Region:Asia

Author(s):Shubham

Product Code:KRAB3221

Pages:80

Published On:October 2025

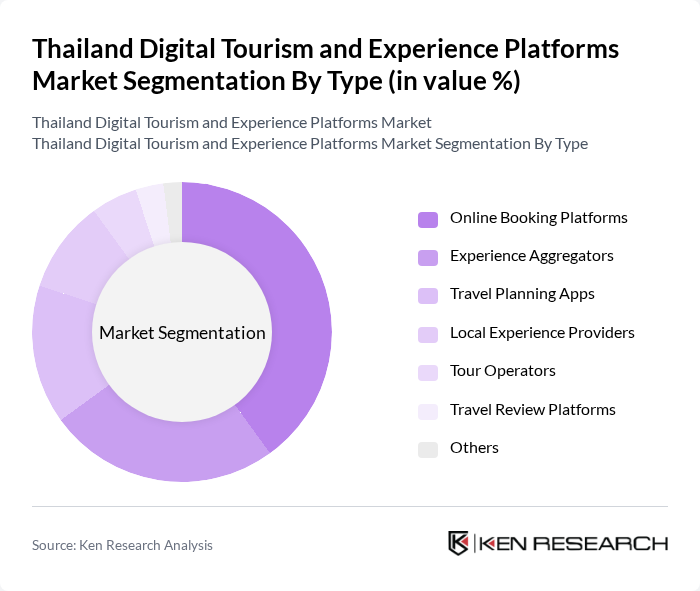

By Type:The market is segmented into various types, including Online Booking Platforms, Experience Aggregators, Travel Planning Apps, Local Experience Providers, Tour Operators, Travel Review Platforms, and Others. Among these, Online Booking Platforms are leading due to their convenience and user-friendly interfaces, allowing travelers to easily book accommodations, flights, and activities. Experience Aggregators are also gaining traction as they provide curated experiences tailored to individual preferences, enhancing the overall travel experience.

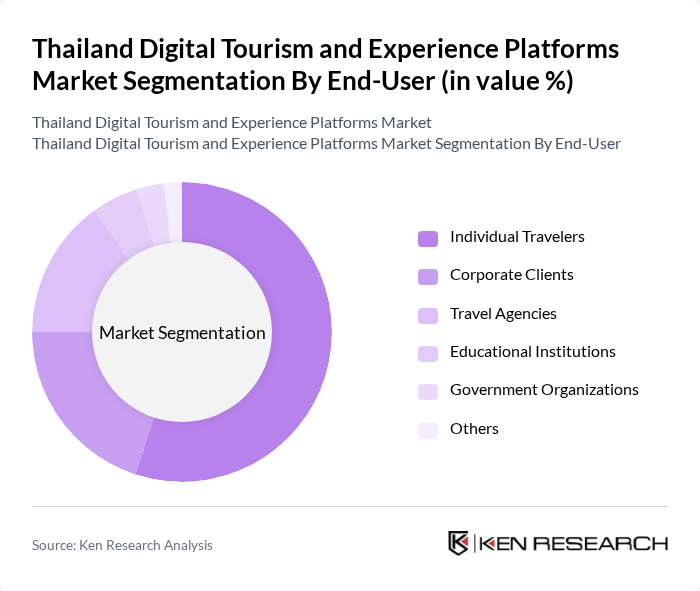

By End-User:The end-user segmentation includes Individual Travelers, Corporate Clients, Travel Agencies, Educational Institutions, Government Organizations, and Others. Individual Travelers dominate the market, driven by the increasing trend of personalized travel experiences and the growing number of solo travelers. Corporate Clients are also significant, as businesses increasingly utilize digital platforms for travel management and employee travel arrangements.

The Thailand Digital Tourism and Experience Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agoda, Klook, Traveloka, TripAdvisor, GetYourGuide, Viator, Airbnb, Booking.com, Expedia, Thai Airways, TAT (Tourism Authority of Thailand), Thailand Travel Agency, Local Alike, Tour East Thailand, Thailand Insider contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's digital tourism market appears promising, driven by technological advancements and evolving consumer preferences. As the integration of AI and data analytics becomes more prevalent, platforms will enhance their ability to offer personalized experiences. Additionally, the increasing focus on sustainable tourism will likely shape offerings, attracting eco-conscious travelers. Collaborations with local businesses will further enrich the tourism experience, fostering community engagement and economic growth in the sector, positioning Thailand as a leader in digital tourism innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Booking Platforms Experience Aggregators Travel Planning Apps Local Experience Providers Tour Operators Travel Review Platforms Others |

| By End-User | Individual Travelers Corporate Clients Travel Agencies Educational Institutions Government Organizations Others |

| By Application | Leisure Travel Business Travel Adventure Tourism Cultural Tourism Eco-Tourism Others |

| By Sales Channel | Direct Sales Online Travel Agencies Mobile Applications Social Media Platforms Others |

| By Distribution Mode | Online Distribution Offline Distribution Hybrid Distribution Others |

| By Price Range | Budget Mid-Range Luxury Others |

| By Customer Segment | Millennials Families Solo Travelers Retirees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hotel Digital Booking Platforms | 150 | Hotel Managers, Digital Marketing Executives |

| Tour Operator Digital Services | 100 | Tour Operators, Business Development Managers |

| Travel Apps User Experience | 120 | Frequent Travelers, App Developers |

| Local Experience Platforms | 80 | Local Guides, Experience Curators |

| Digital Marketing in Tourism | 90 | Marketing Managers, Social Media Strategists |

The Thailand Digital Tourism and Experience Platforms Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital technologies and consumer preferences for online travel services.