Region:Europe

Author(s):Rebecca

Product Code:KRAB1786

Pages:90

Published On:October 2025

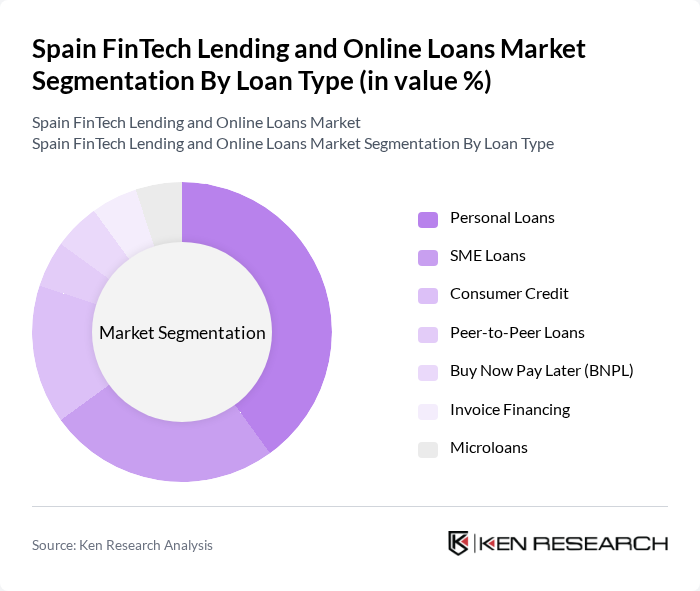

By Loan Type:The loan type segmentation includes various categories such as Personal Loans, SME Loans, Consumer Credit, Peer-to-Peer Loans, Buy Now Pay Later (BNPL), Invoice Financing, and Microloans. Personal loans are currently the most dominant segment, driven by consumer demand for flexible financing options for personal expenses, home improvements, and debt consolidation. The convenience of online applications and quick approval processes has made personal loans particularly appealing to borrowers. BNPL services are also gaining traction, with over one-third of online shoppers in Spain using them at least once in the previous year.

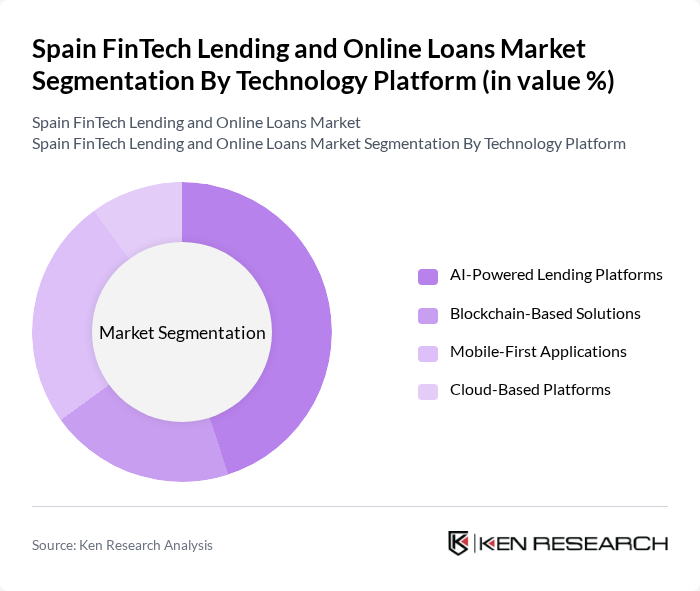

By Technology Platform:The technology platform segmentation encompasses AI-Powered Lending Platforms, Blockchain-Based Solutions, Mobile-First Applications, and Cloud-Based Platforms. AI-Powered Lending Platforms are leading this segment due to their ability to streamline the lending process through advanced algorithms that assess creditworthiness quickly and accurately. This technology not only enhances user experience but also reduces operational costs for lenders.

The Spain FinTech Lending and Online Loans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aplazame, Creditea, Payflow, Belvo, October, Finizens, Indexa Capital, MytripleA, Housers, Bnext, BBVA (Digital Lending Division), Banco Sabadell (FinTech Solutions), ING Direct España, Lendico España, Spotcap España contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FinTech lending market in Spain appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, companies are likely to enhance their offerings with AI-driven solutions and personalized loan products. Additionally, the integration of sustainable lending practices will become increasingly important, aligning with global trends towards responsible finance. These developments will not only improve customer experience but also foster greater trust and engagement in the FinTech ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Loan Type | Personal Loans SME Loans Consumer Credit Peer-to-Peer Loans Buy Now Pay Later (BNPL) Invoice Financing Microloans |

| By Technology Platform | AI-Powered Lending Platforms Blockchain-Based Solutions Mobile-First Applications Cloud-Based Platforms |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Freelancers and Gig Workers Startups |

| By Loan Amount | Microloans (€500 - €5,000) Small Loans (€5,000 - €25,000) Medium Loans (€25,000 - €100,000) Large Loans (€100,000+) |

| By Distribution Channel | Direct Online Platforms Mobile Applications Partnership Networks API Integrations |

| By Processing Speed | Instant Approval (Real-time) Same-Day Processing Standard Processing (1-3 days) |

| By Customer Segment | Prime Borrowers Near-Prime Borrowers Underbanked Customers Digital-Native Millennials |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 100 | Individuals aged 25-45, employed, with prior loan experience |

| Small Business Loan Recipients | 60 | Small business owners, entrepreneurs, financial decision-makers |

| Peer-to-Peer Lending Users | 50 | Tech-savvy individuals, aged 30-50, familiar with online platforms |

| Financial Advisors | 40 | Certified financial planners, investment advisors, and consultants |

| Regulatory Experts | 40 | Legal professionals, compliance officers, and policy analysts |

The Spain FinTech Lending and Online Loans Market is valued at approximately EUR 7.5 billion, driven by the increasing demand for alternative financing solutions among small and medium enterprises (SMEs) and individual consumers.