Region:Asia

Author(s):Rebecca

Product Code:KRAA1334

Pages:89

Published On:August 2025

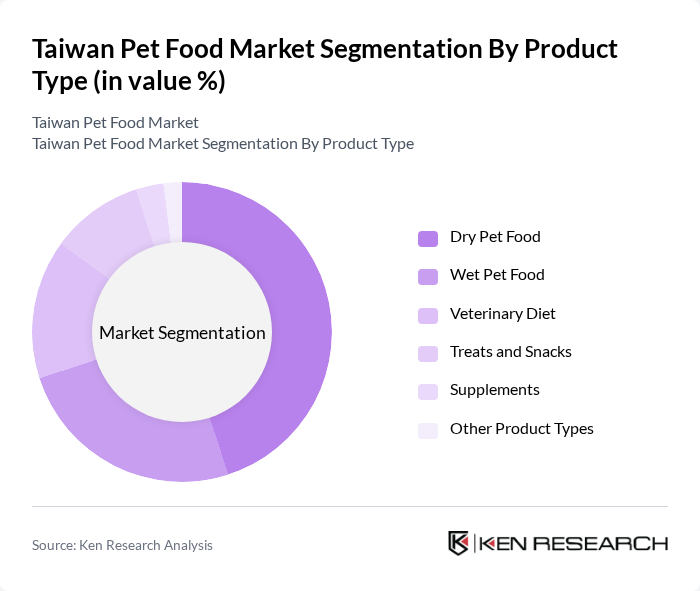

By Product Type:The product type segmentation includes categories such as Dry Pet Food, Wet Pet Food, Veterinary Diet, Treats and Snacks, Supplements, and Other Product Types. Among these, Dry Pet Food is the most dominant segment due to its convenience, longer shelf life, and cost-effectiveness. Consumers often prefer dry food for daily feeding, while Wet Pet Food is gaining traction for its palatability and moisture content. The Veterinary Diet segment is also growing as pet owners become more aware of specific dietary needs for their pets. There is a notable increase in demand for functional and specialized pet foods, including grain-free and prescription diets, as pet owners seek to address specific health concerns and dietary requirements .

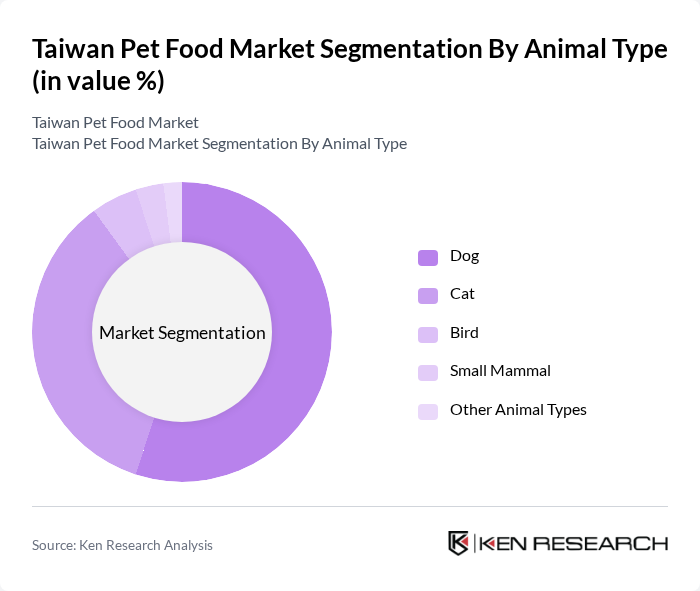

By Animal Type:The animal type segmentation includes Dogs, Cats, Birds, Small Mammals, and Other Animal Types. Dogs and Cats dominate this market, with dogs being the most popular pet in Taiwan. The increasing trend of pet humanization has led to higher spending on premium food for dogs and cats, as owners seek to provide the best nutrition for their pets. The Bird and Small Mammal segments are smaller but are growing as more people adopt these pets. There is also rising demand for specialized nutrition for cats, reflecting the growing cat population in Taiwan .

The Taiwan Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Petcare (Taiwan) Co., Ltd., Nestlé Purina PetCare (Taiwan) Ltd., Hill's Pet Nutrition (Taiwan) Ltd., Uni-President Enterprises Corporation, Fwusow Industry Co., Ltd., Taiwan Sugar Corporation (Taisugar), Chia Hsiu Industrial Co., Ltd. (Dr. Wish), Champion Petfoods (Orijen, Acana), Blue Buffalo (General Mills), WellPet LLC, Diamond Pet Foods, Royal Canin (Taiwan), Stella & Chewy's, Natural Balance Pet Foods, PetLine Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Taiwan pet food market appears promising, driven by evolving consumer preferences and technological advancements. As pet owners increasingly prioritize health and wellness, the demand for specialized and premium products is expected to rise. Additionally, the integration of technology in pet food production and distribution will enhance efficiency and product offerings. Companies that adapt to these trends and invest in innovation will likely capture a larger share of the growing market, ensuring sustainability and profitability.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dry Pet Food Wet Pet Food Veterinary Diet Treats and Snacks Supplements Other Product Types |

| By Animal Type | Dog Cat Bird Small Mammal Other Animal Types |

| By Ingredient Type | Animal-derived Plant-derived Cereals and Cereal Derivatives Other Ingredient Types |

| By Distribution Channel | Specialized Pet Shops Supermarkets/Hypermarkets Online Retail Veterinary Clinics Other Sales Channels |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bags Cans Pouches Other Packaging Types |

| By Nutritional Content | High Protein Low Carb Balanced Nutrition Functional/Health-Specific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 100 | Store Managers, Purchasing Agents |

| Pet Owners | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Pet Supply Distributors | 50 | Distribution Managers, Sales Representatives |

The Taiwan Pet Food Market is valued at approximately USD 960 million, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and a shift towards premium and functional pet food products.