Region:Europe

Author(s):Dev

Product Code:KRAB3084

Pages:88

Published On:October 2025

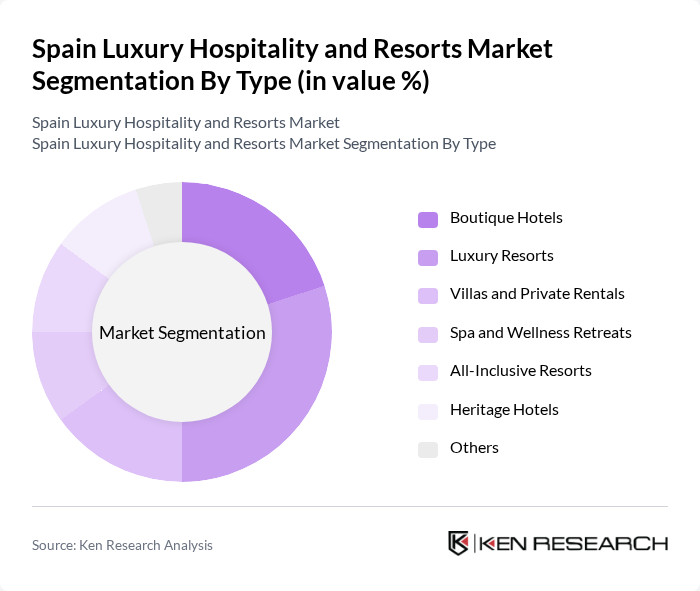

By Type:The luxury hospitality market in Spain is segmented into various types, including Boutique Hotels, Luxury Resorts, Villas and Private Rentals, Spa and Wellness Retreats, All-Inclusive Resorts, Heritage Hotels, and Others. Each of these sub-segments caters to different consumer preferences and travel experiences. Boutique hotels are gaining popularity for their unique designs and personalized services, while luxury resorts offer comprehensive amenities and activities. Villas and private rentals are favored by families and groups seeking privacy, and spa retreats attract wellness-focused travelers.

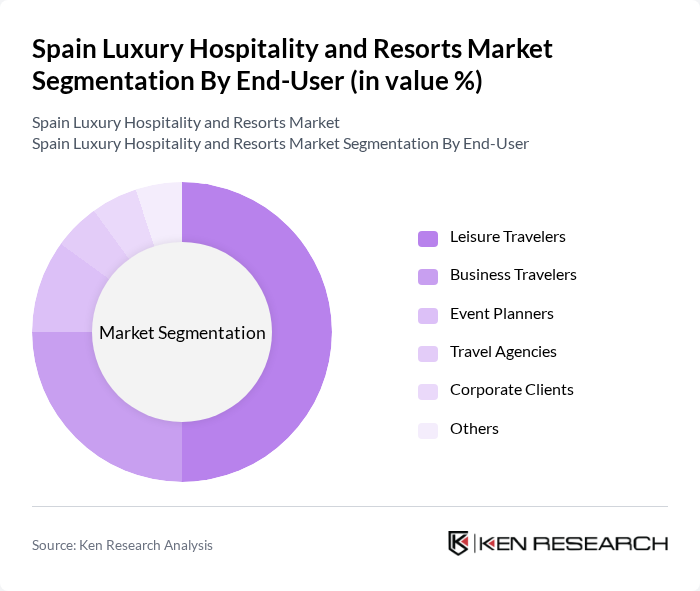

By End-User:The end-user segmentation of the luxury hospitality market includes Leisure Travelers, Business Travelers, Event Planners, Travel Agencies, Corporate Clients, and Others. Leisure travelers dominate the market, driven by a growing trend of experiential travel and luxury vacations. Business travelers seek high-quality accommodations that offer convenience and amenities conducive to work. Event planners and travel agencies play a crucial role in organizing luxury events and trips, while corporate clients often book luxury accommodations for business meetings and retreats.

The Spain Luxury Hospitality and Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marriott International, Inc., Hilton Worldwide Holdings Inc., Accor S.A., Four Seasons Hotels and Resorts, The Ritz-Carlton Hotel Company, L.L.C., InterContinental Hotels Group PLC, Mandarin Oriental Hotel Group, Hyatt Hotels Corporation, Belmond Ltd., Rosewood Hotels & Resorts, Banyan Tree Holdings Limited, Kempinski Hotels S.A., Leading Hotels of the World, Ltd., Small Luxury Hotels of the World, Preferred Hotels & Resorts contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury hospitality market in Spain appears promising, driven by evolving consumer preferences and a robust tourism recovery. As travelers increasingly seek wellness and experiential offerings, luxury resorts are likely to adapt by enhancing their service portfolios. Additionally, the integration of technology to streamline operations and improve guest experiences will be crucial. The focus on sustainability will also shape investment strategies, as eco-conscious travelers become more prevalent in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Boutique Hotels Luxury Resorts Villas and Private Rentals Spa and Wellness Retreats All-Inclusive Resorts Heritage Hotels Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Travel Agencies Corporate Clients Others |

| By Price Range | Premium Luxury Ultra-Luxury Others |

| By Location | Coastal Areas Urban Centers Rural Retreats Mountain Resorts Others |

| By Service Type | Room Services Dining Services Spa and Wellness Services Concierge Services Event Hosting Services Others |

| By Distribution Channel | Direct Booking Online Travel Agencies Travel Agents Corporate Bookings Others |

| By Customer Segment | Families Couples Solo Travelers Groups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Management | 100 | General Managers, Operations Directors |

| Luxury Travel Agencies | 80 | Travel Consultants, Agency Owners |

| High-Net-Worth Individuals | 75 | Affluent Travelers, Lifestyle Managers |

| Luxury Resort Marketing | 60 | Marketing Directors, Brand Managers |

| Tourism Board Officials | 50 | Policy Makers, Economic Development Officers |

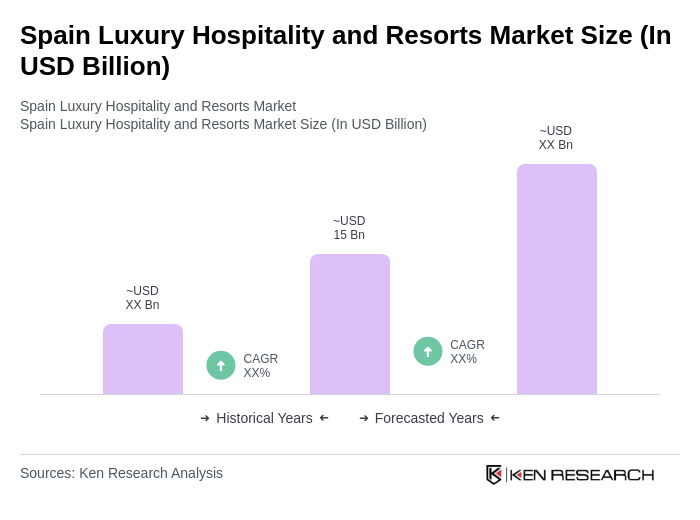

The Spain Luxury Hospitality and Resorts Market is valued at approximately USD 15 billion, reflecting a significant growth driven by increased international tourism, higher disposable incomes, and a demand for unique travel experiences.