Region:Europe

Author(s):Dev

Product Code:KRAA3541

Pages:97

Published On:September 2025

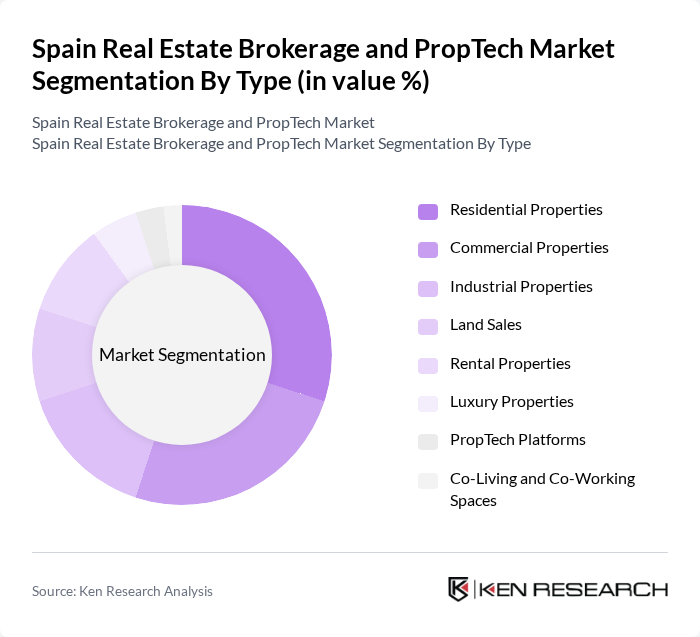

By Type:The market can be segmented into various types, includingResidential Properties,Commercial Properties,Industrial Properties,Land Sales,Rental Properties,Luxury Properties,PropTech Platforms, andCo-Living and Co-Working Spaces. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of the real estate market.

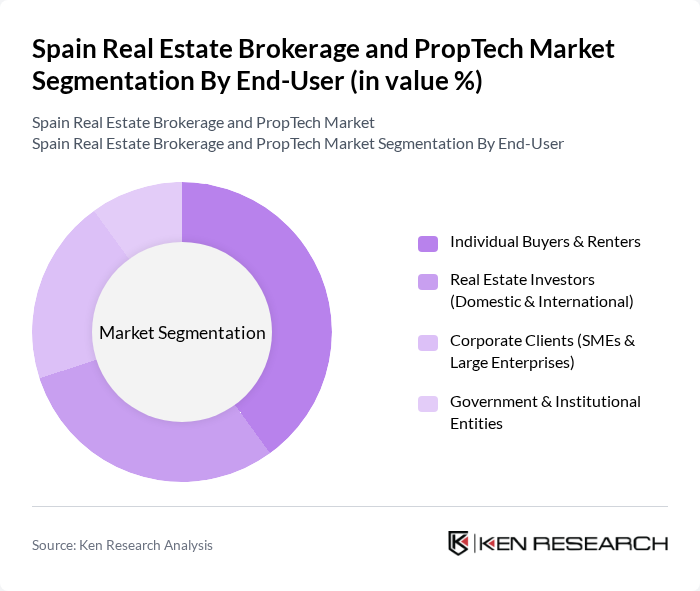

By End-User:The end-user segmentation includesIndividual Buyers & Renters,Real Estate Investors (Domestic & International),Corporate Clients (SMEs & Large Enterprises), andGovernment & Institutional Entities. This segmentation highlights the diverse motivations and requirements of different user groups in the real estate market.

The Spain Real Estate Brokerage and PropTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Idealista, Fotocasa, Habitaclia, Engel & Völkers España, RE/MAX España, Coldwell Banker España, Tecnocasa España, Housell, Badi, Spotahome, Homelike, Gilmar Consulting Inmobiliario, Urbanitae, Inmobiliaria Colonial, Casavo, CBRE España, Savills España, Lucas Fox, Aliseda Inmobiliaria, Solvia contribute to innovation, geographic expansion, and service delivery in this space.

The Spain real estate market is poised for significant transformation as urbanization continues to rise and technology becomes increasingly integrated into property transactions. By future, the demand for rental properties is expected to remain strong, driven by demographic shifts and changing lifestyle preferences. Additionally, the focus on sustainability and smart home technologies will likely shape future developments, creating new avenues for growth and innovation within the brokerage and PropTech sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Land Sales Rental Properties Luxury Properties PropTech Platforms Co-Living and Co-Working Spaces |

| By End-User | Individual Buyers & Renters Real Estate Investors (Domestic & International) Corporate Clients (SMEs & Large Enterprises) Government & Institutional Entities |

| By Sales Channel | Direct Sales (Traditional Brokerage) Online Platforms & Marketplaces Real Estate Agencies/Franchises Auctions & Alternative Channels |

| By Property Size | Micro-units & Studios Small Properties (1-2 bedrooms, <60m²) Medium Properties (2-4 bedrooms, 60–120m²) Large Properties (>120m²) |

| By Investment Type | Buy-to-Let (Rental Investment) Buy-to-Sell (Flipping) Build-to-Rent (BTR) Mixed-Use Investment |

| By Financing Method | Cash Purchases Mortgages Crowdfunding & Alternative Finance Institutional Investment |

| By Policy Support | Subsidies for First-Time Buyers Tax Incentives for Developers & Investors Grants for Renovation & Energy Efficiency Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Brokerage | 100 | Real Estate Agents, Brokers |

| Commercial Real Estate Transactions | 80 | Commercial Property Managers, Investors |

| PropTech Adoption in Brokerage | 70 | PropTech Founders, Technology Officers |

| Market Trends in Real Estate | 90 | Market Analysts, Real Estate Consultants |

| Investment in Real Estate Technology | 60 | Venture Capitalists, Investment Analysts |

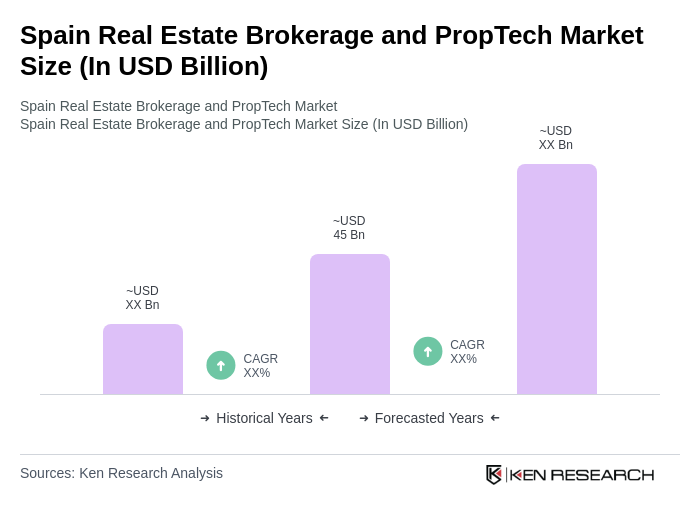

The Spain Real Estate Brokerage and PropTech Market is valued at approximately USD 45 billion, driven by urbanization, demand for properties, and technological integration in real estate transactions.