Region:Europe

Author(s):Rebecca

Product Code:KRAA2177

Pages:84

Published On:August 2025

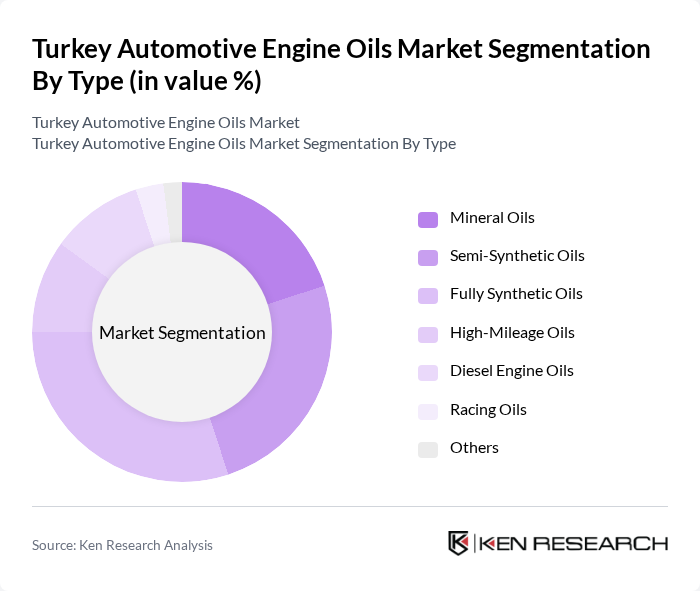

By Type:The market is segmented into Mineral Oils, Semi-Synthetic Oils, Fully Synthetic Oils, High-Mileage Oils, Diesel Engine Oils, Racing Oils, and Others. Each type addresses specific consumer requirements, with synthetic and semi-synthetic oils gaining traction due to their superior thermal stability, protection against engine wear, and compatibility with modern engines. The growing adoption of fully synthetic oils is particularly notable among newer vehicles and those requiring extended oil change intervals .

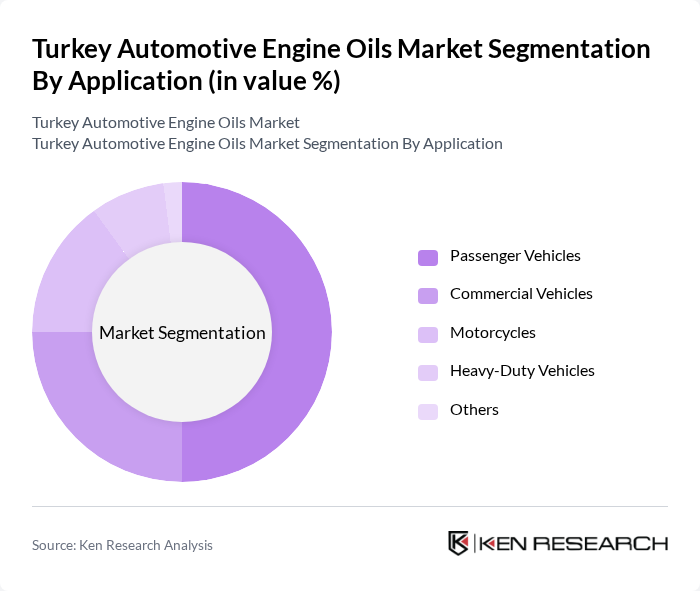

By Application:The application segment includes Passenger Vehicles, Commercial Vehicles, Motorcycles, Heavy-Duty Vehicles, and Others. Passenger vehicles represent the largest segment, attributed to the high number of personal vehicles and frequent oil changes required for urban commuting. Commercial vehicles and heavy-duty vehicles are also significant consumers, driven by Turkey’s expanding logistics and freight transportation sector. Motorcycles and other specialized vehicles contribute to niche demand within the market .

The Turkey Automotive Engine Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petrol Ofisi A.?., BP PLC (Castrol), Shell & Turcas Petrol A.?., TotalEnergies Turkey, Fuchs Petrolub SE, Mobil Oil Türk A.?., Petronas Turkey, Valvoline Inc., Liqui Moly GmbH, Repsol S.A., Chevron Corporation, Gulf Oil International, Klüber Lubrication, ENI S.p.A., Amsoil Inc., Bardahl Manufacturing Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey automotive engine oils market appears promising, driven by technological advancements and evolving consumer preferences. The shift towards synthetic oils is expected to continue, with a projected increase in demand for eco-friendly products. Additionally, the rise of electric vehicles will create new opportunities for specialized lubricants. As manufacturers adapt to these trends, the market is likely to witness innovations that enhance performance and sustainability, positioning it for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Oils Semi-Synthetic Oils Fully Synthetic Oils High-Mileage Oils Diesel Engine Oils Racing Oils Others |

| By Application | Passenger Vehicles Commercial Vehicles Motorcycles Heavy-Duty Vehicles Others |

| By End-User | Individual Consumers Automotive Workshops Fleet Operators OEMs Others |

| By Distribution Channel | Retail (Offline) Retail (Online) Professional Services (Workshops, Service Centers) Direct Sales Distributors Others |

| By Brand Positioning | Premium Brands Mid-Range Brands Budget Brands Others |

| By Packaging Type | Bottles Drums Bulk Packaging Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Oil Retailers | 100 | Store Managers, Sales Representatives |

| Automotive Service Centers | 80 | Service Managers, Technicians |

| Fleet Operators | 50 | Fleet Managers, Procurement Officers |

| Automotive Manufacturers | 40 | Product Development Engineers, Quality Assurance Managers |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

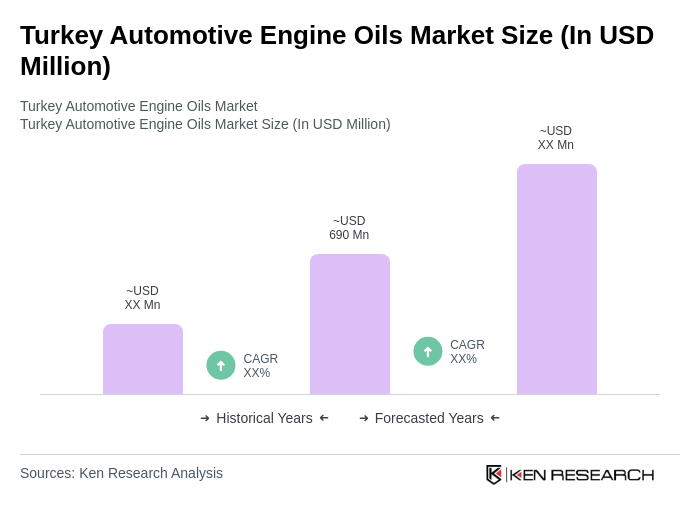

The Turkey Automotive Engine Oils Market is valued at approximately USD 690 million, reflecting a significant growth driven by an expanding vehicle fleet and increasing consumer awareness regarding vehicle maintenance and high-performance lubricants.