Region:Asia

Author(s):Geetanshi

Product Code:KRAA0259

Pages:87

Published On:August 2025

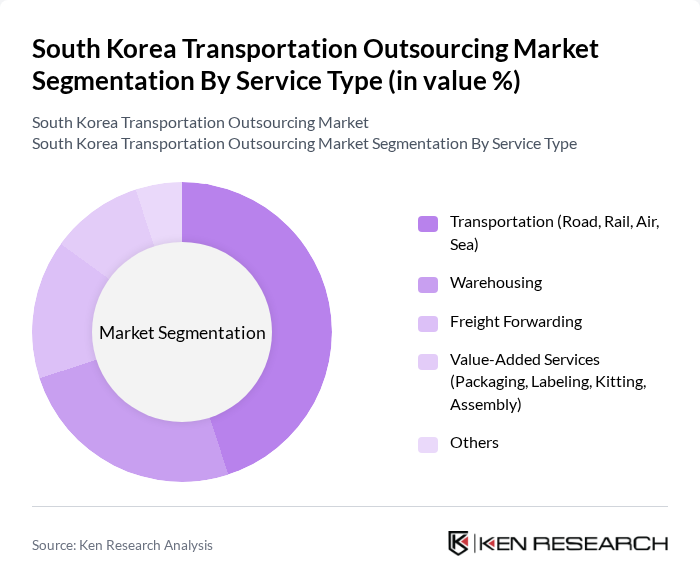

By Service Type:The service type segmentation includes various subsegments such as Transportation (Road, Rail, Air, Sea), Warehousing, Freight Forwarding, Value-Added Services (Packaging, Labeling, Kitting, Assembly), and Others. Among these, Transportation is the leading subsegment, driven by the increasing demand for efficient and timely delivery of goods across various channels. The rise of e-commerce and the integration of digital tracking and automation have significantly boosted the need for reliable transportation services, making it a critical component of the logistics chain .

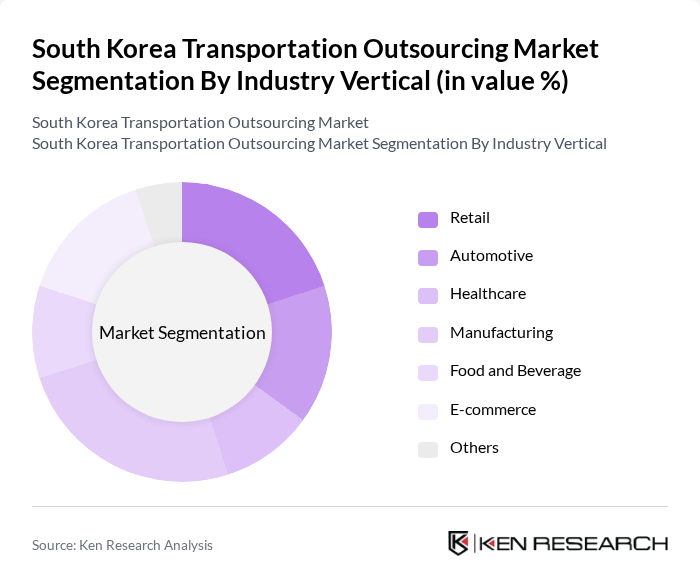

By Industry Vertical:The industry vertical segmentation encompasses Retail, Automotive, Healthcare, Manufacturing, Food and Beverage, E-commerce, and Others. The E-commerce sector is currently the dominant vertical, fueled by the rapid growth of online shopping and consumer demand for fast delivery services. This trend has led to increased investments in logistics capabilities, digital platforms, and last-mile delivery solutions to meet the expectations of consumers for quick and efficient service .

The South Korea Transportation Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Hyundai Glovis, Hanjin Transportation, Lotte Global Logistics, Pantos Logistics, Daewoo Logistics, Samsung SDS, KCTC, Dongbu Express, Logen, Pan Ocean, STX Corporation, Korea Express, HMM (Hyundai Merchant Marine), JD Korea (JD Logistics) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean transportation outsourcing market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As digital platforms for transportation management gain traction, companies will increasingly leverage data analytics and automation to enhance operational efficiency. Furthermore, the focus on sustainability will shape logistics strategies, prompting providers to adopt eco-friendly practices. These trends indicate a shift towards more integrated and responsive logistics solutions, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (Road, Rail, Air, Sea) Warehousing Freight Forwarding Value-Added Services (Packaging, Labeling, Kitting, Assembly) Others |

| By Industry Vertical | Retail Automotive Healthcare Manufacturing Food and Beverage E-commerce Others |

| By Mode of Transportation | Roadways Railways Airways Waterways Others |

| By Logistics Model | PL (Second-Party Logistics) PL (Third-Party Logistics) PL (Fourth-Party Logistics) Others |

| By Customer Type | B2B B2C Government Others |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border Transportation Others |

| By Technology Utilization | Traditional Logistics Digital Logistics Solutions Automated Logistics Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Transportation Outsourcing | 120 | Logistics Managers, Freight Coordinators |

| Last-Mile Delivery Services | 60 | Operations Managers, Delivery Supervisors |

| Third-Party Logistics (3PL) Providers | 50 | Business Development Managers, Supply Chain Analysts |

| Public Transportation Partnerships | 40 | Policy Makers, Transportation Planners |

| Technology Integration in Logistics | 45 | IT Managers, Innovation Officers |

The South Korea Transportation Outsourcing Market is valued at approximately USD 29 billion, reflecting a robust growth trajectory driven by urbanization, e-commerce expansion, and the demand for efficient logistics solutions.