Region:Europe

Author(s):Shubham

Product Code:KRAD0635

Pages:88

Published On:August 2025

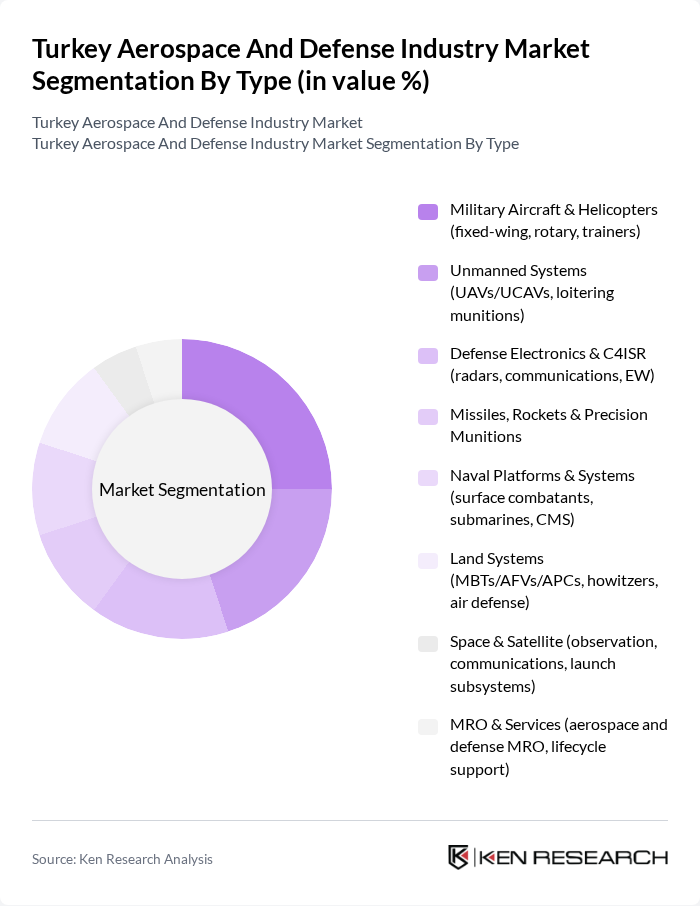

By Type:The market is segmented into various types, including Military Aircraft & Helicopters, Unmanned Systems, Defense Electronics & C4ISR, Missiles, Rockets & Precision Munitions, Naval Platforms & Systems, Land Systems, Space & Satellite, and MRO & Services. Each of these segments plays a crucial role in the overall defense strategy of Turkey, with specific focus areas driving growth.

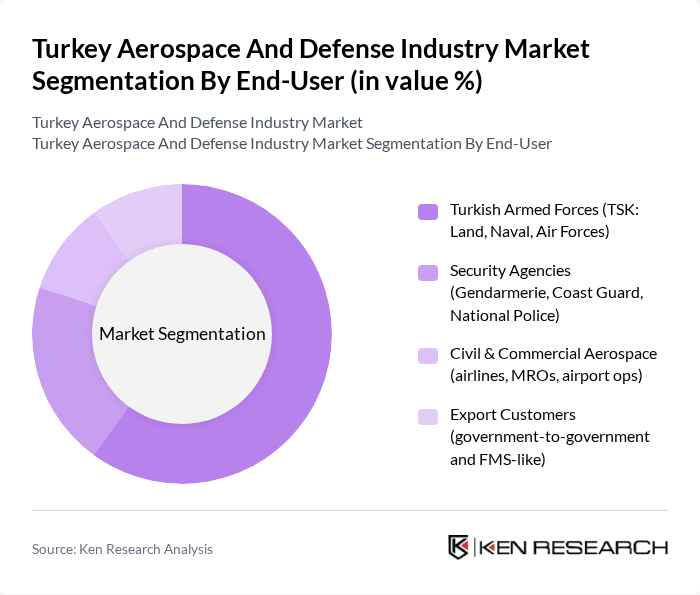

By End-User:The end-user segmentation includes the Turkish Armed Forces, Security Agencies, Civil & Commercial Aerospace, and Export Customers. Each segment has distinct requirements and contributes to the overall market dynamics, with the Turkish Armed Forces being the largest consumer of defense products and services.

The Turkey Aerospace and Defense Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Turkish Aerospace Industries (TUSA?), ASELSAN Elektronik Sanayi ve Ticaret A.?., ROKETSAN Roket Sanayii ve Ticaret A.?., HAVELSAN Hava Elektronik Sanayi ve Ticaret A.?., STM Savunma Teknolojileri Mühendislik ve Ticaret A.?., Baykar Teknoloji (Baykar Makina Sanayi ve Ticaret A.?.), FNSS Savunma Sistemleri A.?., Otokar Otomotiv ve Savunma Sanayi A.?., BMC Otomotiv Sanayi ve Ticaret A.?., Makine ve Kimya Endüstrisi A.?. (MKE), TUSA? Engine Industries (TEI), AYESA? Ayd?n Yaz?l?m ve Elektronik Sanayi A.?., Alp Aviation (Alp Havac?l?k Sanayi ve Ticaret A.?.), Kale Aero / Kale Arge (Kale Grubu), Turkish Technic (Turkish Airlines Technic A.?.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey aerospace and defense industry appears promising, driven by increased defense spending and a focus on technological innovation. As the government prioritizes domestic manufacturing and R&D, the sector is likely to see enhanced capabilities and competitiveness. Additionally, collaboration with NATO and other international partners will facilitate knowledge transfer and access to advanced technologies, positioning Turkey as a regional leader in defense solutions and fostering sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Military Aircraft & Helicopters (fixed-wing, rotary, trainers) Unmanned Systems (UAVs/UCAVs, loitering munitions) Defense Electronics & C4ISR (radars, communications, EW) Missiles, Rockets & Precision Munitions Naval Platforms & Systems (surface combatants, submarines, CMS) Land Systems (MBTs/AFVs/APCs, howitzers, air defense) Space & Satellite (observation, communications, launch subsystems) MRO & Services (aerospace and defense MRO, lifecycle support) |

| By End-User | Turkish Armed Forces (TSK: Land, Naval, Air Forces) Security Agencies (Gendarmerie, Coast Guard, National Police) Civil & Commercial Aerospace (airlines, MROs, airport ops) Export Customers (government-to-government and FMS-like) |

| By Application | Intelligence, Surveillance, Target Acquisition & Reconnaissance (ISTAR) Combat & Strike (air, land, naval) Air & Missile Defense Training & Simulation Logistics, MRO & Lifecycle Support |

| By Component | Airframes & Structures Avionics, Sensors & Mission Systems Propulsion & Power (turbofan/turboprop/engine subsystems) Command, Control & Software (C2, CMS, AI/Autonomy) Weapons, Launchers & Effectors |

| By Sales Channel | Direct Government Procurement OEM & Prime Contractor Sales Offset/Industrial Participation Programs International Exports |

| By Distribution Mode | Domestic (through SSB-managed programs and local primes) International (G2G, commercial export, distributors/agents) |

| By Price Range | Budget (tactical subsystems, light UAS, basic comms) Mid-Range (armored vehicles, medium UAVs, radars) Premium (combat aircraft, major naval platforms, missile systems) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing | 120 | Production Managers, Quality Assurance Leads |

| Defense Procurement | 90 | Procurement Officers, Contract Managers |

| Military Technology Development | 80 | R&D Directors, Technology Officers |

| Unmanned Aerial Systems | 70 | Product Managers, Systems Engineers |

| Naval Defense Systems | 60 | Naval Architects, Defense Analysts |

The Turkey Aerospace and Defense Industry Market is valued at approximately USD 15 billion, driven by increased defense spending, technological advancements, and a focus on domestic production capabilities, as highlighted in recent analyses.