Region:Asia

Author(s):Shubham

Product Code:KRAB6274

Pages:92

Published On:October 2025

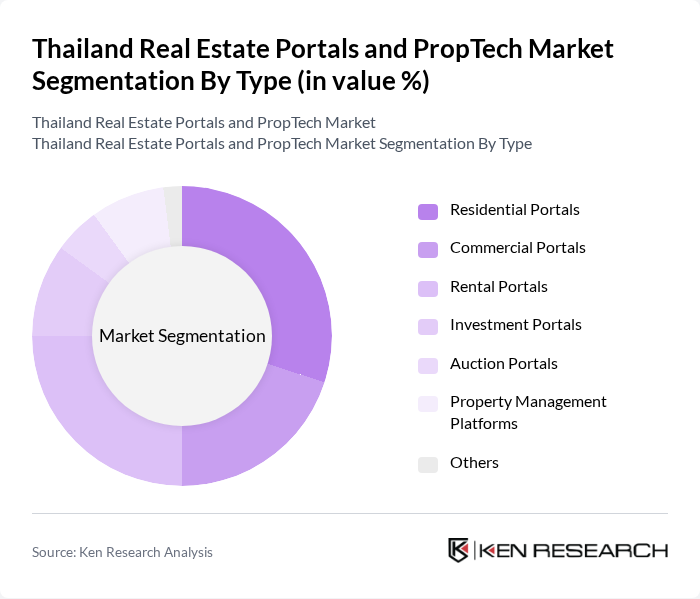

By Type:The market can be segmented into various types, including Residential Portals, Commercial Portals, Rental Portals, Investment Portals, Auction Portals, Property Management Platforms, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of real estate transactions in Thailand.

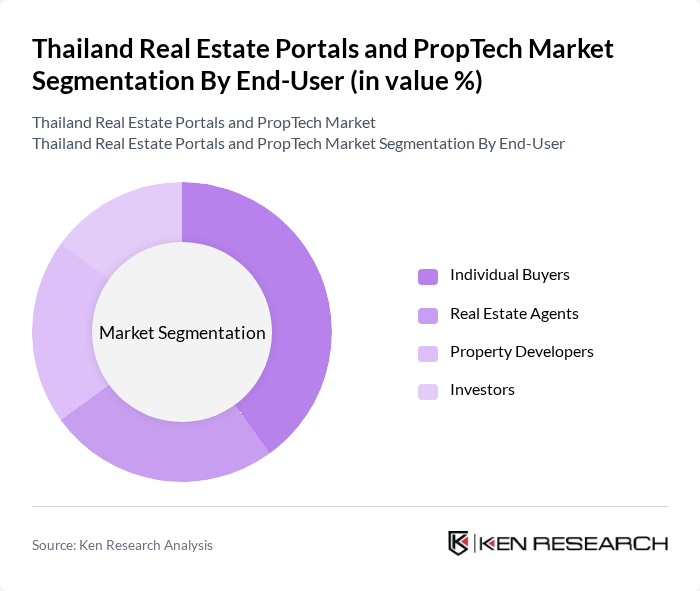

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group has distinct requirements and preferences, influencing their engagement with real estate portals and PropTech solutions.

The Thailand Real Estate Portals and PropTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyGuru Group, Hipflat, Thai Apartment, FazWaz, Baania, 99.co, RentHub, Siam Real Estate, Ananda Development, Sansiri, AP Thailand, LPN Development, Pruksa Real Estate, SET-listed Property Firms, and Local Real Estate Agencies contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand real estate portals and PropTech market is poised for significant transformation as urbanization and technological advancements continue to reshape the landscape. In the future, the integration of AI and virtual reality in property listings will enhance user engagement, while the expansion of digital payment solutions will streamline transactions. Additionally, collaboration between traditional real estate firms and PropTech startups is expected to foster innovation, creating a more efficient and user-friendly market environment that meets the evolving needs of consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Portals Investment Portals Auction Portals Property Management Platforms Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Real Estate Firms |

| By Geographic Coverage | Bangkok Chiang Mai Phuket Pattaya Others |

| By Customer Segment | First-Time Home Buyers Luxury Buyers Commercial Investors Renters |

| By Service Type | Listing Services Marketing Services Analytics Services Consulting Services |

| By Payment Model | Subscription-Based Commission-Based Pay-Per-Listing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Home Buyers, Investors |

| Commercial Real Estate Investors | 100 | Real Estate Fund Managers, Corporate Buyers |

| Real Estate Agents and Brokers | 120 | Licensed Real Estate Agents, Brokerage Owners |

| PropTech Startups | 80 | Founders, Product Managers |

| Property Management Firms | 70 | Property Managers, Operations Directors |

The Thailand Real Estate Portals and PropTech Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital platforms for property transactions and innovative property management solutions.