Region:Europe

Author(s):Dev

Product Code:KRAB0530

Pages:96

Published On:August 2025

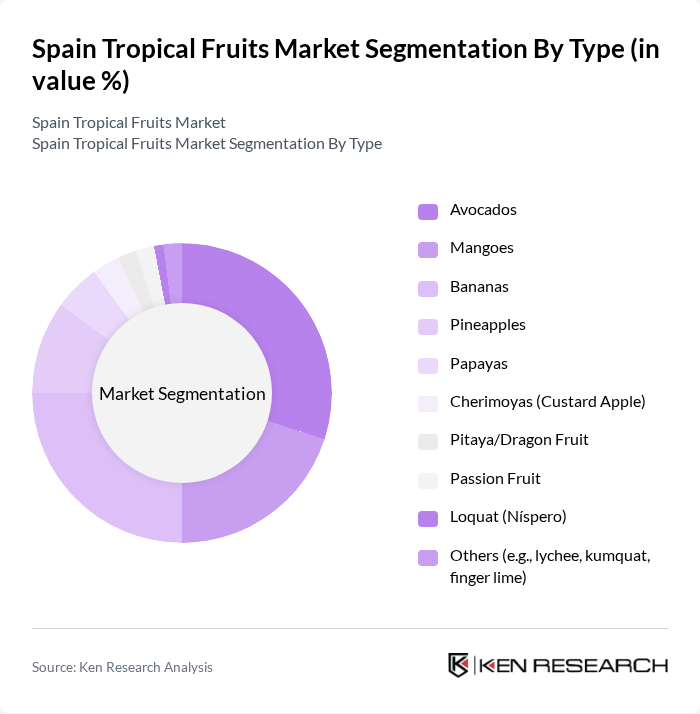

By Type:The tropical fruits market in Spain is segmented into various types, including avocados, mangoes, bananas, pineapples, papayas, cherimoyas (custard apple), pitaya (dragon fruit), passion fruit, loquat (níspero), and others such as lychee, kumquat, and finger lime. Among these, avocados and bananas are particularly popular due to their versatility and health benefits, driving significant consumer demand.

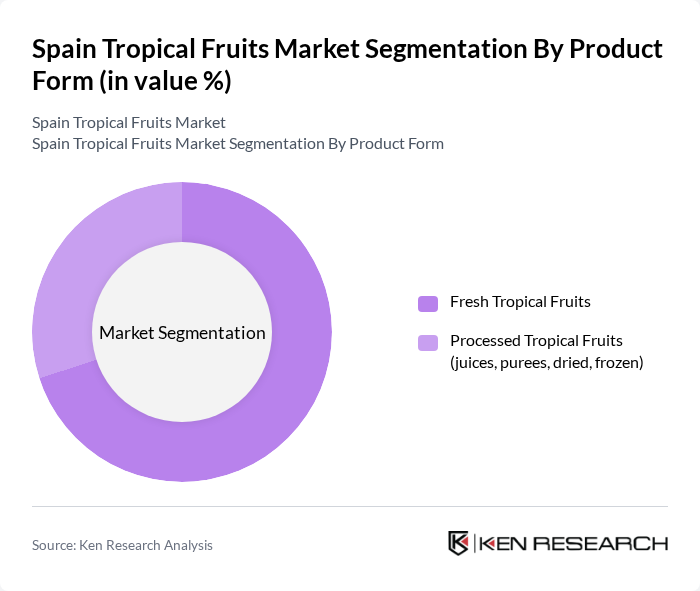

By Product Form:The market is also segmented by product form, which includes fresh tropical fruits and processed tropical fruits such as juices, purees, dried, and frozen products. Fresh tropical fruits dominate the market due to the increasing consumer preference for healthy, unprocessed options. However, the processed segment is gaining traction as consumers seek convenience and longer shelf life.

The Spain Tropical Fruits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Frutas Montosa S.A., Trops (Cooperativa Agraria de Málaga), Reyes Gutiérrez S.A., Anecoop S. Coop., Eurobanan (Grupo Bananas), Unica Group S.C.A., Dole plc (Spain), Chiquita Brands International (Spain), Fyffes (Spain), Frutas Tropicales del Valle S.L., La Unión Corp., SAT 2803 Pitpit (dragon fruit), Natural Tropic S.A.T., Axarfruit S.L., Frutas Bordas Chinchurreta S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain tropical fruits market appears promising, driven by increasing health awareness and a growing preference for exotic flavors. As consumers continue to seek out nutritious options, the demand for tropical fruits is expected to rise. Additionally, advancements in sustainable farming practices and innovative distribution methods will likely enhance market resilience. The focus on organic produce and e-commerce will further shape the landscape, providing opportunities for growth and diversification in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Avocados Mangoes Bananas Pineapples Papayas Cherimoyas (Custard Apple) Pitaya/Dragon Fruit Passion Fruit Loquat (Níspero) Others (e.g., lychee, kumquat, finger lime) |

| By Product Form | Fresh Tropical Fruits Processed Tropical Fruits (juices, purees, dried, frozen) |

| By End-User | Household/Consumers Retailers Foodservice (HORECA) Processors/Manufacturers |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Greengrocers/Fruit Stores Wholesale Markets |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Price Range | Premium Mid-Range Budget |

| By Organic Certification | Certified Organic Non-Organic |

| By Region | Andalusia (Málaga, Granada, Almería) Valencia Community (Alicante, Valencia) Canary Islands Catalonia Others (Murcia, Balearic Islands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Tropical Fruits | 140 | Store Managers, Category Buyers |

| Wholesale Distribution Channels | 100 | Wholesale Managers, Supply Chain Coordinators |

| Importers of Exotic Fruits | 80 | Import Managers, Logistics Directors |

| Consumer Preferences and Trends | 150 | End Consumers, Health-Conscious Shoppers |

| Farmers and Producers of Tropical Fruits | 70 | Farm Owners, Agricultural Managers |

The Spain Tropical Fruits Market is valued at approximately EUR 1.4 billion, reflecting a significant growth trend driven by increasing consumer demand for exotic fruits and health-conscious eating habits.