Region:Europe

Author(s):Rebecca

Product Code:KRAB0274

Pages:91

Published On:August 2025

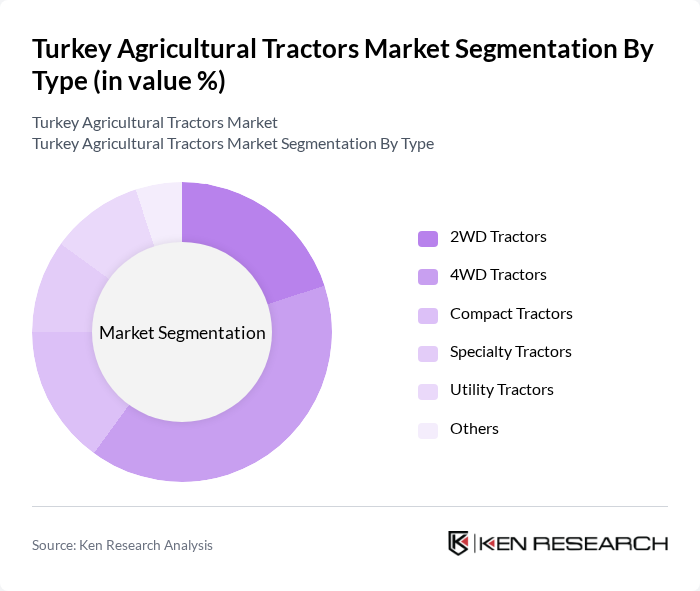

By Type:The market is segmented into various types of tractors, including 2WD Tractors, 4WD Tractors, Compact Tractors, Specialty Tractors, Utility Tractors, and Others. Among these, 4WD Tractors are increasingly preferred due to their superior traction and versatility, making them suitable for a wide range of agricultural tasks. The demand for advanced machinery capable of handling various terrains and crop types is driving the adoption of 4WD Tractors. The ongoing trend of precision farming and the need for higher productivity are further accelerating the uptake of these tractors, as they offer enhanced control, efficiency, and adaptability to modern agricultural practices.

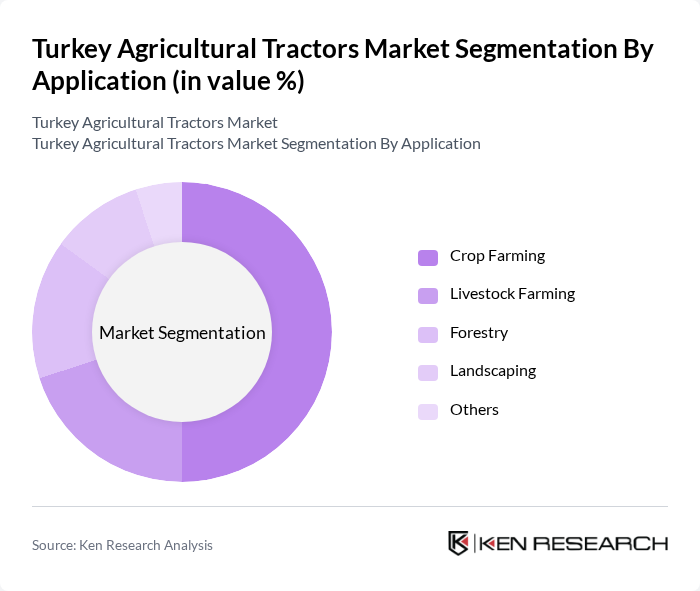

By Application:The agricultural tractors market is further segmented by application into Crop Farming, Livestock Farming, Forestry, Landscaping, and Others. Crop Farming remains the dominant application segment, driven by the need for efficient land cultivation and harvesting. The increasing focus on food security and the imperative to enhance agricultural productivity have led to a surge in the adoption of tractors tailored for crop farming. This segment benefits from ongoing technological advancements, such as GPS and automation, that improve yield and reduce labor costs, making it a preferred choice among farmers seeking to optimize operations.

The Turkey Agricultural Tractors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tümosan Motor ve Traktör Sanayi A.?., Türk Traktör ve Ziraat Makineleri A.?., Erkunt Traktör Sanayii A.?., Hattat Traktör Sanayi ve Ticaret A.?., Uzel Makina Sanayi A.?., AGCO Corporation (Massey Ferguson, Fendt, Valtra), CNH Industrial N.V. (New Holland, Case IH, Steyr), Deere & Company (John Deere), Kubota Corporation, Claas KGaA mbH, SDF Group (Deutz-Fahr, SAME, Lamborghini Trattori), Landini (Argo Tractors S.p.A.), Zetor Tractors a.s., Yanmar Co., Ltd., Basak Traktör Tar?m Ziraat ve ?? Makinalar? Sanayi A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey agricultural tractors market is poised for significant transformation, driven by technological advancements and increasing adoption of precision agriculture. As farmers seek to enhance productivity and sustainability, the integration of smart farming technologies will become more prevalent. Additionally, the government's continued support through subsidies and financing initiatives will likely facilitate greater access to modern tractors, enabling farmers to meet the rising food demand. Overall, the market is expected to evolve, focusing on innovation and efficiency in agricultural practices.

| Segment | Sub-Segments |

|---|---|

| By Type | WD Tractors WD Tractors Compact Tractors Specialty Tractors Utility Tractors Others |

| By Application | Crop Farming Livestock Farming Forestry Landscaping Others |

| By End-User | Individual Farmers Agricultural Cooperatives Government Agencies Agribusiness Corporations Others |

| By Sales Channel | Direct Sales Dealers and Distributors Online Sales Auctions Others |

| By Distribution Mode | Retail Outlets Wholesale Markets E-commerce Platforms Direct Delivery Others |

| By Price Range | Less than 50 HP HP to 75 HP HP to 100 HP HP to 150 HP HP to 200 HP More than 200 HP |

| By Brand Preference | Domestic Brands International Brands Emerging Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers | 60 | Farm Owners, Agricultural Workers |

| Large Agricultural Enterprises | 40 | Farm Managers, Procurement Officers |

| Tractor Dealers and Distributors | 40 | Sales Managers, Business Development Executives |

| Agricultural Machinery Manufacturers | 40 | Product Managers, R&D Specialists |

| Agricultural Consultants and Experts | 40 | Industry Analysts, Policy Advisors |

The Turkey Agricultural Tractors Market is valued at approximately USD 1.8 billion, reflecting a steady increase in tractor sales driven by the mechanization of agriculture and rising food production demands.