Region:Europe

Author(s):Rebecca

Product Code:KRAB4187

Pages:80

Published On:October 2025

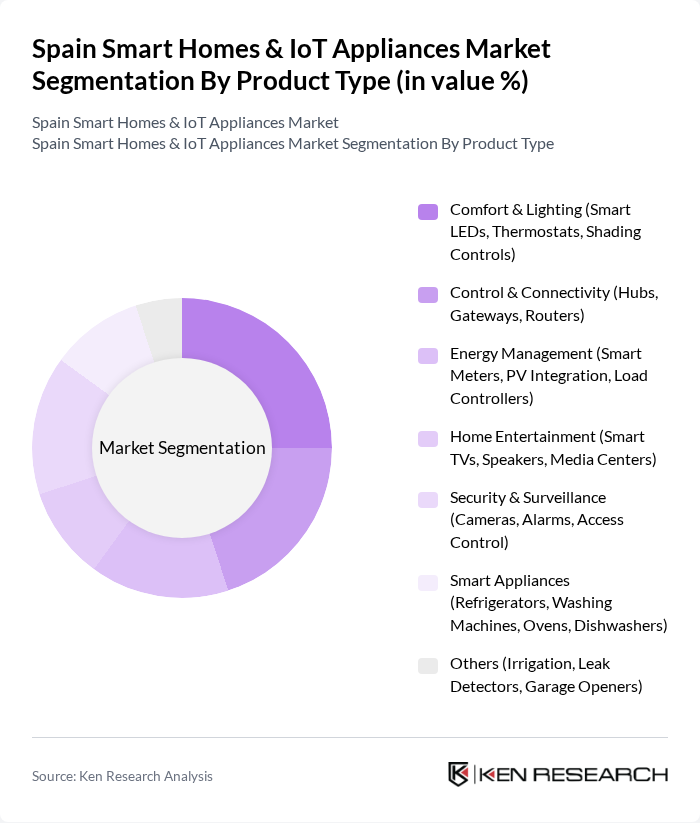

By Product Type:The product type segmentation includes Comfort & Lighting, Control & Connectivity, Energy Management, Home Entertainment, Security & Surveillance, Smart Appliances, and Others. Comfort & Lighting encompasses smart LEDs, thermostats, and shading controls, which are widely adopted for their contribution to energy savings and user comfort. Control & Connectivity includes hubs, gateways, and routers, enabling seamless device integration and centralized management. Energy Management features smart meters, PV integration, and load controllers, supporting sustainability and cost reduction. Home Entertainment covers smart TVs, speakers, and media centers, reflecting growing demand for integrated digital experiences. Security & Surveillance includes cameras, alarms, and access control, addressing rising consumer focus on safety. Smart Appliances such as refrigerators, washing machines, ovens, and dishwashers are increasingly IoT-enabled, offering convenience and efficiency. The Others category includes irrigation systems, leak detectors, and garage openers, catering to niche automation needs .

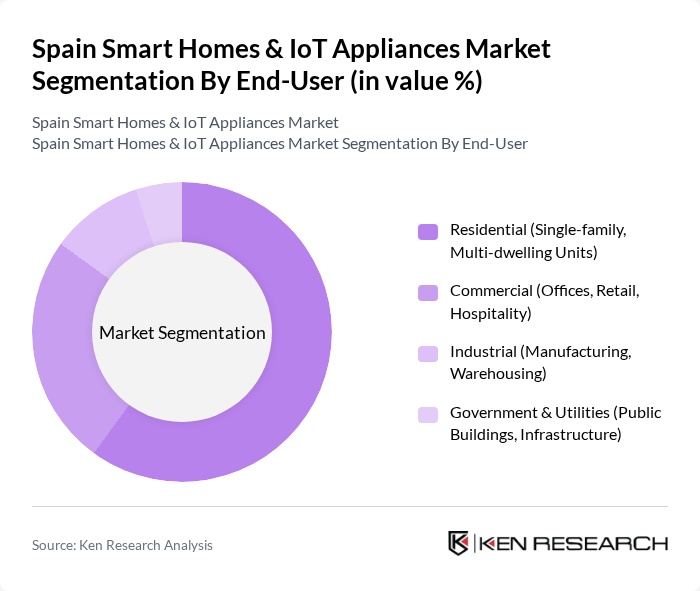

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities sectors. The Residential segment, comprising single-family and multi-dwelling units, leads adoption due to retrofit flexibility and developer-driven smart-ready branding. The Commercial segment, including offices, retail, and hospitality, adopts smart solutions for operational efficiency and customer experience. Industrial users leverage smart technologies for facility management and energy optimization, while Government & Utilities focus on public buildings and infrastructure upgrades to meet sustainability targets .

The Spain Smart Homes & IoT Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify (Philips Hue), Google Nest, Amazon (Echo, Ring), Samsung SmartThings, Xiaomi Smart Home, Honeywell Home, Ecobee, TP-Link (Kasa), Bosch Smart Home, LG ThinQ, Schneider Electric, ABB (free@home), Siemens Smart Infrastructure, Fermax (Spain-based, smart intercoms & lighting), and Somfy (smart shading, Spain presence) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain Smart Homes & IoT Appliances market appears promising, driven by technological advancements and increasing consumer awareness. As 5G networks expand, the connectivity of smart devices will improve, enhancing user experiences. Additionally, the trend towards sustainability will likely lead to more eco-friendly smart appliances. With government support and rising consumer interest, the market is poised for significant growth, fostering innovation and competition among key players in the industry.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Comfort & Lighting (Smart LEDs, Thermostats, Shading Controls) Control & Connectivity (Hubs, Gateways, Routers) Energy Management (Smart Meters, PV Integration, Load Controllers) Home Entertainment (Smart TVs, Speakers, Media Centers) Security & Surveillance (Cameras, Alarms, Access Control) Smart Appliances (Refrigerators, Washing Machines, Ovens, Dishwashers) Others (Irrigation, Leak Detectors, Garage Openers) |

| By End-User | Residential (Single-family, Multi-dwelling Units) Commercial (Offices, Retail, Hospitality) Industrial (Manufacturing, Warehousing) Government & Utilities (Public Buildings, Infrastructure) |

| By Sales Channel | Online Retail (E-commerce Platforms) Offline Retail (Electronics Stores, Supermarkets) Direct Sales (Manufacturer Websites, Showrooms) Distributors (Wholesalers, System Integrators) |

| By Component | Hardware (Devices, Sensors, Controllers) Software (Platforms, Apps, Analytics) Services (Installation, Maintenance, Support) |

| By Application | Home Automation (Lighting, Climate, Appliances) Energy Management (Monitoring, Optimization) Security and Surveillance (Access, Alarms, Cameras) Health Monitoring (Air Quality, Wellness Devices) |

| By Distribution Mode | Direct Distribution (B2C, B2B) Indirect Distribution (Retailers, Resellers) E-commerce Platforms (Amazon, MediaMarkt, El Corte Inglés) |

| By Price Range | Budget (Entry-level, Basic Functionality) Mid-Range (Enhanced Features, Brand Reliability) Premium (Advanced Integration, Luxury Brands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Lighting Solutions | 60 | Homeowners, Interior Designers |

| Home Security Systems | 50 | Security Managers, Homeowners |

| IoT Kitchen Appliances | 45 | Chefs, Home Cooks, Appliance Retailers |

| Energy Management Systems | 40 | Energy Consultants, Homeowners |

| Smart Thermostats | 55 | HVAC Technicians, Homeowners |

The Spain Smart Homes & IoT Appliances Market is valued at approximately USD 3.3 billion, driven by increasing consumer demand for energy-efficient solutions and the rapid adoption of IoT-enabled devices.