Region:Asia

Author(s):Geetanshi

Product Code:KRAA0300

Pages:87

Published On:August 2025

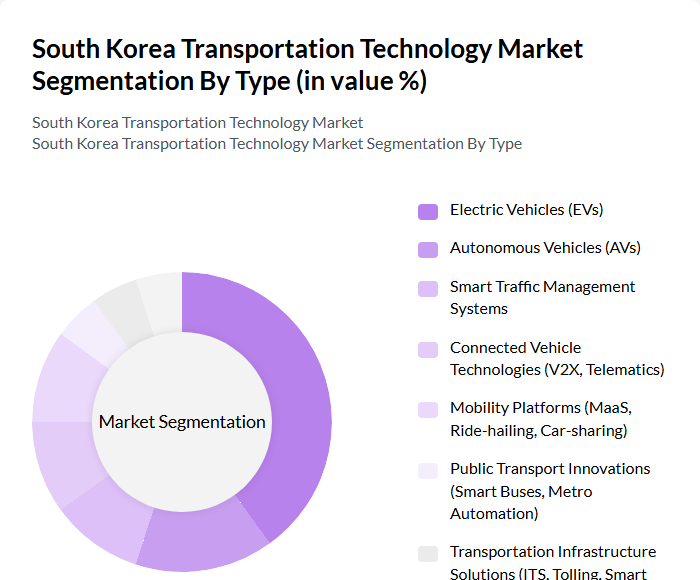

By Type:The market is segmented into various types, including Electric Vehicles (EVs), Smart Traffic Management Systems, Autonomous Vehicles & Delivery Drones, Connected Vehicle Technologies (V2X, Telematics), Mobility-as-a-Service (MaaS) Platforms, and Others. Among these, Electric Vehicles (EVs) are leading the market due to increasing consumer demand for sustainable transportation options and government incentives promoting EV adoption. Smart Traffic Management Systems are also gaining traction as cities seek to optimize traffic flow and reduce congestion. The adoption of connected vehicle technologies and MaaS platforms is accelerating, driven by the integration of IoT and real-time data analytics to enhance urban mobility and safety .

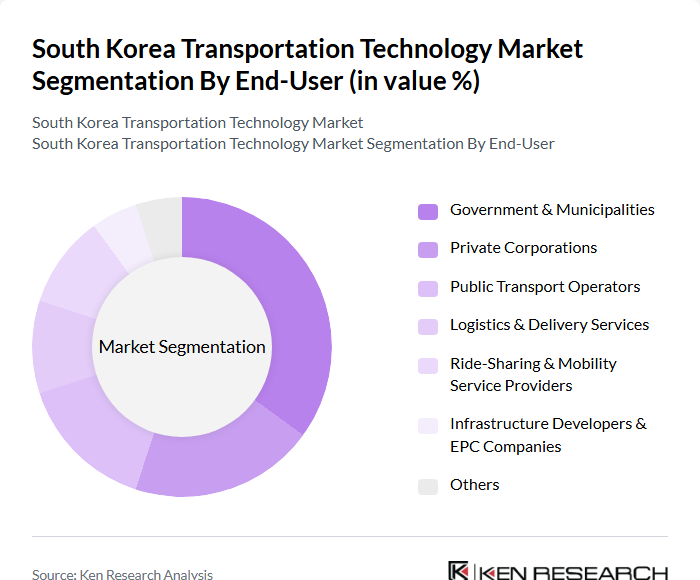

By End-User:The end-user segmentation includes Public Transportation Operators, Logistics and Freight Companies, Ride-Sharing & Mobility Service Providers, Individual/Personal Commuters, Government & Municipal Agencies, and Others. Public Transportation Operators are the dominant segment, driven by the need for efficient and sustainable public transport solutions. The rise of ride-sharing services is also notable, as they cater to changing consumer preferences for flexible mobility options. Logistics and freight companies are increasingly adopting digital and automated solutions to enhance supply chain efficiency and reduce operational costs .

The South Korea Transportation Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyundai Motor Company, Kia Corporation, Samsung SDS, LG CNS, SK Telecom, KT Corporation, Daewoo Engineering & Construction, Samsung C&T, GS Engineering & Construction, Hanon Systems, POSCO, CJ Logistics, Naver Corporation, Kakao Mobility, Hyundai Rotem, Doosan Corporation, Autonomous a2z, StradVision, RideFlux contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea transportation technology market is poised for transformative growth, driven by urbanization and government initiatives. In future, the integration of smart technologies and sustainable practices will reshape the landscape, enhancing efficiency and reducing environmental impact. The focus on electric vehicles and autonomous systems will likely accelerate, supported by substantial investments in infrastructure. As public awareness increases, the adoption of innovative solutions will gain momentum, positioning South Korea as a leader in transportation technology advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles (EVs) Smart Traffic Management Systems Autonomous Vehicles & Delivery Drones Connected Vehicle Technologies (V2X, Telematics) Mobility-as-a-Service (MaaS) Platforms Others |

| By End-User | Public Transportation Operators Logistics and Freight Companies Ride-Sharing & Mobility Service Providers Individual/Personal Commuters Government & Municipal Agencies Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two- & Three-Wheelers (including e-bikes, scooters) Public Transport Vehicles (buses, metros, trains) Drones & Unmanned Aerial Vehicles Others |

| By Technology | Electric Powertrains & Battery Systems Advanced Driver Assistance Systems (ADAS) Vehicle-to-Everything (V2X) Communication Smart Sensors, IoT Devices & Telematics Artificial Intelligence & Data Analytics Others |

| By Application | Fleet Management & Optimization Traffic Monitoring & Control Route & Mobility Optimization Passenger Information & Ticketing Systems Predictive Maintenance Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Traffic Management Systems | 100 | City Planners, Traffic Engineers |

| Electric Vehicle Adoption | 60 | Fleet Managers, Sustainability Officers |

| Autonomous Vehicle Technology | 50 | R&D Managers, Automotive Engineers |

| Public Transport Innovations | 70 | Transit Authority Officials, Operations Managers |

| Logistics and Supply Chain Technologies | 55 | Logistics Directors, Supply Chain Analysts |

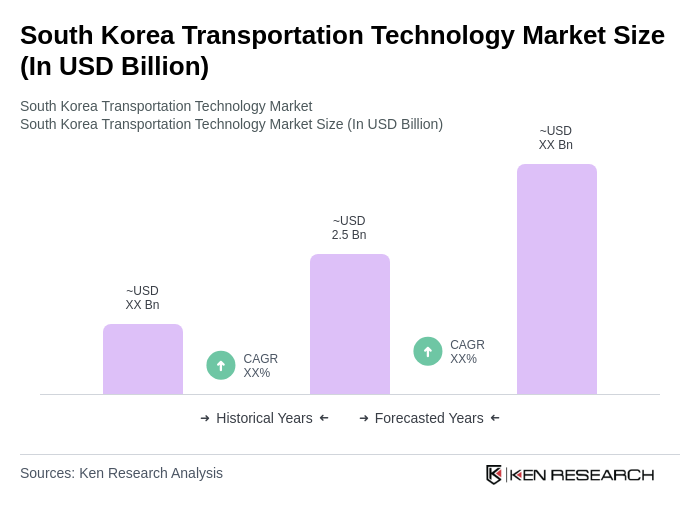

The South Korea Transportation Technology Market is valued at approximately USD 2.5 billion, driven by advancements in electric vehicle technology, smart traffic management systems, and investments in autonomous vehicle development, supported by government initiatives for sustainable mobility solutions.