Region:Asia

Author(s):Shubham

Product Code:KRAC0654

Pages:85

Published On:August 2025

By Type:

The Uninterruptible Power Supply market can be segmented into five types: Online/Double-Conversion UPS, Offline/Standby UPS, Line-Interactive UPS, Modular/Scalable UPS, and Rotary/Hybrid UPS. Among these, the Online/Double-Conversion UPS segment is leading the market due to its ability to provide a consistent and high-quality power supply, making it ideal for critical applications in data centers and healthcare facilities. The increasing reliance on technology and the need for uninterrupted power in sensitive environments are driving the demand for this segment.

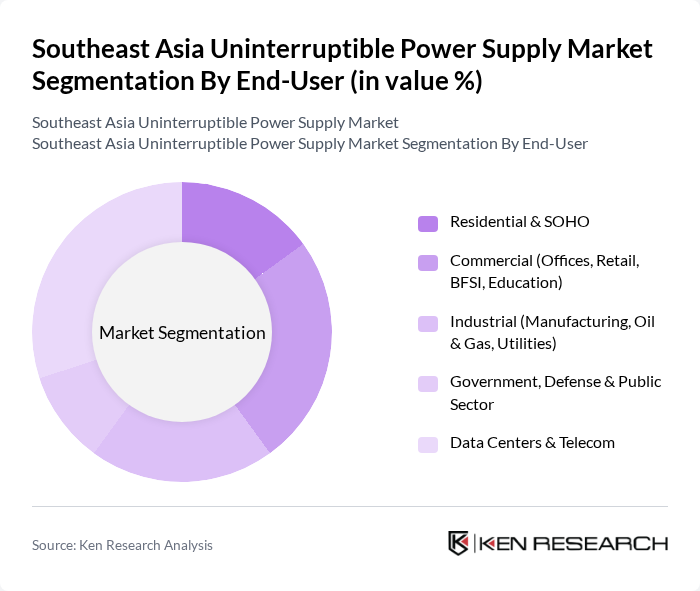

By End-User:

The market can be segmented by end-user into Residential & SOHO, Commercial (Offices, Retail, BFSI, Education), Industrial (Manufacturing, Oil & Gas, Utilities), Government, Defense & Public Sector, and Data Centers & Telecom. The Data Centers & Telecom segment is currently the dominant end-user category, driven by the exponential growth of data consumption and the need for reliable power solutions to support critical IT infrastructure. The increasing number of data centers in Southeast Asia is significantly contributing to the demand for UPS systems in this segment.

The Southeast Asia Uninterruptible Power Supply market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Eaton Corporation plc, Vertiv Holdings Co., ABB Ltd., Delta Electronics, Inc., Legrand (including the APC by Schneider Electric brand portfolio context), Riello Elettronica S.p.A. (Riello UPS), KSTAR Science & Technology Co., Ltd. (KSTAR), Huawei Digital Power, Toshiba Corporation, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., CyberPower Systems, Inc., Salicru S.A., Socomec Group S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Southeast Asia uninterruptible power supply market appears promising, driven by technological advancements and increasing energy demands. As industries continue to expand, the integration of smart UPS systems will become essential for operational efficiency. Additionally, the growing emphasis on sustainability will likely lead to increased investments in renewable energy sources, further enhancing the role of UPS systems in maintaining power quality and reliability across various sectors in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Online/Double-Conversion UPS Offline/Standby UPS Line-Interactive UPS Modular/Scalable UPS Rotary/Hybrid UPS |

| By End-User | Residential & SOHO Commercial (Offices, Retail, BFSI, Education) Industrial (Manufacturing, Oil & Gas, Utilities) Government, Defense & Public Sector Data Centers & Telecom |

| By Application | Data Centers and Cloud Facilities IT and Telecommunications Networks Healthcare and Hospitals Industrial Automation and Process Control Commercial Buildings & Critical Infrastructure Others |

| By Distribution Channel | Direct Sales (OEM/Projects) Distributors/Value-Added Resellers Online/E-commerce Retail & System Integrators |

| By Power Rating | Below 1 kVA kVA to 10 kVA kVA to 100 kVA Above 100 kVA |

| By Battery Type | Valve-Regulated Lead-Acid (VRLA) Lithium-Ion Nickel-Cadmium Others (Flywheel, Supercapacitor) |

| By Region | Singapore Malaysia Thailand Indonesia Vietnam Philippines Rest of ASEAN |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Data Center UPS Solutions | 120 | IT Managers, Data Center Operations Heads |

| Healthcare Facility Power Backup | 90 | Facility Managers, Biomedical Engineers |

| Industrial UPS Applications | 80 | Production Managers, Electrical Engineers |

| Commercial Building Power Systems | 100 | Building Managers, Energy Consultants |

| Residential UPS Market | 70 | Homeowners, Electrical Contractors |

The Southeast Asia Uninterruptible Power Supply market is valued at approximately USD 1.1 billion, reflecting a significant demand for reliable power solutions across various sectors, including IT, healthcare, and manufacturing, driven by increasing power outages in the region.