Region:Europe

Author(s):Dev

Product Code:KRAB6082

Pages:84

Published On:October 2025

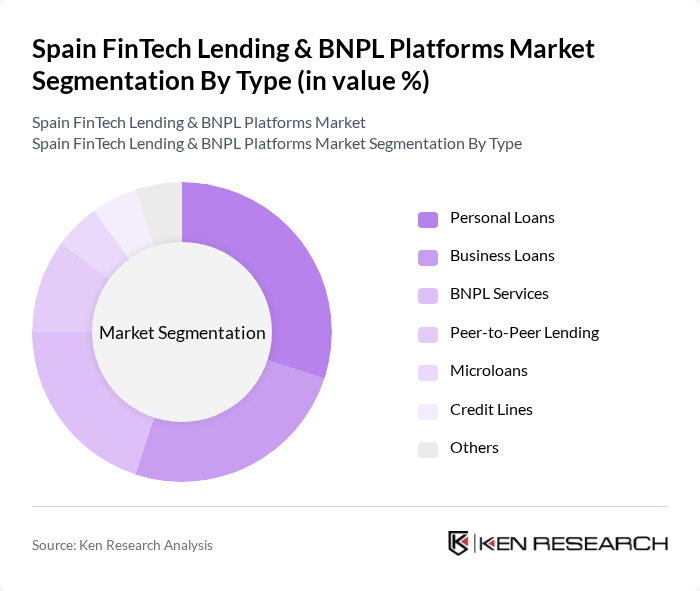

By Type:The market is segmented into various types of lending solutions, including personal loans, business loans, BNPL services, peer-to-peer lending, microloans, credit lines, and others. Personal loans are particularly popular due to their accessibility and flexibility, catering to a wide range of consumer needs. Business loans are also significant, driven by the growth of SMEs seeking funding for expansion. BNPL services have gained traction, especially among younger consumers who prefer installment payments for online purchases.

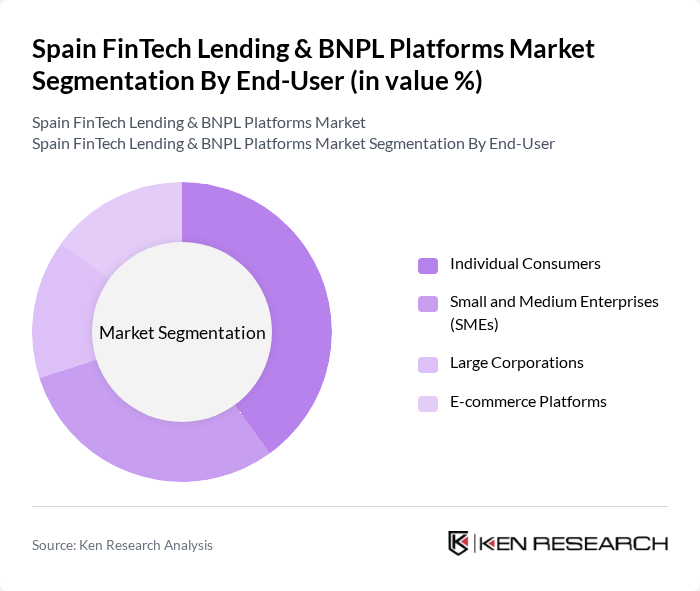

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and e-commerce platforms. Individual consumers represent a significant portion of the market, driven by the need for personal financing solutions. SMEs are increasingly turning to alternative lending options to support their growth, while large corporations utilize these platforms for quick access to capital. E-commerce platforms are also leveraging BNPL services to enhance customer experience and drive sales.

The Spain FinTech Lending & BNPL Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco Santander, BBVA, Klarna, Aplazame, Spotcap, Creditea, Finizens, Lendico, Qonto, N26, Revolut, Fintonic, Bnext, MytripleA, Housers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain FinTech lending and BNPL market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As digital payment solutions become more integrated into everyday transactions, the demand for flexible financing options is expected to rise. Additionally, the regulatory landscape is likely to evolve, fostering innovation while ensuring consumer protection. Companies that leverage data analytics and AI will be well-positioned to offer personalized services, enhancing customer experiences and driving market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans BNPL Services Peer-to-Peer Lending Microloans Credit Lines Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations E-commerce Platforms |

| By Application | Retail Purchases Service Payments Travel and Leisure Education Financing |

| By Distribution Channel | Online Platforms Mobile Applications Partner Retailers Financial Institutions |

| By Customer Segment | Millennials Gen Z Working Professionals Retirees |

| By Loan Amount | Small Loans (up to €1,000) Medium Loans (€1,001 - €10,000) Large Loans (above €10,000) |

| By Payment Terms | Short-term (up to 6 months) Medium-term (6 months to 2 years) Long-term (above 2 years) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer BNPL Usage | 150 | Millennials, Gen Z Consumers |

| FinTech Lending Platforms | 100 | Product Managers, Marketing Directors |

| Regulatory Impact Assessment | 80 | Compliance Officers, Financial Regulators |

| Market Trends in Lending | 120 | Financial Analysts, Investment Advisors |

| Consumer Attitudes towards Lending | 90 | General Consumers, Financial Literacy Advocates |

The Spain FinTech Lending & BNPL Platforms Market is valued at approximately EUR 5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a shift in consumer behavior towards online lending solutions.