Region:Asia

Author(s):Shubham

Product Code:KRAB3155

Pages:86

Published On:October 2025

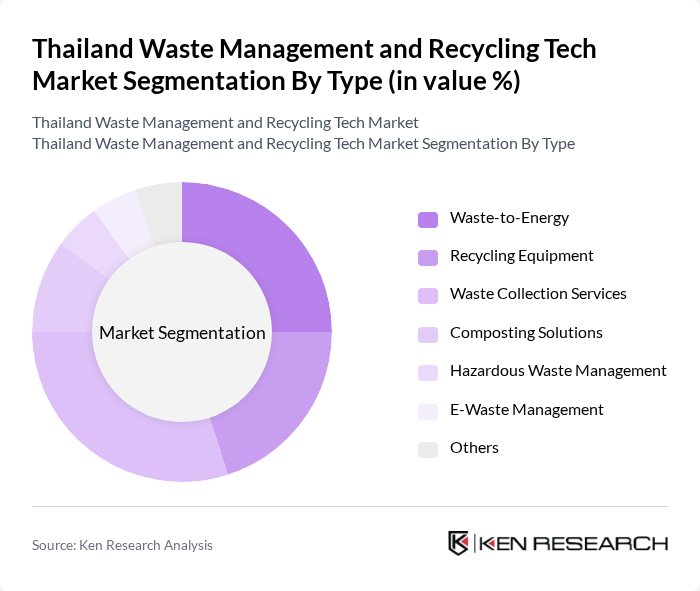

By Type:The market is segmented into various types, including Waste-to-Energy, Recycling Equipment, Waste Collection Services, Composting Solutions, Hazardous Waste Management, E-Waste Management, and Others. Each of these segments plays a crucial role in addressing the diverse waste management needs of the country.

The Waste Collection Services segment is currently dominating the market due to the increasing need for efficient waste management solutions in urban areas. With the rise in population and urbanization, the demand for reliable waste collection services has surged. This segment is characterized by a variety of service providers, including municipal and private companies, which cater to both residential and commercial sectors. The focus on improving service efficiency and customer satisfaction is driving innovations in this area, making it a critical component of the overall waste management strategy.

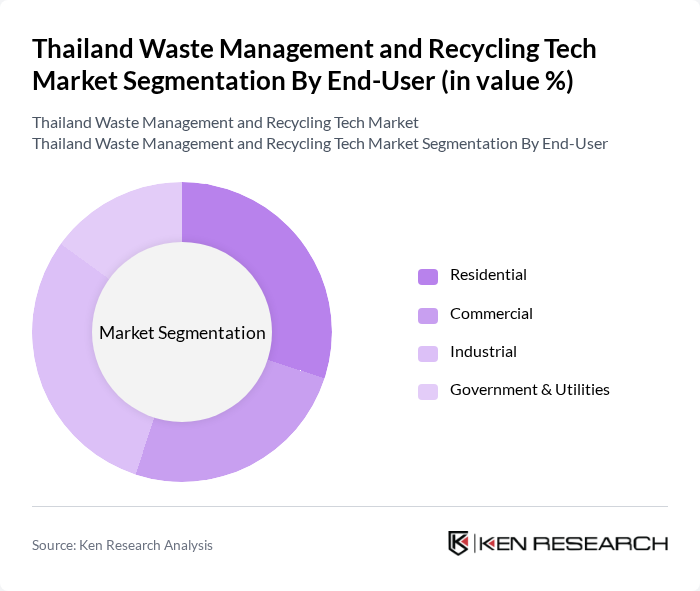

By End-User:The market is segmented by end-user into Residential, Commercial, Industrial, and Government & Utilities. Each end-user category has distinct waste management requirements and contributes differently to the overall market dynamics.

The Industrial segment is leading the market due to the substantial waste generated by manufacturing and production activities. Industries are increasingly adopting advanced waste management practices to comply with environmental regulations and enhance operational efficiency. This segment is characterized by significant investments in waste reduction technologies and recycling initiatives, driven by both regulatory pressures and corporate sustainability goals. The focus on minimizing waste and maximizing resource recovery is propelling the growth of this segment.

The Thailand Waste Management and Recycling Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waste Management Public Company Limited, Veolia Environmental Services (Thailand) Ltd., SUEZ Recycling and Recovery Thailand, Eco Recycling Co., Ltd., TPI Polene Public Company Limited, Bangkok Sumpak Co., Ltd., Green Planet Co., Ltd., Thai Waste Management Co., Ltd., PTT Global Chemical Public Company Limited, SCG Chemicals Co., Ltd., Chao Phraya Waste Management Co., Ltd., AEC Waste Management Co., Ltd., BioCycle Co., Ltd., Recycle Thailand Co., Ltd., Green Energy Solutions Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's waste management and recycling tech market appears promising, driven by increasing urbanization and government support. In the future, the integration of smart technologies, such as IoT and AI, is expected to enhance operational efficiency in waste collection and processing. Furthermore, the adoption of circular economy principles will likely reshape waste management practices, encouraging sustainable resource use. As environmental awareness continues to rise, the market is poised for significant growth, attracting investments and fostering innovation in waste management solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Waste-to-Energy Recycling Equipment Waste Collection Services Composting Solutions Hazardous Waste Management E-Waste Management Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Municipal Waste Management Industrial Waste Management Construction Waste Management Medical Waste Management |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Grants for Recycling Initiatives |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Waste Managers, Environmental Officers |

| Recycling Technology Providers | 80 | Product Managers, Technical Directors |

| Community Recycling Initiatives | 70 | NGO Representatives, Community Leaders |

| Industrial Waste Processing | 60 | Operations Managers, Sustainability Coordinators |

| Consumer Attitudes towards Recycling | 90 | General Public, Environmental Advocates |

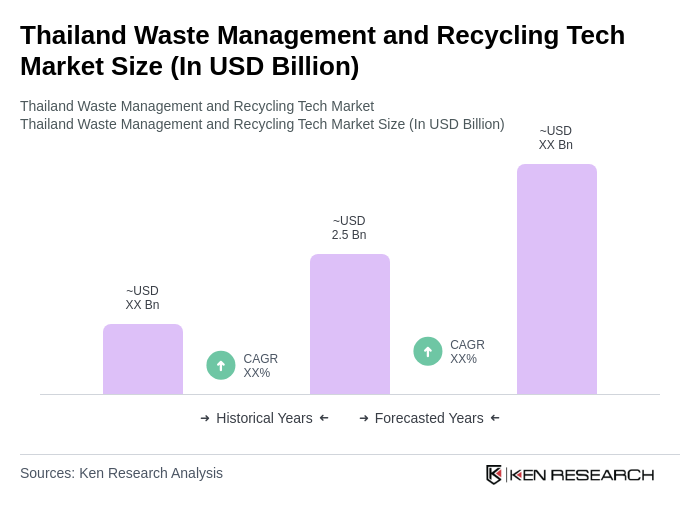

The Thailand Waste Management and Recycling Tech Market is valued at approximately USD 2.5 billion, driven by urbanization, waste generation, and government initiatives aimed at enhancing waste management infrastructure and promoting recycling technologies.