logistics, Pantos Logistics (LG Group), Samsung SDS, SK Networks, GS Global, KCTC, Hanil Express, Logen, Dongbu Express, Daewoo Logistics, Sebang, Korea Express contribute to innovation, geographic expansion, and service delivery in this space .

The South Korean supply chain industry is poised for transformative growth driven by technological innovation and evolving consumer demands. As companies increasingly adopt automation and AI, operational efficiencies will improve, enabling faster response times. Additionally, government investments in infrastructure will enhance logistics capabilities. However, challenges such as labor shortages and global disruptions will require strategic adaptations. Overall, the industry is expected to evolve, focusing on resilience and sustainability to meet future demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Model Type | PL (Second-Party Logistics) PL (Third-Party Logistics) PL (Fourth-Party Logistics) In-house Logistics Others |

| By Transportation Mode | Road Rail Air Sea Multimodal Others |

| By End-User | Retail & Consumer Goods Manufacturing Healthcare Automotive E-commerce High Technology Products Energy & Utilities Others |

| By Region | Seoul Busan Incheon Daegu Gwangju Others |

| By Technology | IoT Solutions Cloud Computing Big Data Analytics Robotics Process Automation Blockchain Others |

| By Application | Supply Chain Management Demand Forecasting Order Fulfillment Transportation Management Payment & Settlement Counterfeit Detection Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Public-Private Partnerships Others |

| By Policy Support | Tax Incentives Grants and Subsidies Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Optimization | 100 | Supply Chain Managers, Operations Directors |

| Logistics Technology Adoption | 60 | IT Managers, Logistics Coordinators |

| Cold Chain Logistics in Food Sector | 50 | Quality Assurance Managers, Distribution Managers |

| Last-Mile Delivery Solutions | 70 | Delivery Operations Managers, Customer Experience Leads |

| Sustainability Practices in Supply Chain | 40 | Sustainability Managers, Compliance Officers |

The South Korea Supply Chain Industry is valued at approximately USD 210 billion, driven by technological advancements, increased e-commerce demand, and the need for efficient logistics solutions. This growth reflects a significant investment in infrastructure and technology to meet consumer expectations.